Question: I recently asked the problem below to a Chegg expert (such as yourself) and was provided with the solution given below. However, I am in

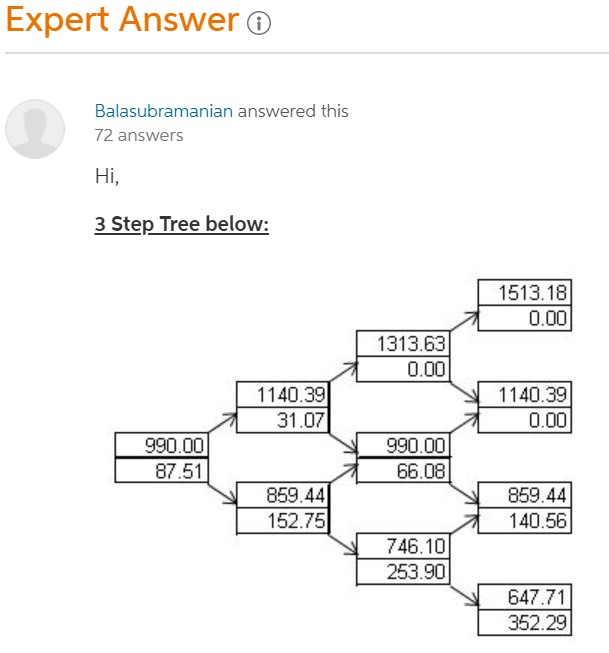

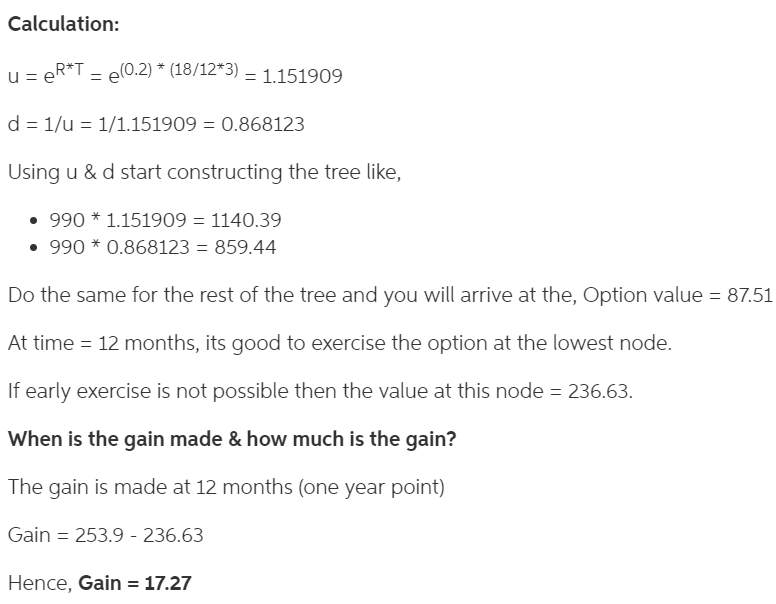

I recently asked the problem below to a Chegg expert (such as yourself) and was provided with the solution given below. However, I am in need of some more clarification on the solution provided. Can you please explain how you found the option values displayed in the solution tree below (e.g. 87.51, 31.07, 152.75, etc.)? Can you please also explain what is mean by "If early exercise is not possible then the value at this node = 236.63", why that value would be 236.63 instead of the value given in the tree (253.90), why the gain is found from that particular node, and why the answer for the gain is what it is shown to be below?

Options, Futures, and Other Derivatives (9th Edition) Chapter 13, Problem 28FQ Bookmark) Show all steps: ON Problem A stock index is currently 990, the risk-free rate is 5%, and the dividend yield on the index is 2%. Use a three-step tree to value an 18-month American put option with a strike price of 1,000 when the volatility is 20% per annum. How much does the option holder gain by being able to exercise early? When is the gain made? when eary? When is the gain madeds the option holder Options, Futures, and Other Derivatives (9th Edition) Chapter 13, Problem 28FQ Bookmark) Show all steps: ON Problem A stock index is currently 990, the risk-free rate is 5%, and the dividend yield on the index is 2%. Use a three-step tree to value an 18-month American put option with a strike price of 1,000 when the volatility is 20% per annum. How much does the option holder gain by being able to exercise early? When is the gain made? when eary? When is the gain madeds the option holder

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts