Question: I really need help with this question, can someone kindly help me, please. Mountain Sports Ltd. Income Statement For the Year Ended Dec 31, 2019

I really need help with this question, can someone kindly help me, please.

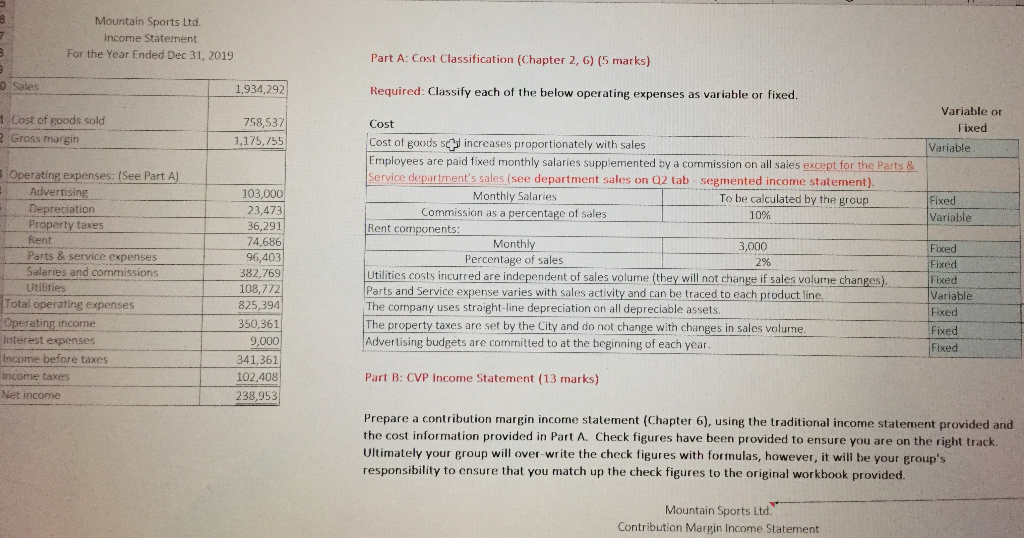

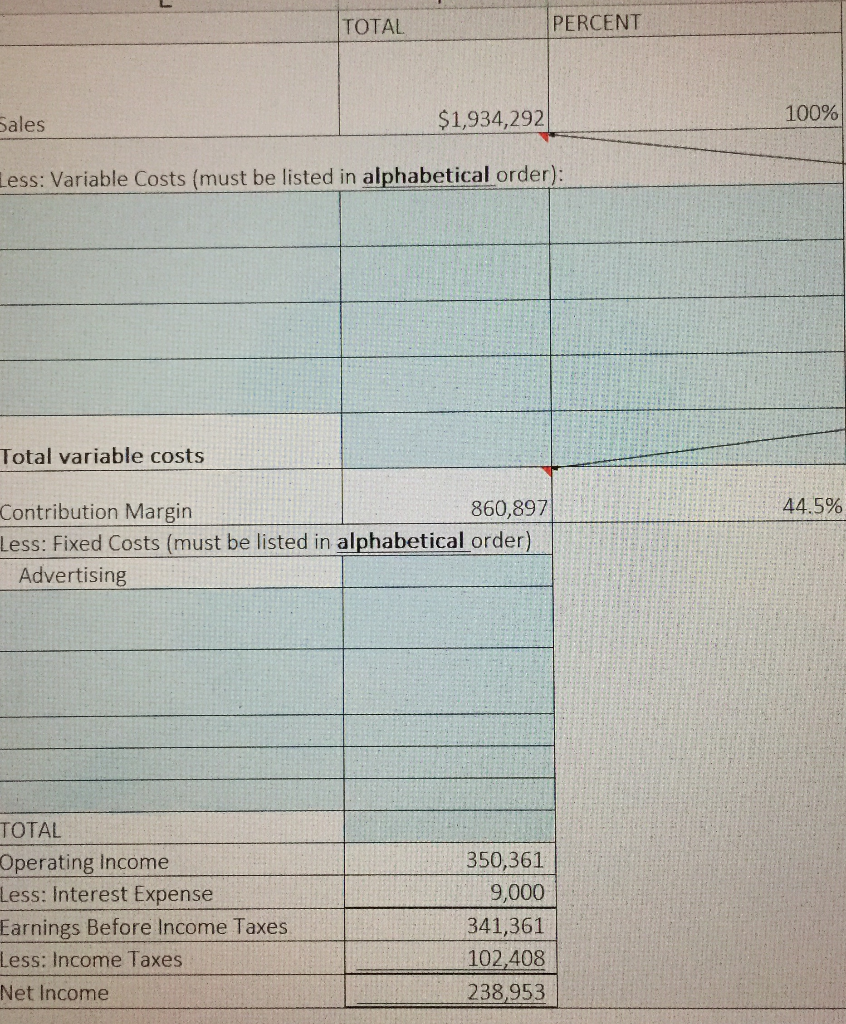

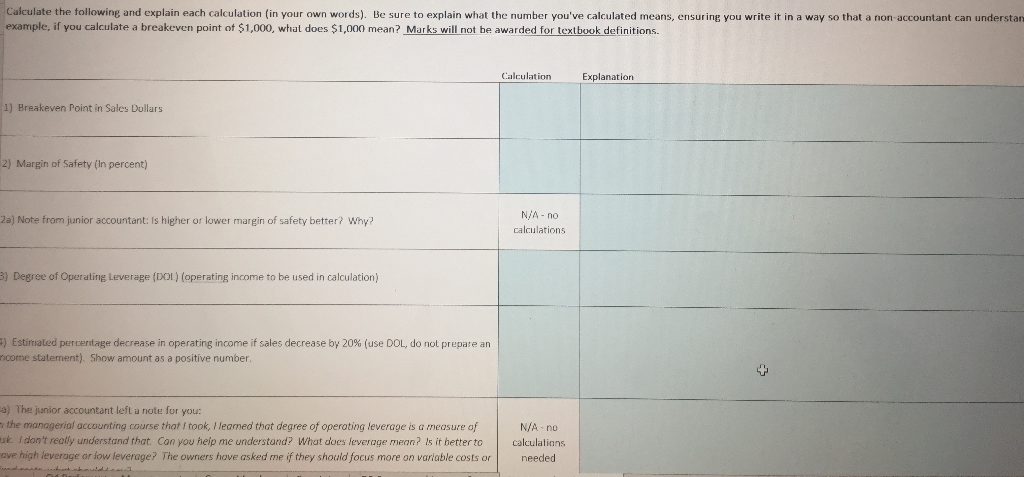

Mountain Sports Ltd. Income Statement For the Year Ended Dec 31, 2019 Part A: Cost Classification (Chapter 2, 6) (5 marks) Sales 1.934,292 Required: Classify each of the below operating expenses as variable or fixed. Cost of goods sold Gross margin 758,537 1,175,755 Variable or Fixed Variable Fixed Variable Operating expenses: (See Part A) Advertising Depreciation Property taxes Rent Parts & service expenses Salaries and commissions Utilities Total operating expenses Operating income Interest expenses Income before taxes Income taxes Net income 2% Cost Cost of goods sc increases proportionately with sales Employees are paid fixed monthly salaries supplemented by a commission on all sales except for the Parts & Service department's sales (see department sales on Q2 tab segmented income statement). Monthly Salaries To be calculated by the group Commission as a percentage of sales 10% Rent components: Monthly 3,000 Percentage of sales Utilities costs incurred are independent of sales volume (they will not change if sales volume changes). Parts and Service expense varies with sales activity and can be traced to each product line. The company uses straight-line depreciation on all depreciable assets. The property taxes are set by the City and do not change with changes in sales volume. Advertising budgets are committed to at the beginning of each year. 103,000 23,473 36,291 74,686 96,403 382,769 108,772 825,394 350,361 9,000 341,361 102,408 238,953 Fixed Fixed Fixed Variable Fixed Fixed Fixed Part B: CVP Income Statement (13 marks) Prepare a contribution margin income statement (Chapter 6), using the traditional income statement provided and the cost information provided in Part A. Check figures have been provided to ensure you are on the right track. Ultimately your group will over write the check figures with formulas, however, it will be your group's responsibility to ensure that you match up the check figures to the original workbook provided. Mountain Sports Ltd Contribution Margin Income Statement TOTAL PERCENT Sales $1,934,292 100% Less: Variable Costs (must be listed in alphabetical order): Total variable costs 44.5% Contribution Margin 860,897 Less: Fixed Costs (must be listed in alphabetical order) Advertising TOTAL Operating Income Less: Interest Expense Earnings Before Income Taxes Less: Income Taxes Vet Income 350,361 9,000 341,361 102,408 238,953 Calculate the following and explain each calculation (in your own words). Be sure to explain what the number you've calculated means, ensuring you write it in a way so that a non-accountant can understan example, if you calculate a breakeven point of $1,000, what does $1,000 mean? Marks will not be awarded for textbook definitions. Calculation Explanation 1) Breakeven Point in Sales Dollars 2) Margin of Safety (In percent) 2a) Note from junior accountant: is higher or lower margin of safety better? Why? N/A - no calculations Degree of Operating Leverage (DOL) (operating income to be used in calculation) Estimated percentage decrease in operating income if sales decrease by 20% (use DOL, do not prepare an come statement). Show amount as a positive number. a) The junior accountant left a note for you! the managerial accounting course that took, I leamed that degree of operating leverage is a measure of sk. I don't really understand that Can you help me understand? What does leverage mean? Is it better to Vergleverage or low leverage? The owners have asked me if they should focus more on variable costs or calculations needed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts