Question: I really need help with these before tonight. 1. (15 points) Shack Depot is a leading specialty retailer of hardware and home improvement. It operates

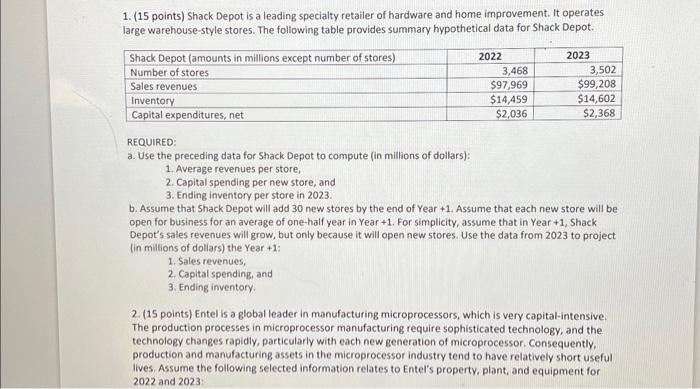

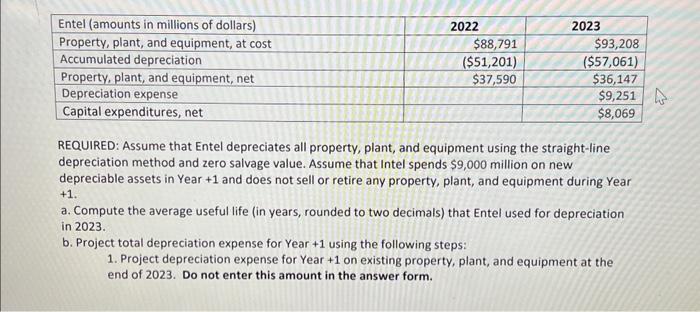

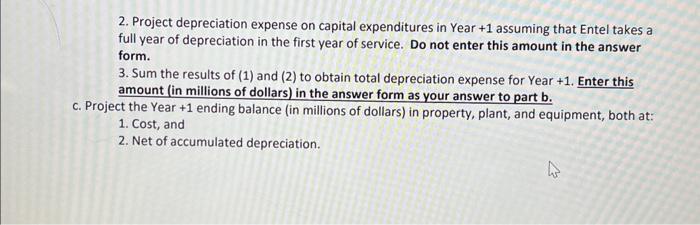

1. (15 points) Shack Depot is a leading specialty retailer of hardware and home improvement. It operates large warehouse-style stores. The following table provides summary hypothetical data for Shack Depot. REQUIRED: a. Use the preceding data for Shack Depot to compute (in millions of dollars): 1. Average revenues per store, 2. Capital spending per new store, and 3. Ending inventory per store in 2023. b. Assume that Shack Depot will add 30 new stores by the end of Year +1 . Assume that each new store will be open for business for an average of one-half year in Year +1 . For simplicity, assume that in Year +1 , Shack Depot's sales revenues will grow, but only because it will open new stores. Use the data from 2023 to project (in millions of dollars) the Year +1 : 1. Sales revenues, 2. Capital spending, and 3. Ending inventory. 2. (15 points) Entel is a global leader in manufacturing microprocessors, which is very capital-intensive. The production processes in microprocessor manufacturing require sophisticated technology, and the technology changes rapidly, particularly with each new generation of microprocessor. Consequently, production and manufacturing assets in the microprocessor industry tend to have relatively short useful lives. Assume the following selected information relates to Entel's property, plant, and equipment for 2022 and 2023 : REQUIRED: Assume that Entel depreciates all property, plant, and equipment using the straight-line depreciation method and zero salvage value. Assume that Intel spends $9,000 million on new depreciable assets in Year +1 and does not sell or retire any property, plant, and equipment during Year +1 . a. Compute the average useful life (in years, rounded to two decimals) that Entel used for depreciation in 2023. b. Project total depreciation expense for Year +1 using the following steps: 1. Project depreciation expense for Year +1 on existing property, plant, and equipment at the end of 2023. Do not enter this amount in the answer form. 2. Project depreciation expense on capital expenditures in Year +1 assuming that Entel takes a full year of depreciation in the first year of service. Do not enter this amount in the answer form. 3. Sum the results of (1) and (2) to obtain total depreciation expense for Year +1 . Enter this amount (in millions of dollars) in the answer form as your answer to part b. c. Project the Year +1 ending balance (in millions of dollars) in property, plant, and equipment, both at: 1. Cost, and 2. Net of accumulated depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts