Question: I realize there are existing solutions to this exact problem on Chegg, but they do not have the answers I have. I would like to

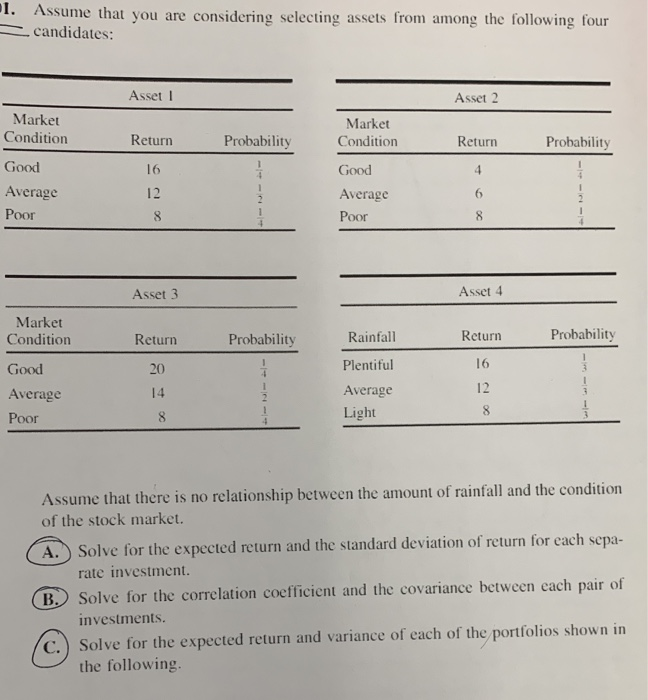

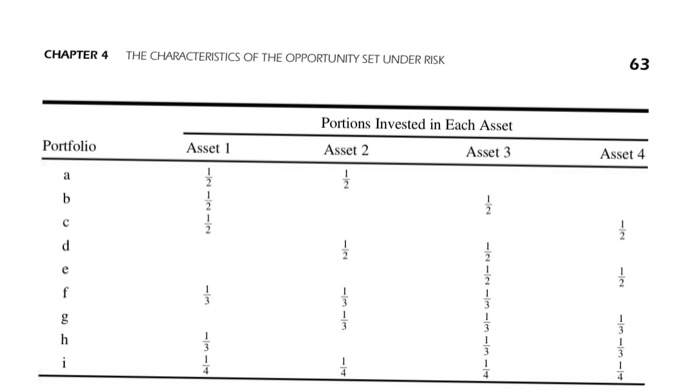

1. Assume that you are considering selecting assets from among the following four = candidates: Asset Asset 2 Market Condition Return Market Condition Probability Return Probability 16 Good Average Poor 12 8 Good Average Poor Asset 3 Asset 4 Market Condition Return Probability Rainfall Return Probability Plentiful Good Average Poor Average Light Assume that there is no relationship between the amount of rainfall and the condition of the stock market. A. Solve for the expected return and the standard deviation of return for each sepa- rate investment. B.) Solve for the correlation coefficient and the covariance between each pair of investments. Solve for the expected return and variance of each of the portfolios shown in the following CHAPTER 4 THE CHARACTERISTICS OF THE OPPORTUNITY SET UNDER RISK Portions Invested in Each Asset Asset 2 Asset 3 Portfolio Asset 1 Asset 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts