Question: i really need help with these three i dont understand them plz help!!!! Pu A common stock is selling for $60.78 and paid a $1.12

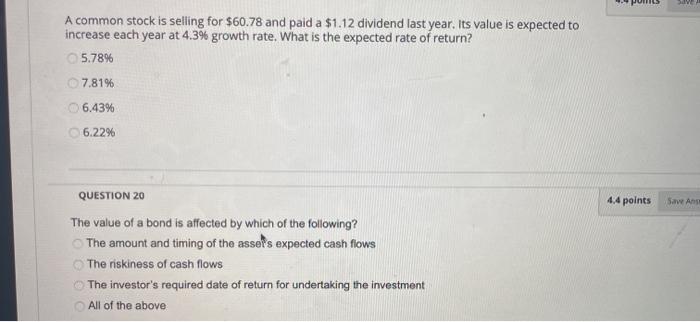

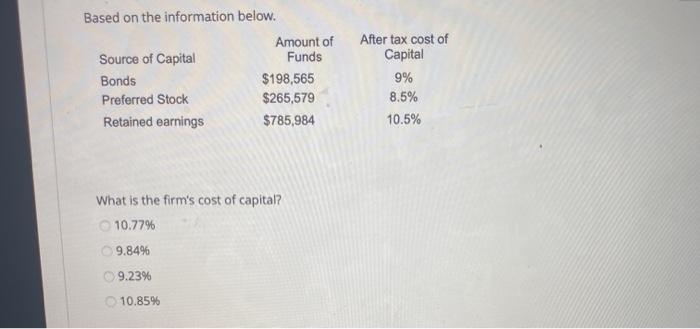

Pu A common stock is selling for $60.78 and paid a $1.12 dividend last year. Its value is expected to increase each year at 4.3% growth rate. What is the expected rate of return? 5.78% 7.81% 6.43% 6.22% QUESTION 20 4.4 points Save As The value of a bond is affected by which of the following? The amount and timing of the asset's expected cash flows The riskiness of cash flows The investor's required date of return for undertaking the investment All of the above Based on the information below. Amount of Source of Capital Funds Bonds $198,565 Preferred Stock $265,579 Retained earnings $785,984 After tax cost of Capital 9% 8.5% 10.5% What is the firm's cost of capital? 10.77% 9.84% 9.23% 10.85%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts