Question: I really need some help on Table 3 Estimation Procedures: Table 1. Calculate Depreciation - MACRS Schedule Table 2. Calculate Operating Cash Flows - Fill

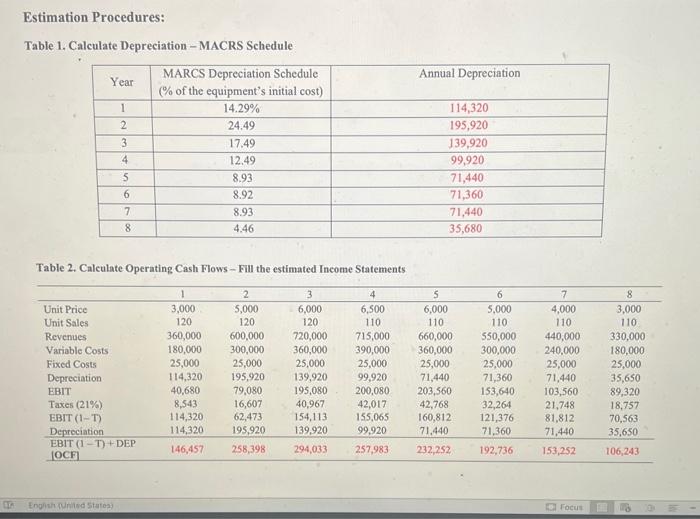

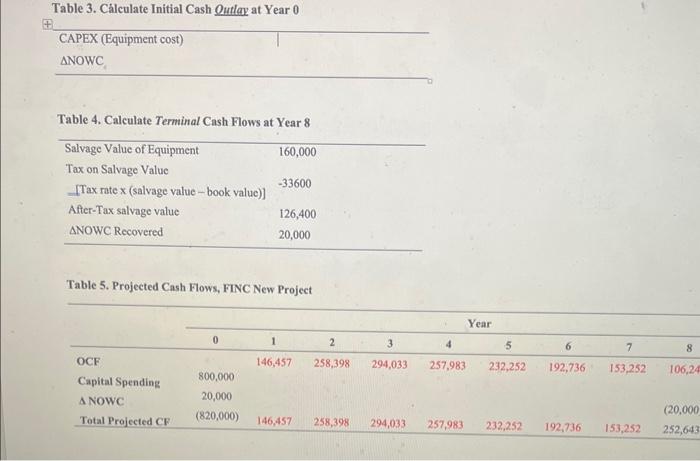

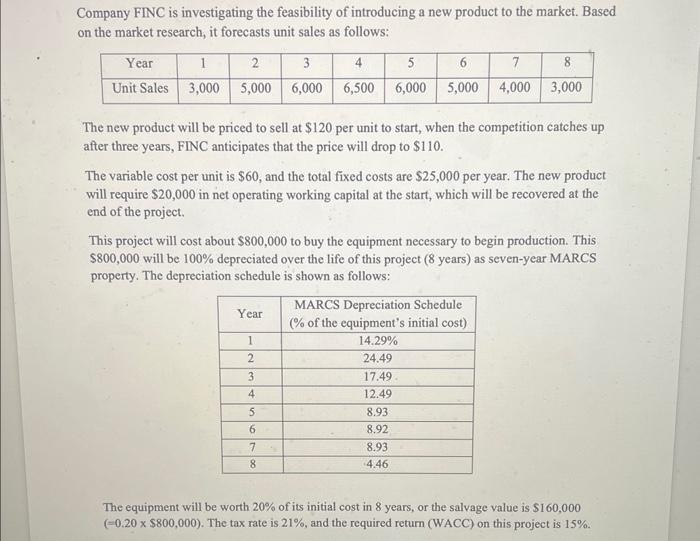

Estimation Procedures: Table 1. Calculate Depreciation - MACRS Schedule Table 2. Calculate Operating Cash Flows - Fill the estimated Income Statements Table 3. Clculate Initial Cash Ouflay at Year 0 Table 4. Calculate Terminal Cash Flows at Year 8 Table 5. Projected Cash Flows, FINC New Project Company FINC is investigating the feasibility of introducing a new product to the market. Based on the market research, it forecasts unit sales as follows: The new product will be priced to sell at $120 per unit to start, when the competition catches up after three years, FINC anticipates that the price will drop to $110. The variable cost per unit is $60, and the total fixed costs are $25,000 per year. The new product will require $20,000 in net operating working capital at the start, which will be recovered at the end of the project. This project will cost about $800,000 to buy the equipment necessary to begin production. This $800,000 will be 100% depreciated over the life of this project ( 8 years) as seven-year MARCS property. The depreciation schedule is shown as follows: The equipment will be worth 20% of its initial cost in 8 years, or the salvage value is $160,000 (=0.20$800,000). The tax rate is 21%, and the required return (WACC) on this project is 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts