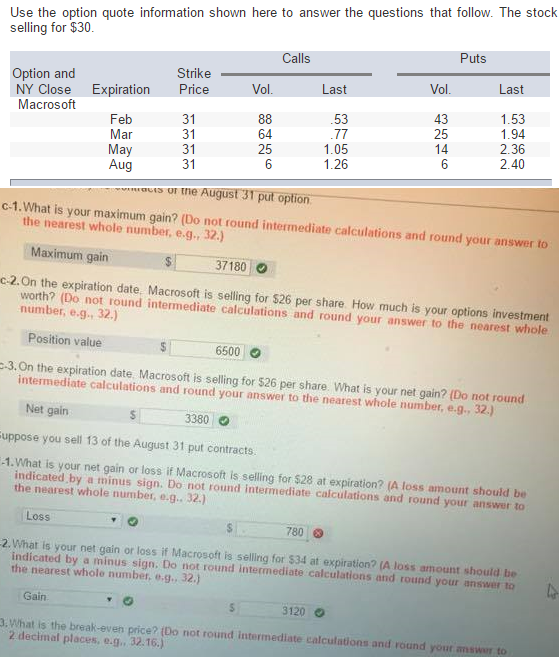

Question: I really just need help with D-2 (the one tht has an X next to the answer) Thanks! cant figure it out Use the option

I really just need help with D-2 (the one tht has an X next to the answer) Thanks! cant figure it out

I really just need help with D-2 (the one tht has an X next to the answer) Thanks! cant figure it out

Use the option quote information shown here to answer the questions that follow. The stock selling for $30. Puts Shiko Option and NY Close Expiration Price Macrosoft Last 53 1.05 Vol. 31 31 31 31 43 25 14 6 1.53 1.94 2.36 2.40 64 25 May Aug 1.26 uts ur the August 31 put option ES OF the c-1.What is your maximum gain? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Maximum gain $1 37180 c-2.On the expiration date. Macrosoft is selling for $26 per share. How much is your options investment worth? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g 32.) Position value 6500 o 6500 3.On the expiration date Macrosoft is selling for $26 per share. What is your net gain? (Do not round intermediate calculations and round your answer to the neatest whole number, e-g., 32.) Net gain 3380 uppose you sell 13 of the August 31 put contracts -1. What is your net gain or loss if Macrosoft is selling for $28 at expiration? (A loss amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g.32.) Loss 780 2. What is your net gain or loss if Macrosoft is sellig for $34 at expiration? (A loss amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, o.g. 32.) Gain 3120 . What is the break-even price? (Do not round intermediate calculations and round your amswer to 2 decimal places, e.g., 32.16.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts