Question: I really need help with this problem, PLEASE HELP Sierra Corporation outstanding common stock 80% acquired by Padre, Inc Cash paid by Padre, Inc. for

I really need help with this problem, PLEASE HELP

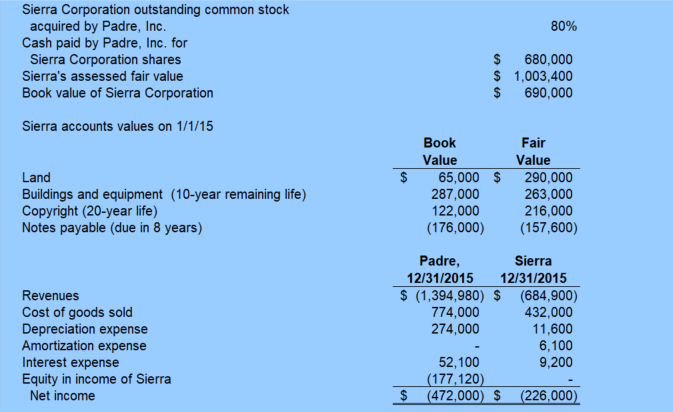

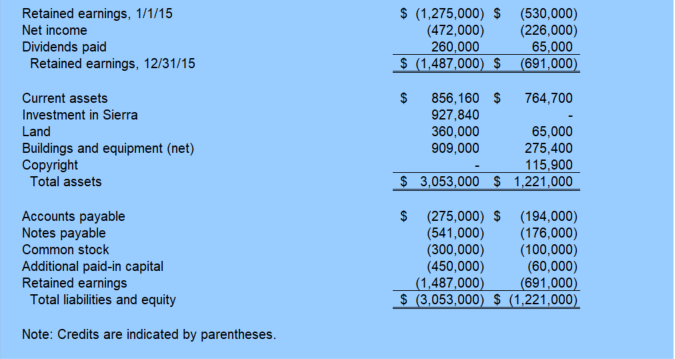

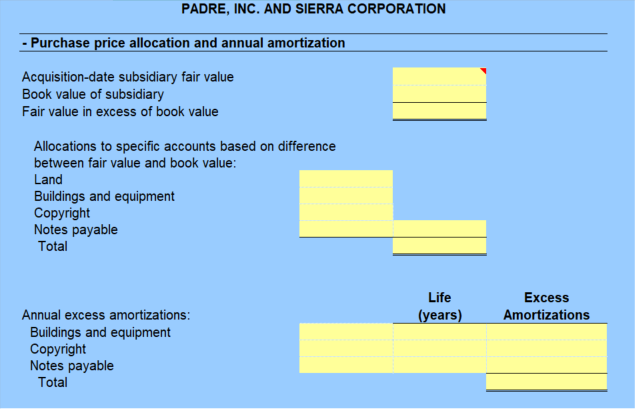

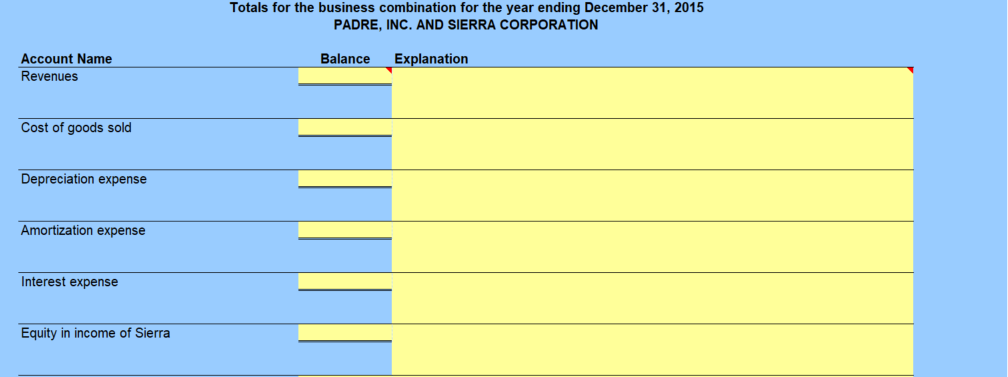

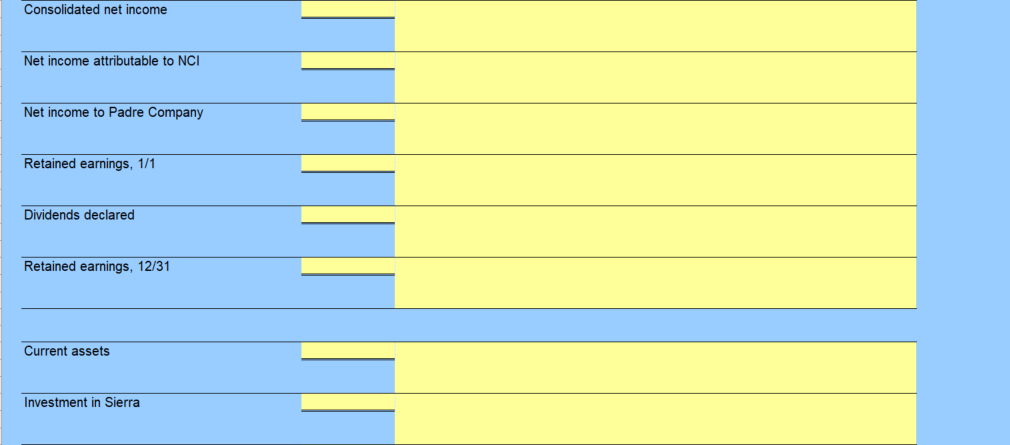

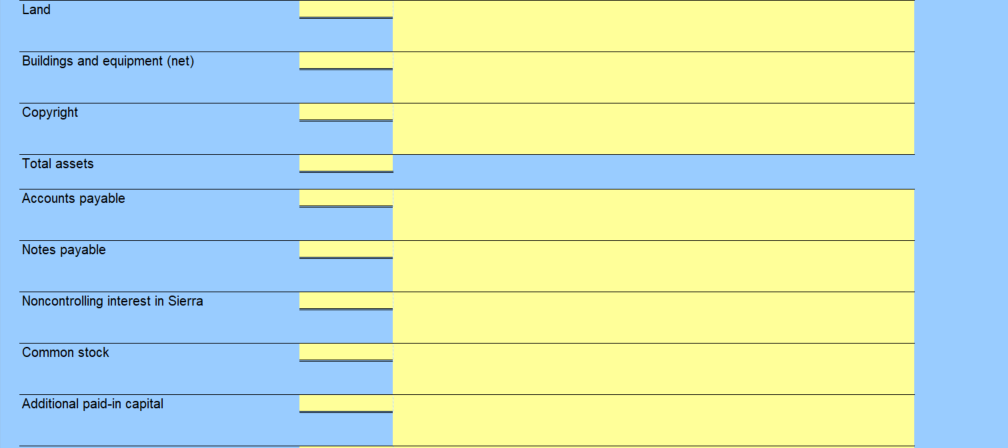

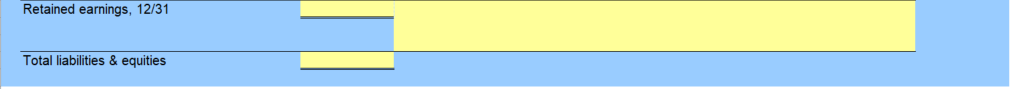

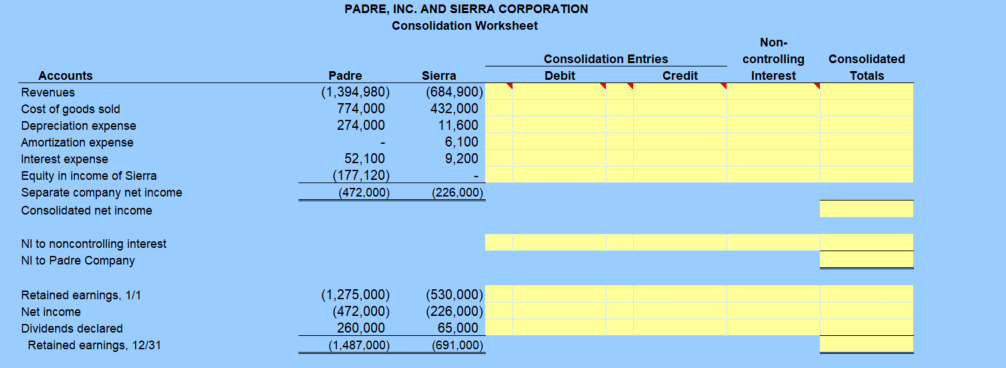

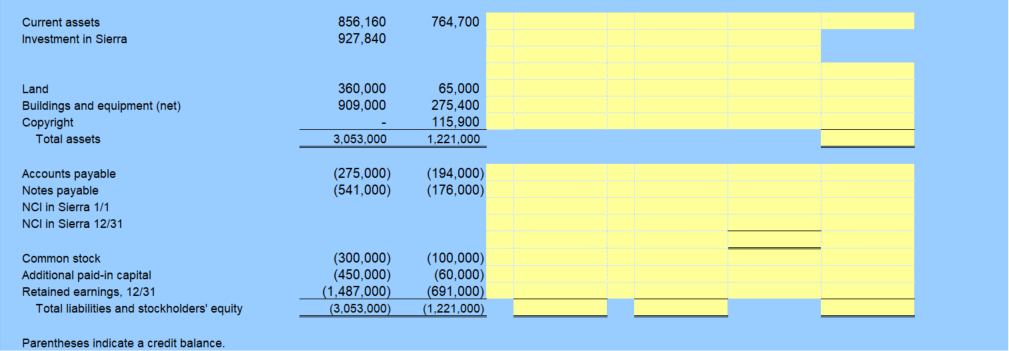

Sierra Corporation outstanding common stock 80% acquired by Padre, Inc Cash paid by Padre, Inc. for Sierra Corporation shares Sierra's assessed fair value Book value of Sierra Corporation $ 680,000 $ 1,003,400 $ 690,000 Sierra accounts values on 1/1/15 Book Value Fair Value Land Buildings and equipment (10-year remaining life) Copyright (20-year life) Notes payable (due in 8 years) $ 65,000 $ 290,000 263,000 216,000 (176,000) (157,600) 287,000 122,000 Padre, 12/31/2015 12/31/2015 Sierra Revenues Cost of goods sold Depreciation expense Amortization expense Interest expense Equity in income of Sierra S (1,394,980) $ (684,900) 432,000 11,600 6,100 9,200 774,000 274,000 52,100 177,120) Net income $ (472,000) $ (226,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts