Question: I really need help understanding how to solve this accounting problem. I appreciate it. Required information (The following information applies to the questions displayed below.)

I really need help understanding how to solve this accounting problem. I appreciate it.

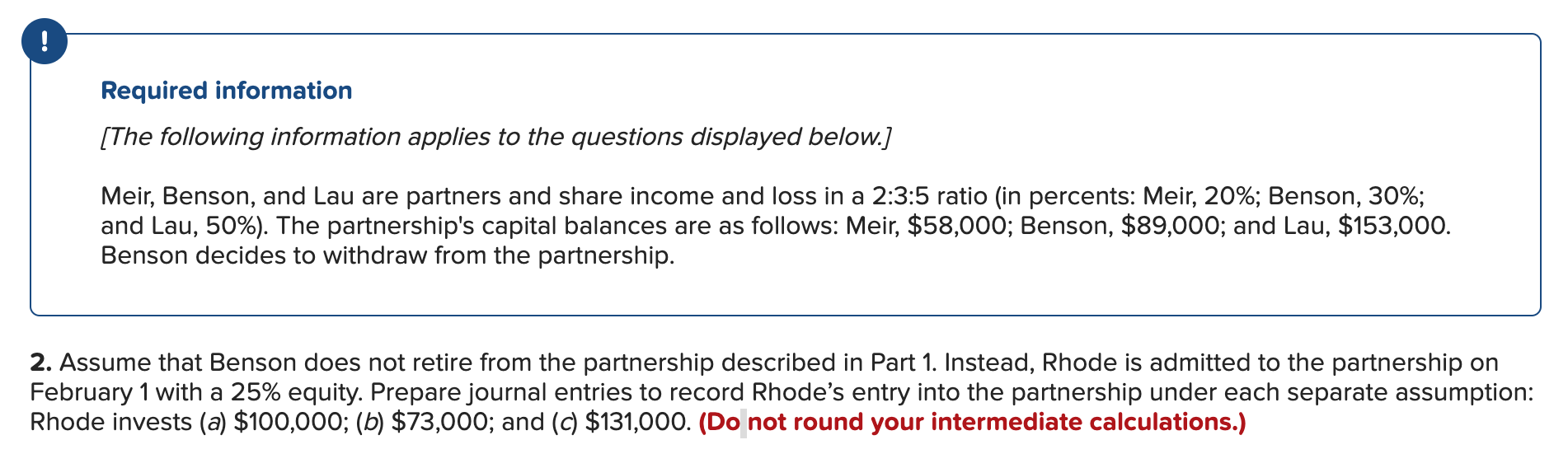

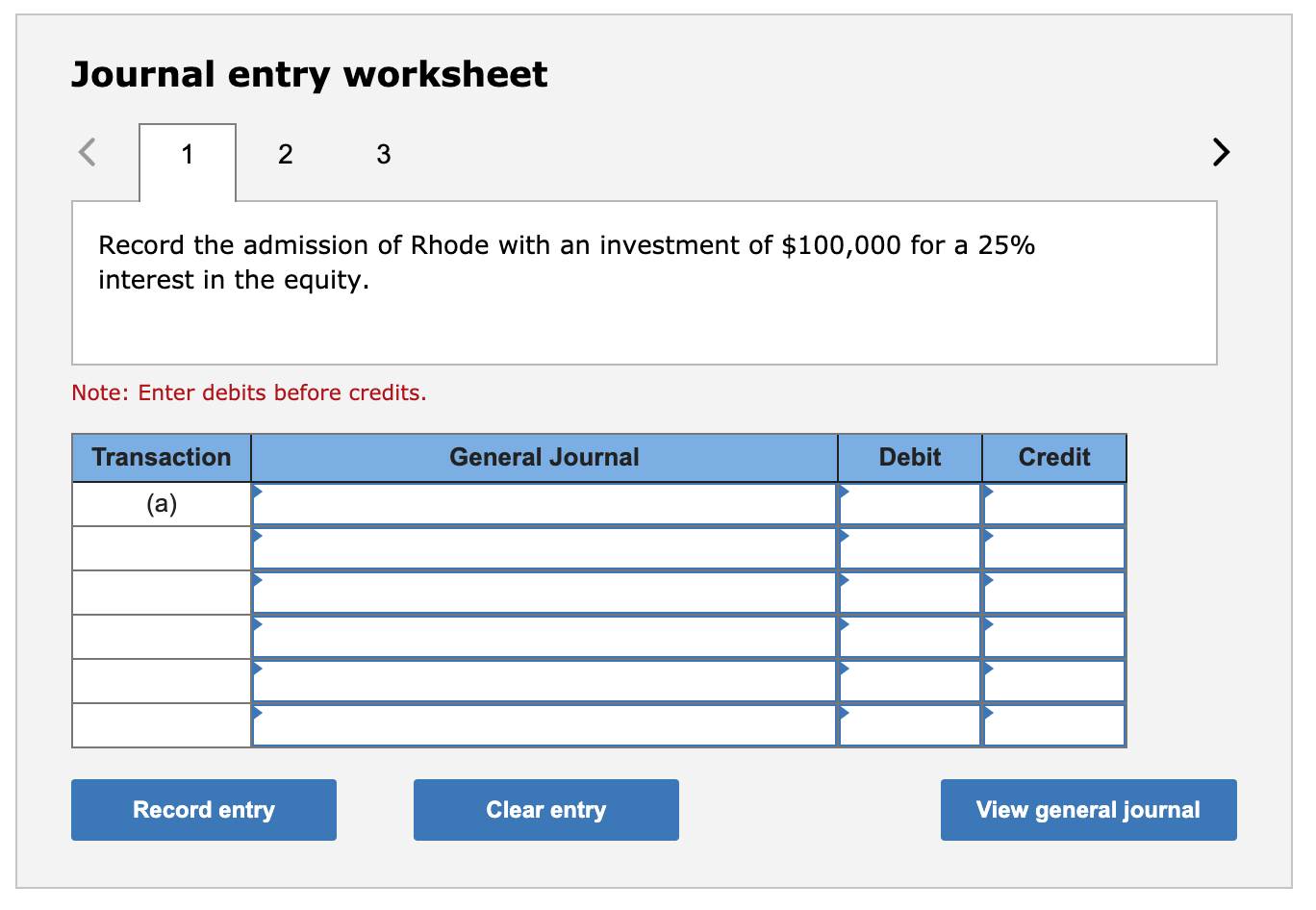

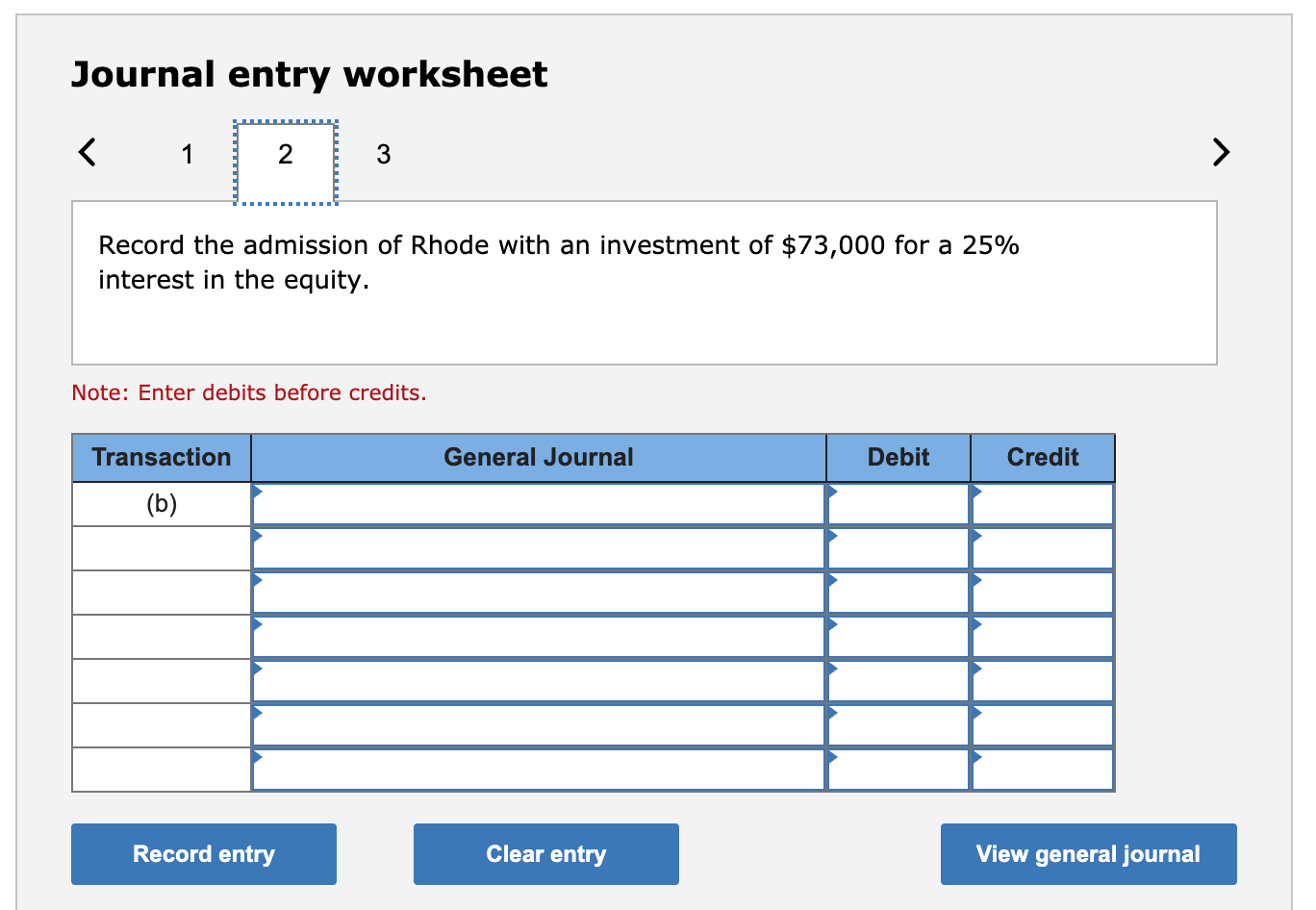

Required information (The following information applies to the questions displayed below.) Meir, Benson, and Lau are partners and share income and loss in a 2:3:5 ratio (in percents: Meir, 20%; Benson, 30%; and Lau, 50%). The partnership's capital balances are as follows: Meir, $58,000; Benson, $89,000; and Lau, $153,000. Benson decides to withdraw from the partnership. 2. Assume that Benson does not retire from the partnership described in Part 1. Instead, Rhode is admitted to the partnership on February 1 with a 25% equity. Prepare journal entries to record Rhode's entry into the partnership under each separate assumption: Rhode invests (a) $100,000; (b) $73,000; and (c) $131,000. (Do not round your intermediate calculations.) Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts