Question: I really need help with the problem below. I've tried it so many ways but I can't seem to solve it. These are the balanced

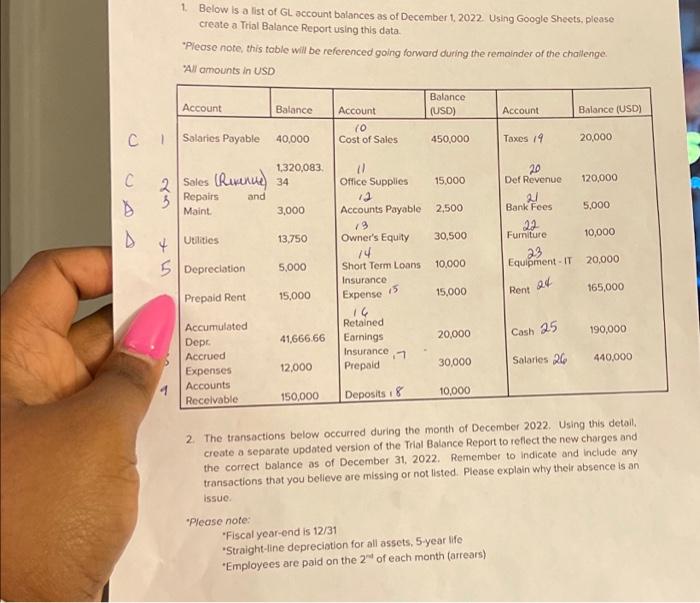

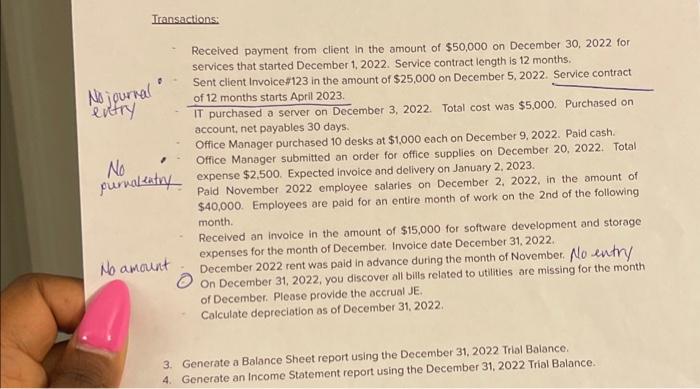

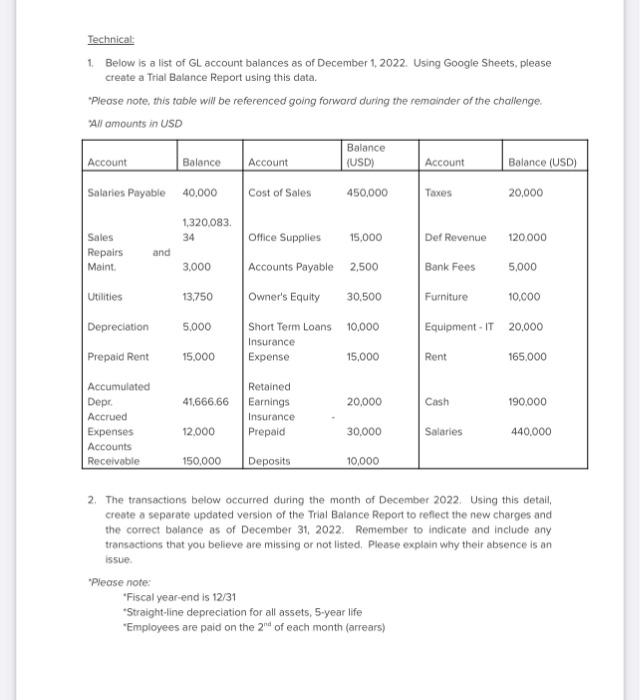

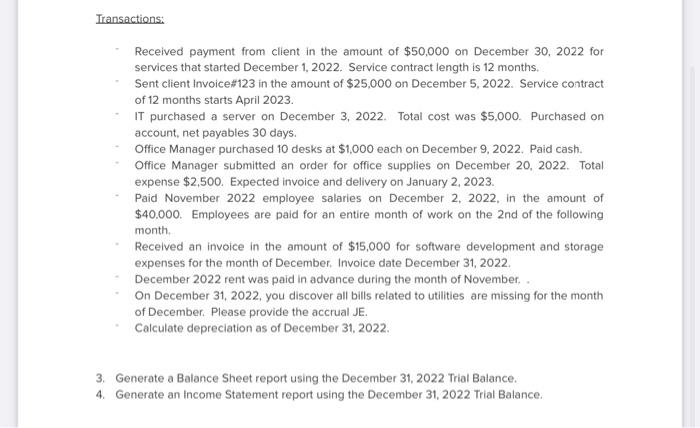

Received payment from client in the amount of $50,000 on December 30,2022 for services that started December 1, 2022. Service contract length is 12 months. - Sent client Invoice $123 in the amount of $25,000 on December 5, 2022. Service contract of 12 months starts April 2023. IT purchased a server on December 3, 2022. Total cost was $5,000. Purchased on account, net payables 30 days. - Office Manager purchased 10 desks at $1,000 each on December 9, 2022. Paid cash. - Office Manager submitted an order for office supplies on December 20, 2022. Total alentry expense \$2,500. Expected invoice and delivery on January 2, 2023. Paid November 2022 employee salaries on December 2. 2022, in the amount of $40,000. Employees are paid for an entire month of work on the 2 nd of the following month. Received an invoice in the amount of $15,000 for software development and storage expenses for the month of December. Invoice date December 31, 2022. December 2022 rent was paid in advance during the month of November. No entry On December 31, 2022, you discover all bills related to utilities are missing for the month of December. Please provide the accrual JE. Calculate depreciation as of December 31, 2022. 3. Generate a Balance Sheet report using the December 31, 2022 Trial Balance. 4. Generate an Income Statement report using the December 31, 2022 Trial Balance. - Received payment from client in the amount of $50,000 on December 30,2022 for services that started December 1, 2022. Service contract length is 12 months. Sent client Invoice $123 in the amount of $25,000 on December 5, 2022. Service contract of 12 months starts April 2023. - IT purchased a server on December 3, 2022. Total cost was $5,000. Purchased on account, net payables 30 days. Office Manager purchased 10 desks at $1,000 each on December 9,2022 . Paid cash. Office Manager submitted an order for office supplies on December 20, 2022. Total expense \$2,500. Expected invoice and delivery on January 2, 2023. Paid November 2022 employee salaries on December 2, 2022, in the amount of $40.000. Employees are paid for an entire month of work on the 2 nd of the following month. Received an invoice in the amount of $15,000 for software development and storage expenses for the month of December. Invoice date December 31, 2022. December 2022 rent was paid in advance during the month of November. . On December 31, 2022, you discover all bills related to utilities are missing for the month of December. Please provide the accrual JE. Calculate depreciation as of December 31, 2022. 3. Generate a Balance Sheet report using the December 31, 2022 Trial Balance. 4. Generate an income Statement report using the December 31, 2022 Trial Balance. 1. Below is a list of GL account balances as of December 1, 2022 Using Google Sheets, picase create a Trial Balance Report using this data. -Pleose note, this toble will be referenced gaing forward during the remainder of the challenge. Ail amounts in USD 2. The transactions below occurred during the month of December 2022. Using this detail, create a separate updated version of the Trial Balance Report to reflect the new charges and the correct balance as of December 31, 2022. Remember to indicate and include any transactions that you belleve are missing or not listed. Please explain why their absence is an issue. -Please note: - Fiscal year-end is 12/31 -Straight-line depreciation for all assets, 5 -year life "Employees are paid on the 2"4 of each month (arrears) Technical: 1. Below is a list of GL account balances as of December 1, 2022. Using Google Sheets, please create a Trial Balance Report using this data. "Pleose note, this table will be referenced going forword during the remainder of the challenge. xAll amounts in USD 2. The transactions below occurred during the month of December 2022. Using this detail, create a separate updated version of the Trial Balance Repart to reflect the new charges and the correct balance as of December 31, 2022. Remember to indicate and include any transactions that you believe are missing or not listed. Please explain why their absence is an issue. Please note: "Fiscal year-end is 12/31 "Straight-line depreciation for all assets, 5-year life "Employees are paid on the 2nd of each month (arrears)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts