Question: I recently received a payment from a customer for a past due bill. He paid $ 4 8 0 0 which did not include the

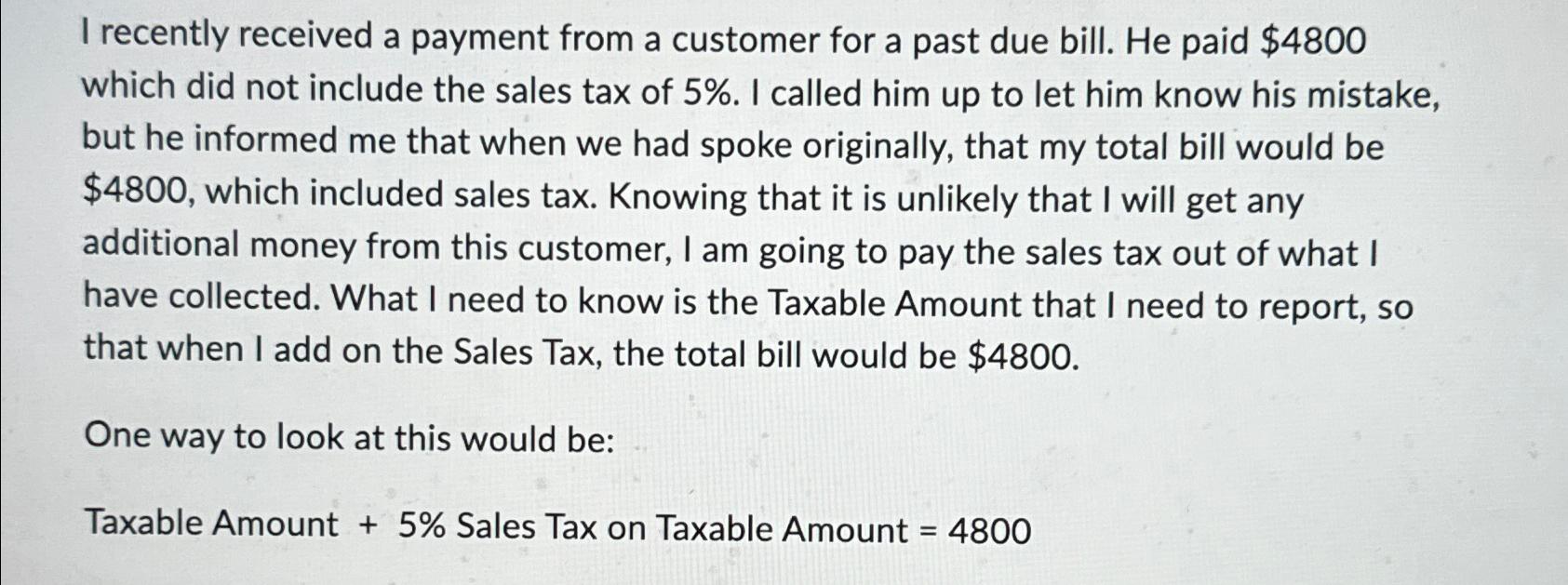

I recently received a payment from a customer for a past due bill. He paid $ which did not include the sales tax of I called him up to let him know his mistake, but he informed me that when we had spoke originally, that my total bill would be $ which included sales tax. Knowing that it is unlikely that I will get any additional money from this customer, I am going to pay the sales tax out of what I have collected. What I need to know is the Taxable Amount that I need to report, so that when I add on the Sales Tax, the total bill would be $

One way to look at this would be:

Taxable Amount Sales Tax on Taxable Amount

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock