Question: I really need help with that !!!! Am test Puthufactures its products in two separate departments Machining and Assembly Total manufacturing overhead costs for the

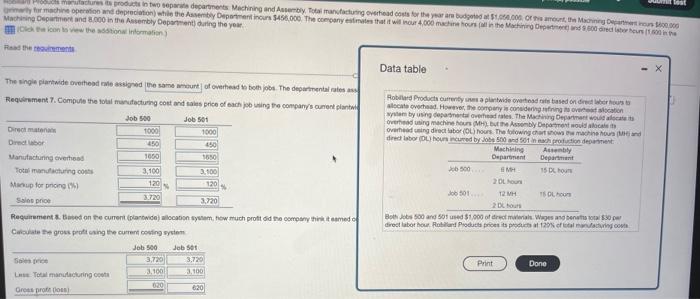

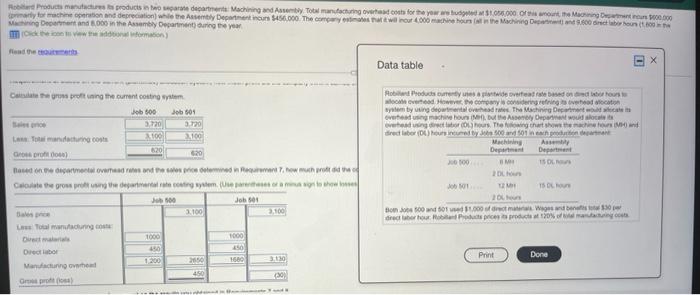

Am test Puthufactures its products in two separate departments Machining and Assembly Total manufacturing overhead costs for the year are budgeted at $1.058 000 of the amount the Machining Departm$600,000 grimarily for machine operation and depreciation) while the Assembly Department incurs $456,000. The company estimates that it will nour 4,000 machine hours (all in the Machining Department and 8,600 direct isbor hours (1,600 in the Machining Department and 8.000 in the Assembly Department) during the year Click the icon to view the additional information) Read the requirements Data table The single plantwide overhead rate assigned the same amount of overhead to both jobs. The departmental rates ass Requirement 7. Compute the total manufacturing cost and sales price of each job using the company's curent plant Robillard Products currently uses a plantwide overhead rats based on direct labor hours to alocate overhead. However, the company is considering refining to overheat alocation system by using departmental overhead rates. The Machining Department would alocate t overhead using machine hours (MH), but the Assembly Department would alocals t overhead using direct labor (DL) hours. The following chart shows the machine hours (MH) and direct labor (DL) hours incurred by Jobs 500 and 501 in each production department Job 500 Job 501 Direct mate 1000 1000 Direct labor 450 450 Assembly Department 15 Do 1000 1650 Manufacturing overhead Machining Department SMH 20 hours 12 MH Job 500 Total manufacturing costs 3,100 3,100 120 Job 501 TOL Markup for pricing (5) 3.720 2 DL hours Sales price 3,720 Both Jobs 500 and 501 used $1,000 of direct materials. Wages and benatts total $30 per direct labor hour. Robiland Products prices its products at 120% of total manufacturing costs Requirement & Based on the current (plantwide) allocation system, how much profit did the company think it eamed of Calculate the gross profit using the current costing system Job 500 Job 501 Print Done Less Total manufacturing costs Gross profs Doss 120% 3,720 3,100 020 3,720 3.100 620 Robert Products manufactures to products in two separate departments Machining and Assembly Total manufacturing overhead costs for the year are budgeted at $1,055,000 of this amount, the Machining Department nours $000,000 primarly for machine operation and depreciation) while the Assembly Department incurs $456,000. The company estimates that it will incur 4,000 machine hours (all in the Machining Department and S600 direct labor hours (1800 t Machining Department and 8,000 in the Assembly Department) during the year (Click the icon to view the additional information) Read the requirements X Data table Calculate the gross profit using the current costing system Job 500 Job 501 Robiland Products currently uses a plantwide overhead rate based on direct labor hours alocale overhead However, the company is considering refiring it overhead location system by using departmental overhead rates. The Machining Department would alocate t overhead using machine hours (M), but the Assembly Department would alocales overhead using direct labor (06) hours. The following chart shows the machine hours (M) and direct labor (DL) hours incumed by Jobs 500 and 501 in each production department 3,720 3.720 100 3.100 Less Total manufacturing costs 620 Gross profDoss) 620 Machining Department M 2 DL 12 M Assembly Department 15 ON J500 Based on the departmental overhead rates and the sales price determined in Requirement 7, how much profit did the o Calculate the gross proft using the departmental rate costing system. (Use parentheses or a minus sign to show losses Job 501 15 DL hour 20 hour Job 500 Job 501 3.100 3.100 Sales price Both Jobs 500 and 501 used $1,000 of direct materials Wages and benefits total $30 per direct labor hour Robiad Products prices its products at 120% of total uning costs Les Total manufacturing co Direct malarials Direct labor Print Done 2650 3.130 Manufacturing overhead (30) Gross proft (o) 1000 450 450 1000 450 1660 met in thes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts