Question: I really need a detailed solution to this problem. Who can help me. Please I need step by step explaination! The table below gives information

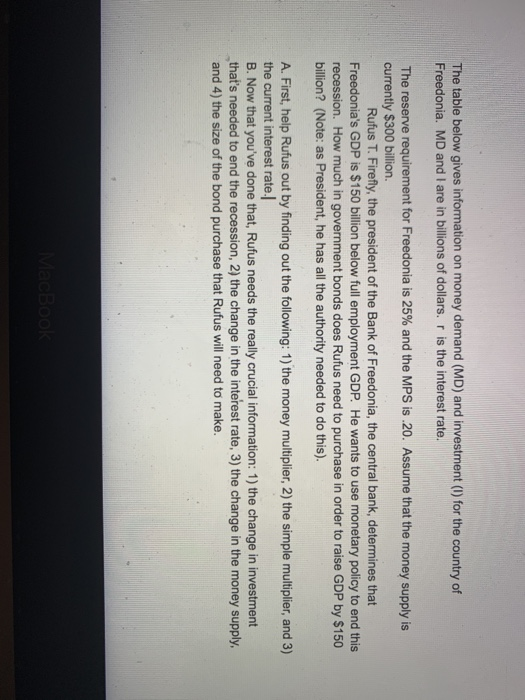

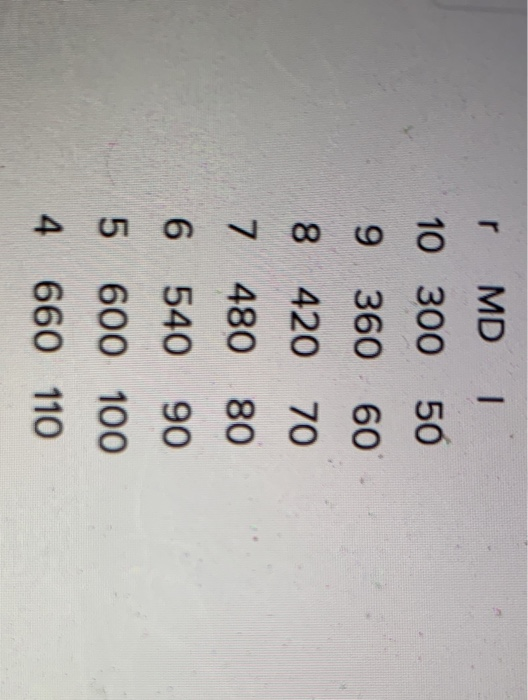

The table below gives information on money demand (MD) and investment (1) for the country of Freedonia. MD and I are in billions of dollars. r is the interest rate. The reserve requirement for Freedonia is 25% and the MPS is.20. Assume that the money supply is currently $300 billion. Rufus T. Firefly, the president of the Bank of Freedonia, the central bank, determines that Freedonia's GDP is $150 billion below full employment GDP. He wants to use monetary policy to end this recession. How much in government bonds does Rufus need to purchase in order to raise GDP by $150 billion? (Note: as President, he has all the authority needed to do this). A. First, help Rufus out by finding out the following: 1) the money multiplier, 2) the simple multiplier, and 3) the current interest rate. B. Now that you've done that, Rufus needs the really crucial information: 1) the change in investment that's needed to end the recession, 2) the change in the interest rate, 3) the change in the money supply, and 4) the size of the bond purchase that Rufus will need to make. MacBook r MD - 10 300 50 9 360 60 8 420 70 7 480 80 6 540 90 5 600 100 4 660 110 The table below gives information on money demand (MD) and investment (1) for the country of Freedonia. MD and I are in billions of dollars. r is the interest rate. The reserve requirement for Freedonia is 25% and the MPS is.20. Assume that the money supply is currently $300 billion. Rufus T. Firefly, the president of the Bank of Freedonia, the central bank, determines that Freedonia's GDP is $150 billion below full employment GDP. He wants to use monetary policy to end this recession. How much in government bonds does Rufus need to purchase in order to raise GDP by $150 billion? (Note: as President, he has all the authority needed to do this). A. First, help Rufus out by finding out the following: 1) the money multiplier, 2) the simple multiplier, and 3) the current interest rate. B. Now that you've done that, Rufus needs the really crucial information: 1) the change in investment that's needed to end the recession, 2) the change in the interest rate, 3) the change in the money supply, and 4) the size of the bond purchase that Rufus will need to make. MacBook r MD - 10 300 50 9 360 60 8 420 70 7 480 80 6 540 90 5 600 100 4 660 110

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts