Question: I really need especially correct answers for the red ones. I gave the all information for this question. Background: Laughter Landscaping collected the following data

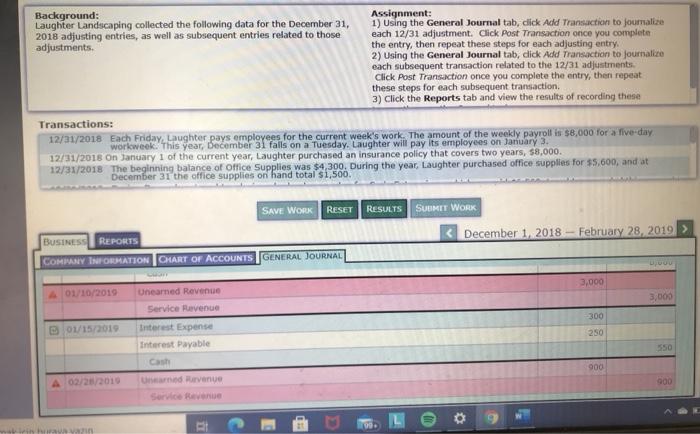

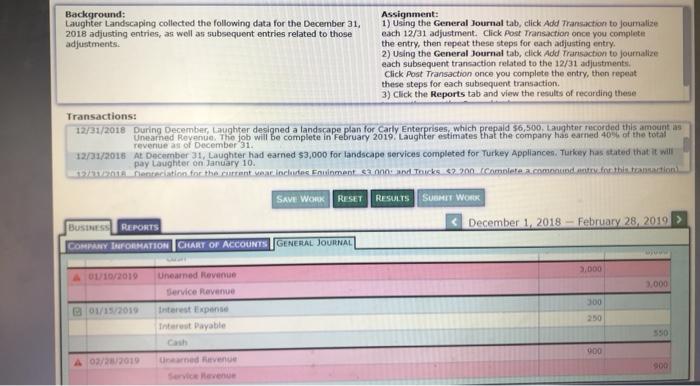

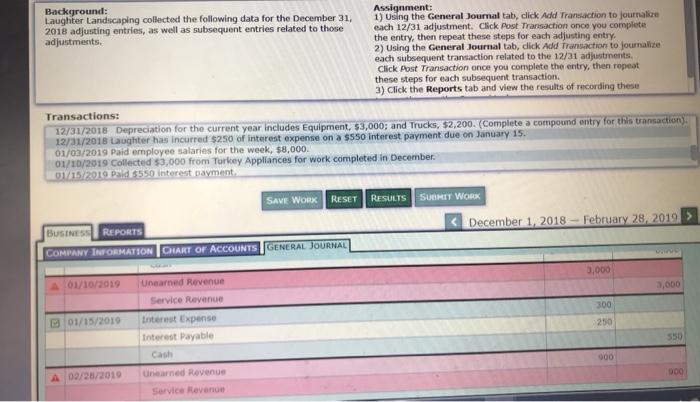

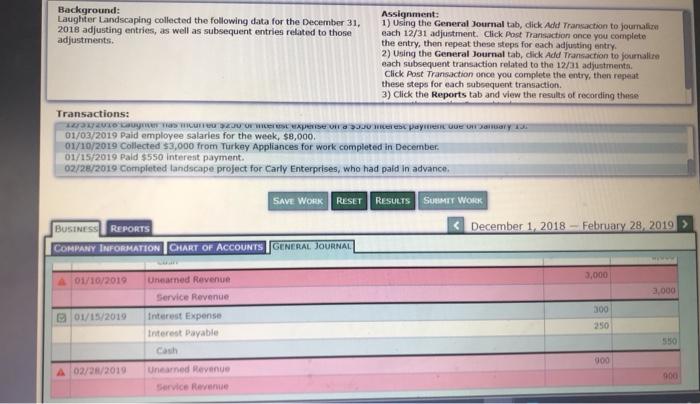

Background: Laughter Landscaping collected the following data for the December 31, 2018 adjusting entries, as well as subsequent entries related to those adjustments, Assignment: 1) Using the General Journal tab, click Add Transaction to joumaliza each 12/31 adjustment. Click Post Transaction once you complete the entry, then repeat these steps for each adjusting entry 2) Using the General Journal tab, click Add Transaction to journalize each subsequent transaction related to the 12/31 adjustments Click Post Transaction once you complete the entry, then repeat these steps for each subsequent transaction 3) Click the Reports tab and view the results of recording these Transactions: 12/01/2018 Each Friday, Laughter pays employees for the current week's work. The amount of the weekly payroll is $8,000 for a live-day workweek. This year, December 31 falls on a Tuesday. Laughter will pay its employees on January 3. 12/31/2018 On January 1 of the current year, Laughter purchased an insurance policy that covers two years, $8,000. 12/31/2018 The beginning balance of Office Supplies was $4 300. During the year, Laughter purchased office supplies for $5.600, and at December 31 the office supplies on hand total $1,500. SAVE WORK RESET RESULTS SUENT WORK December 1, 2018 - February 28, 2019 > BUSINESS REPORTS COMPANY FORMATION CHART OF ACCOUNTS GENERAL JOURNAL DUO 3,000 01/10/2019 3,000 Unearned Revenue Service Revenue Interest Expense Interest Payable -300 01/15/2019 250 550 900 A 02/28/2010 durvenue Service Re Background: Assignment: Laughter Landscaping collected the following data for the December 31, 1) Using the General Journal tab, click Add Transaction to journalize 2018 adjusting entries, as well as subsequent entries related to those each 12/31 adjustment. Click Post Transaction once you complete adjustments the entry, then repeat these steps for each adjusting entry 2) Using the General Journal tab, click Add Transaction to journalize each subsequent transaction related to the 12/31 adjustments Click Post Transaction once you complete the entry, then repeat these steps for each subsequent transaction. 3) Click the Reports tab and view the results of recording these Transactions: 12/31/2018 During December, Laughter designed a landscape plan for Carly Enterprises, which prepaid $6,500. Laughter recorded this amounts Unearned Revenue. The job will be complete in February 2019. Laughter estimates that the company has earned 40% of the total revenue as of December 31. 12/31/2015 At December 31, Laughter had earned $3,000 for landscape services completed for Turkey Appliances, Turkey has stated that it will pay Laughter on January 10. Detection for the current alocs Enginment 3d Trucks $2.200Complete a.comune.for this transaction RESULTS SUBMIT WORK SAVE WORK RESET BUSINESS REPORTS COMPANY FORMATION CHART OF ACCOUNTS GENERAL JOURNAL BUSINESS REPORTS COMPANY INFORMATION CHART OF ACCOUNTS GENERAL JOURNAL 3,000 01/10/2019 3,000 Unearned Revenue Service Revenue 300 B 01/15/2019 250 Interest Expense Interest Payable Cash 550 000 000 02/28/2019 Linearned Revenue Service Revenue Background: Laughter Landscaping collected the following data for the December 31, 2018 adjusting entries, as well as subsequent entries related to those adjustments Assignment: 1) Using the General Journal tab, click Add Transaction to journali each 12/31 adjustment. Click Post Transaction once you complete the entry, then repeat these steps for each adjusting entry. 2) Using the General Journal tab, click Add Transaction to journale each subsequent transaction related to the 12/31 adjustments Click Post Transaction once you complete the entry, then repeat these steps for each subsequent transaction. 3) Click the Reports tab and view the results of recording these Transactions: wanaye Gowice penser We payment 01/03/2019 Paid employee salaries for the week, $8,000. 01/10/2019 Collected $3,000 from Turkey Appliances for work completed in December 01/15/2019 Paid $550 interest payment. 02/28/2019 Completed landscape project for Carly Enterprises, who had paid in advance SAVE WOUX RESET RESULTS SUBMIT WORK BUSINESS REPORTS December 1, 2018 - February 28, 2019 COMPANY INFORMATION CHART OF ACCOUNTS GENERAL JOURNAL 3,000 01/10/2019 3,000 01/15/2019 300 250 Uneaed Revenue Service Revenue Interest Expense Interest Payable Cash Uneamed Revenue Service Revenue 900 A 02/28/2019 900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts