Question: I really need help understanding these two questions, any help would be greatly appreciated. Thanks! QUESTION 5 2 You are considering two independent projects both

I really need help understanding these two questions, any help would be greatly appreciated. Thanks!

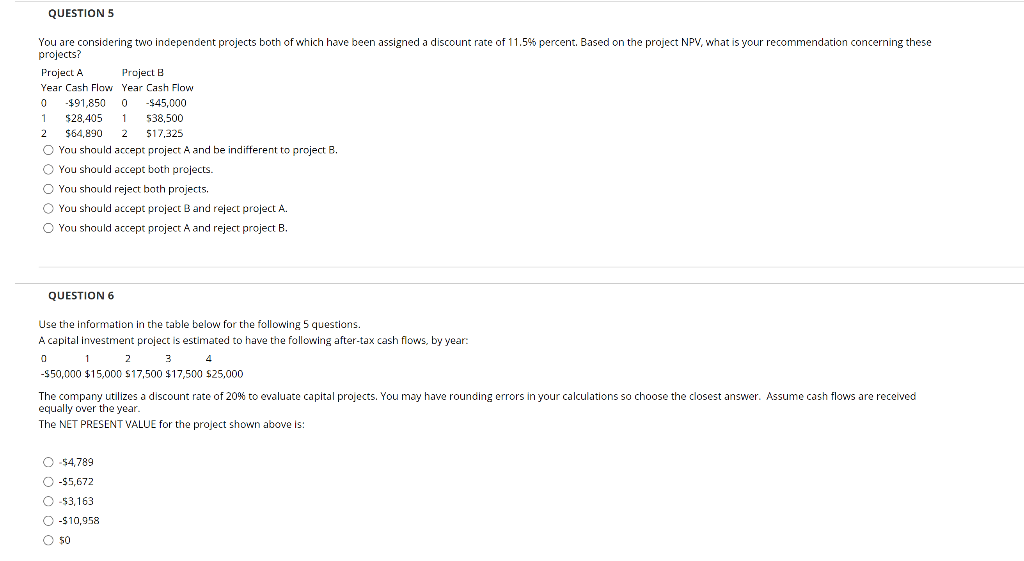

QUESTION 5 2 You are considering two independent projects both of which have been assigned a discount rate of 11.54 percent. Based on the project NPV, what is your recommendation concerning these projects? Project A Project Year Cash Flow Year Cash Flow 0 -$91,850 0 -$45,000 $28,405 1 538,500 $64,890 2 $17,325 You should accept project A and be indifferent to project B. You should accept both projects. O You should reject both projects. You should accept project B and reject project A. O You should accept project A and reject project B. QUESTION 6 Use the information in the table below for the following 5 questions. A capital investment project is estimated to have the following after-tax cash flows, by year: 0 1 2 3 4 -$50,000 $15,000 $17,500 $17,500 $25,000 The company utilizes a discount rate of 20% to evaluate capital projects. You may have rounding errors in your calculations so choose the closest answer. Assume cash flows are received equally over the year. The NET PRESENT VALUE for the project shown above is: 0 54,789 0-$5,672 0-53,163 O -$10.95 O $0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts