Question: I really need help on solving this accounting problem. It is very difficult for me. Very much appreciated. Required information [The following information applies to

I really need help on solving this accounting problem. It is very difficult for me. Very much appreciated.

![to the questions displayed below.] Tamar Co. manufactures a single product in](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e5fc7c009e5_41166e5fc7b9132d.jpg)

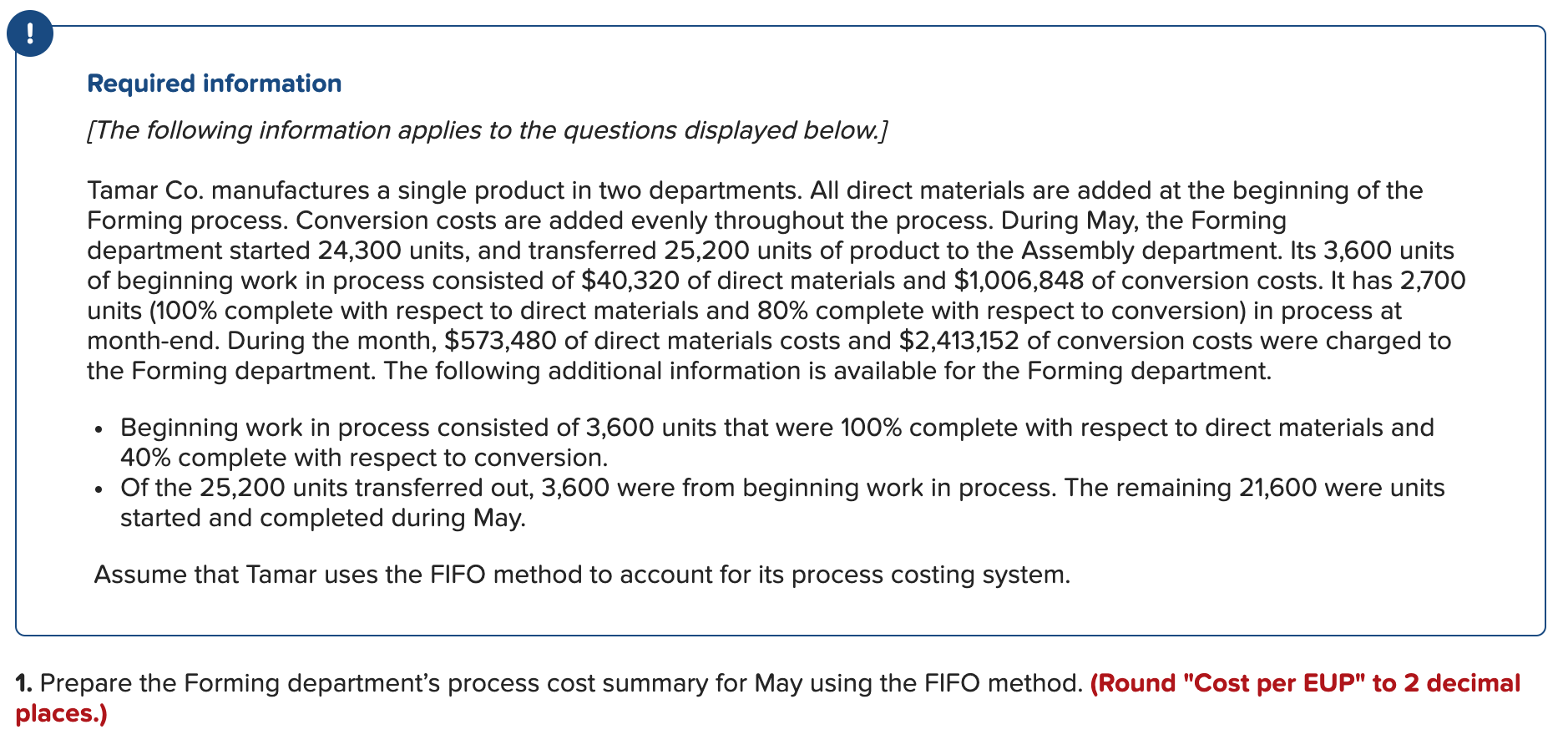

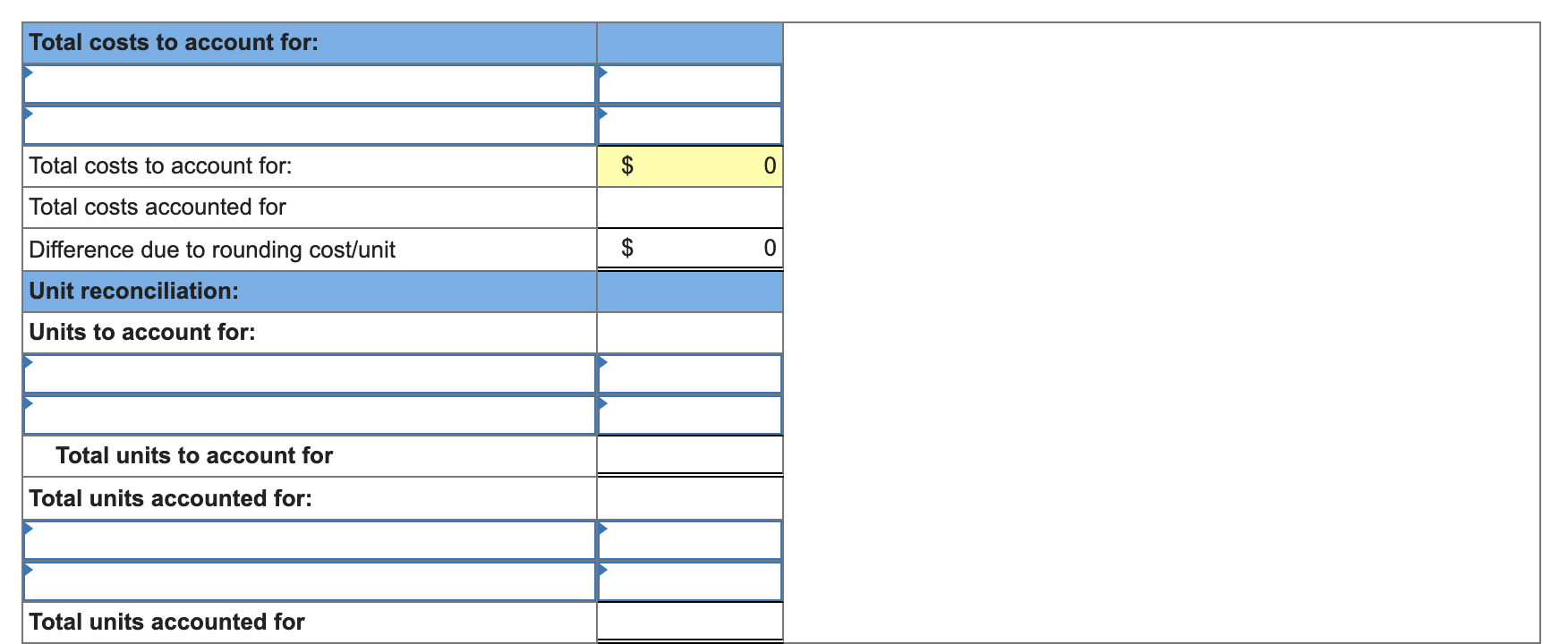

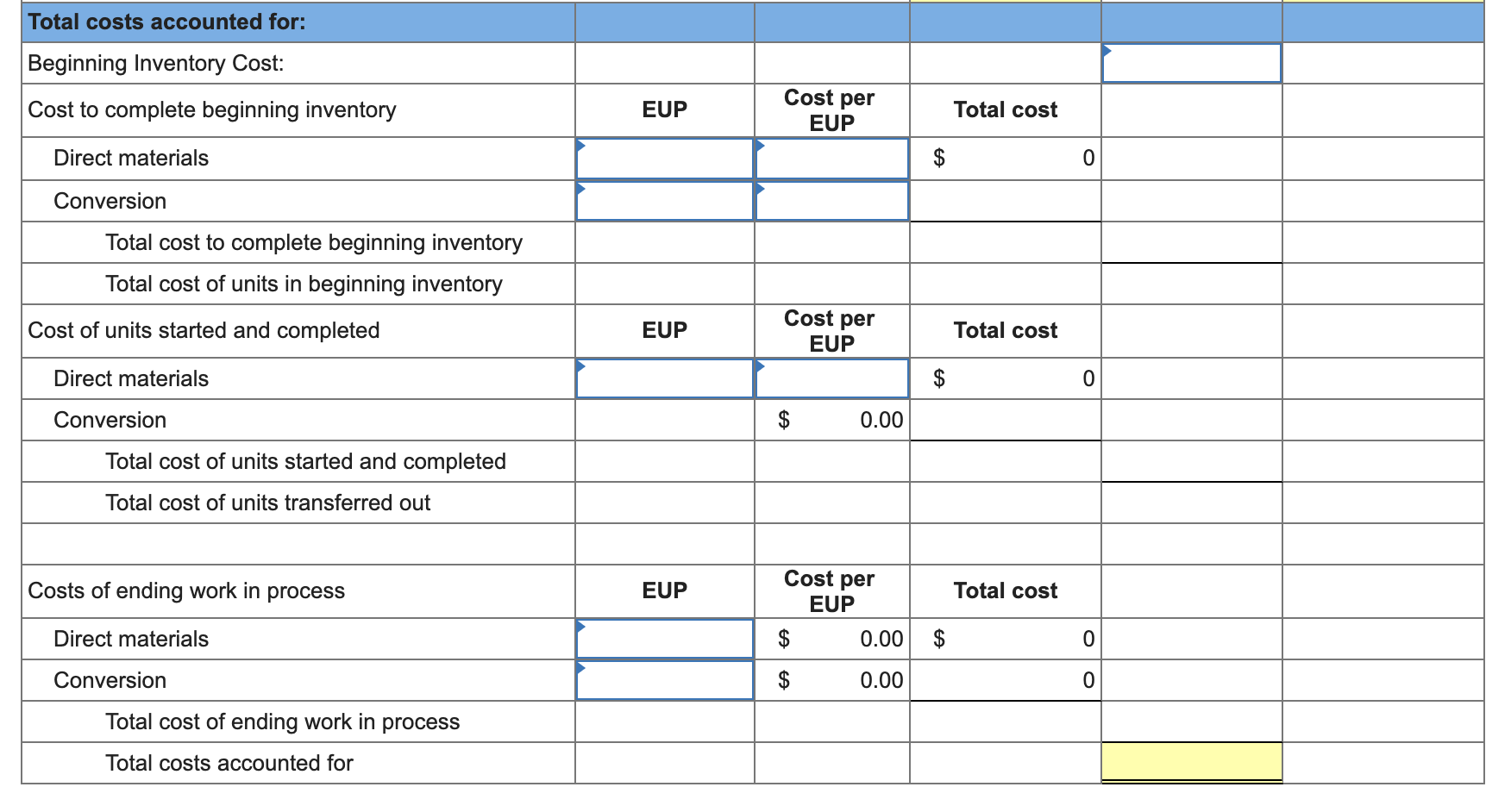

Required information [The following information applies to the questions displayed below.] Tamar Co. manufactures a single product in two departments. All direct materials are added at the beginning of the Forming process. Conversion costs are added evenly throughout the process. During May, the Forming department started 24,300 units, and transferred 25,200 units of product to the Assembly department. Its 3,600 units of beginning work in process consisted of $40,320 of direct materials and $1,006,848 of conversion costs. It has 2,700 units (100% complete with respect to direct materials and 80% complete with respect to conversion) in process at month-end. During the month, $573,480 of direct materials costs and $2,413,152 of conversion costs were charged to the Forming department. The following additional information is available for the Forming department. Beginning work in process consisted of 3,600 units that were 100% complete with respect to direct materials and 40% complete with respect to conversion. Of the 25,200 units transferred out, 3,600 were from beginning work in process. The remaining 21,600 were units started and completed during May. Assume that Tamar uses the FIFO method to account for its process costing system. 1. Prepare the Forming department's process cost summary for May using the FIFO method. (Round "Cost per EUP" to 2 decimal places.) Total costs to account for: Total costs to account for: $ 0 Total costs accounted for 0 Difference due to rounding cost/unit Unit reconciliation: Units to account for: Total units to account for Total units accounted for: Total units accounted for Equivalent units of production (EUP)- FIFO method Units % Materials EUP- Materials % Conversion EUP. Conversion 0 Total units Cost per equivalent unit of production Materials Conversion Total costs Costs Costs EUP EUP 0 O - Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) 0 0 Total costs accounted for: Beginning Inventory Cost: Cost per Cost to complete beginning inventory EUP Total cost EUP Direct materials 0 Conversion Total cost to complete beginning inventory Total cost of units in beginning inventory Cost per Cost of units started and completed EUP Total cost EUP Direct materials $ 0 Conversion 0.00 Total cost of units started and completed Total cost of units transferred out Costs of ending work in process EUP Cost per EUP Total cost Direct materials 0.00 Conversion 0.00 0 Total cost of ending work in process Total costs accounted for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts