Question: I really need help completing and understanding this problem. Very much appreciated. Lopez Company reported the following current-year data for its only product. The company

I really need help completing and understanding this problem. Very much appreciated.

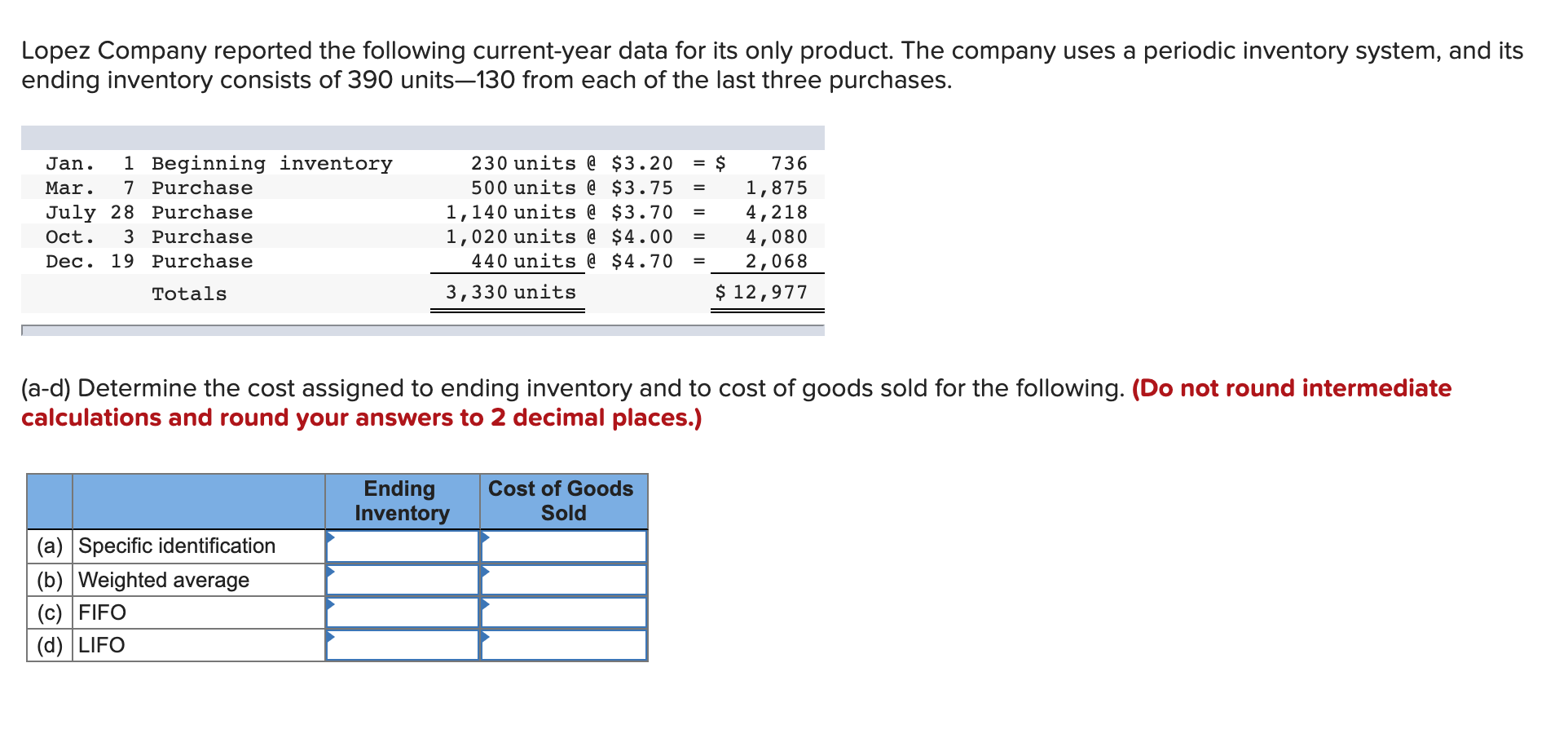

Lopez Company reported the following current-year data for its only product. The company uses a periodic inventory system, and its ending inventory consists of 390 units130 from each of the last three purchases. = = Jan. 1 Beginning inventory Mar. 7 Purchase July 28 Purchase Oct. 3 Purchase Dec. 19 Purchase Totals 230 units @ $3.20 500 units @ $3.75 1,140 units @ $3.70 1,020 units @ $4.00 440 units @ $4.70 3,330 units = $ 736 1,875 4,218 4,080 2,068 $ 12,977 = = (a-d) Determine the cost assigned to ending inventory and to cost of goods sold for the following. (Do not round intermediate calculations and round your answers to 2 decimal places.) Ending Inventory Cost of Goods Sold (a) Specific identification (b) Weighted average (c) FIFO (d) LIFO (e) Which method yields the highest net income? Specific identification FIFO Weighted average O LIFO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts