Question: I really need help with part b. Forward exchange contract designated as a fair value hedge of a foreign-currency-denominated accounts payable, strengthening $US forward rates,

I really need help with part b.

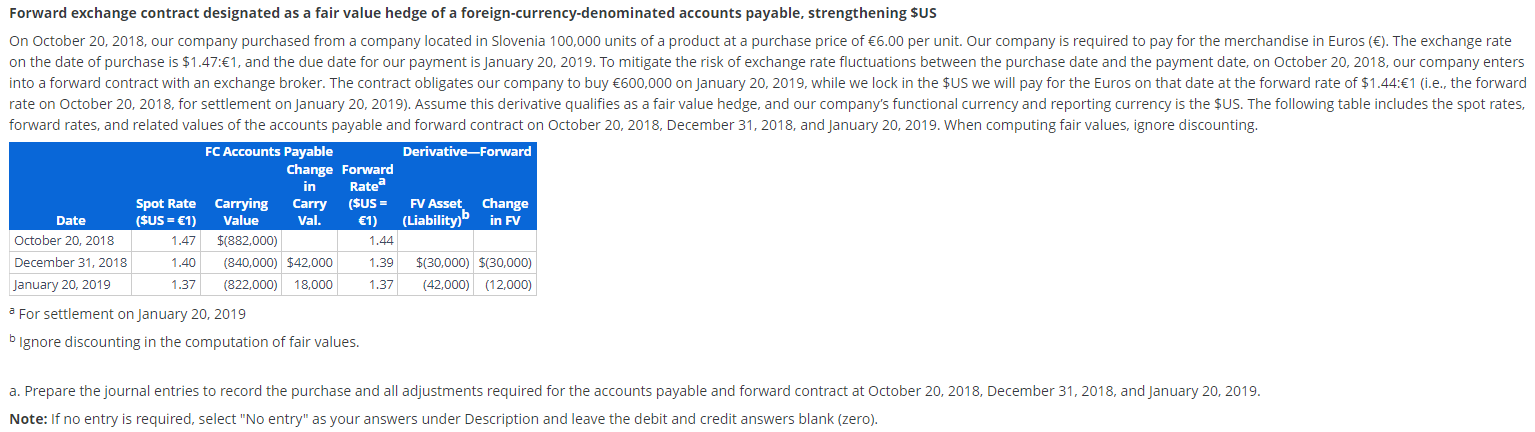

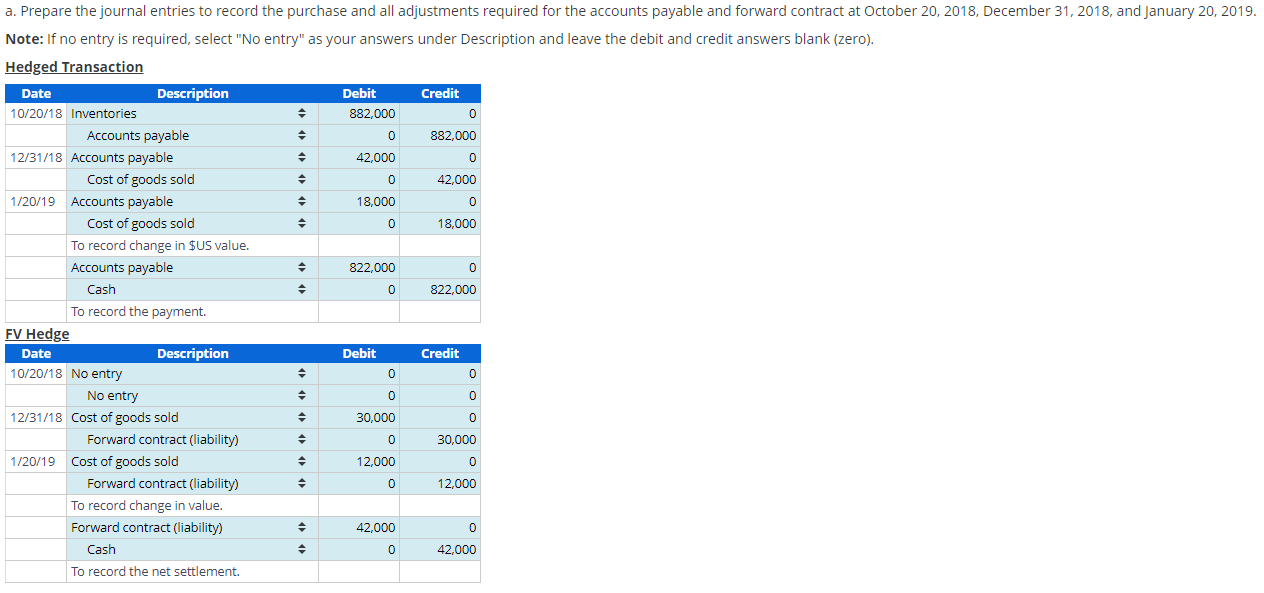

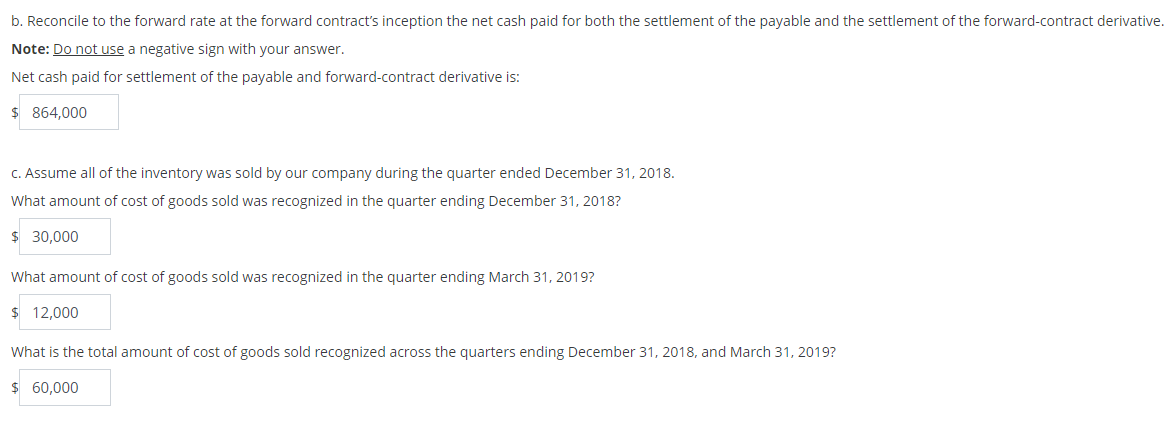

Forward exchange contract designated as a fair value hedge of a foreign-currency-denominated accounts payable, strengthening \$US forward rates, and related values of the accounts payable and forward contract on October 20, 2018, December 31, 2018, and January 20, 2019. When computing fair values, ignore discounting. a For settlement on January 20, 2019 Ignore discounting in the computation of fair values. a. Prepare the journal entries to record the purchase and all adjustments required for the accounts payable and forward contract at October 20, 2018 , December 31 , 2018 , and January 20, 2019. Note: If no entry is required, select "No entry" as your answers under Description and leave the debit and credit answers blank (zero). a. Prepare the journal entries to record the purchase and all adjustments required for the accounts payable and forward contract at October 20, 2018, December 31,2018, and January 20,2019. Note: If no entry is required, select "No entry" as your answers under Description and leave the debit and credit answers blank (zero). b. Reconcile to the forward rate at the forward contract's inception the net cash paid for both the settlement of the payable and the settlement of the forward-contract derivative. Note: Do not use a negative sign with your answer. Net cash paid for settlement of the payable and forward-contract derivative is: c. Assume all of the inventory was sold by our company during the quarter ended December 31, 2018. What amount of cost of goods sold was recognized in the quarter ending December 31, 2018? What amount of cost of goods sold was recognized in the quarter ending March 31, 2019? $ What is the total amount of cost of goods sold recognized across the quarters ending December 31,2018, and March 31,2019? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts