Question: I requested help on the following homework assignment but only a portion was answered please help with answering the section in bold please: Please help

I requested help on the following homework assignment but only a portion was answered please help with answering the section in bold please:

Please help with the following homework:

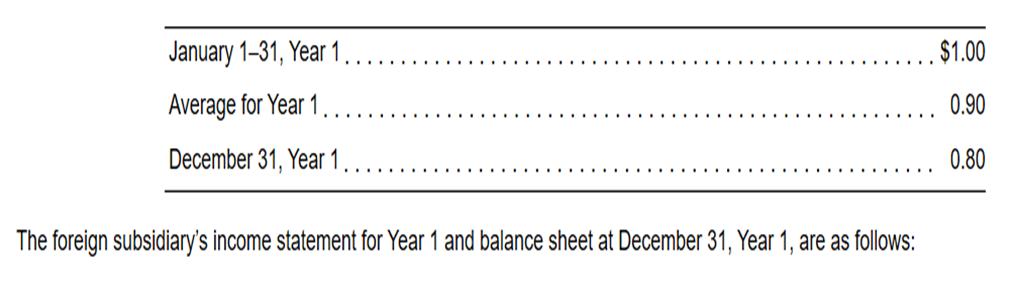

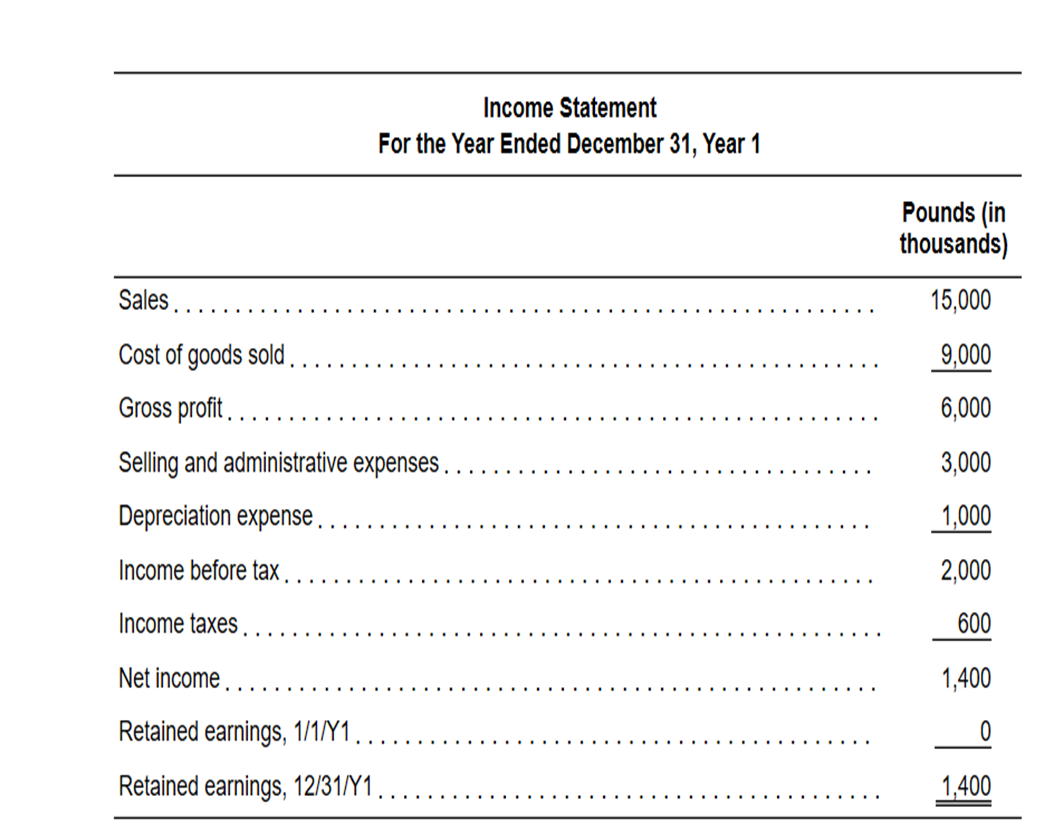

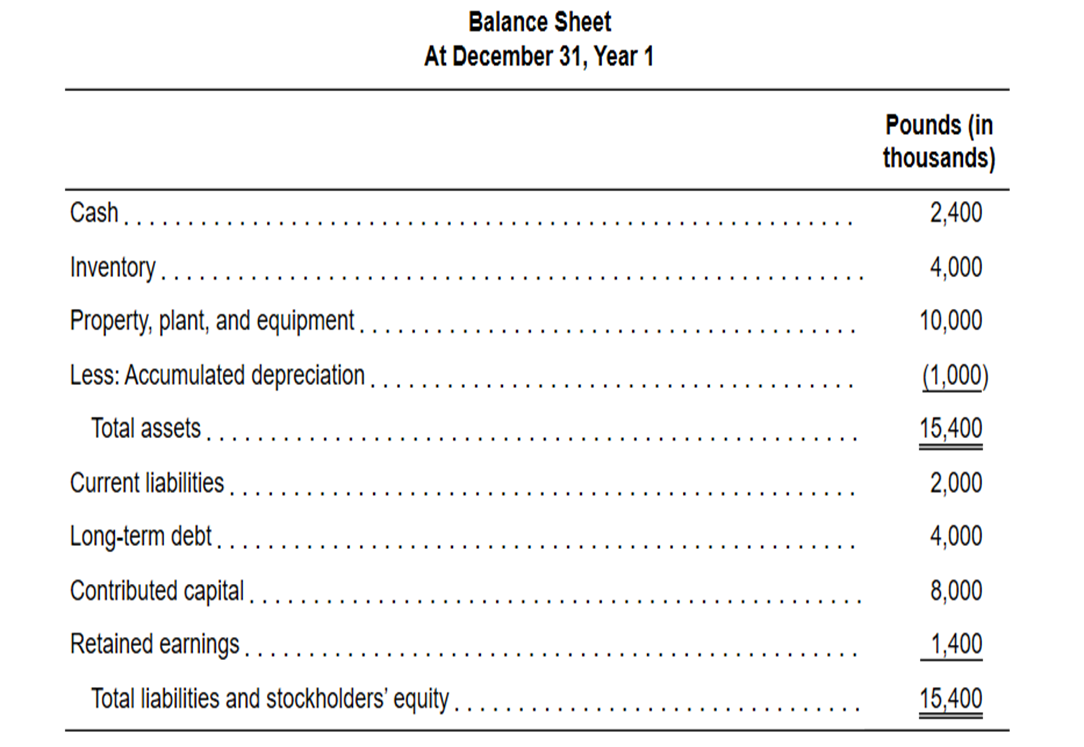

Palmerstown Company established a subsidiary in a foreign country on January 1, Year 1, by investing 8,000,000 pounds when the exchange rate was $1.00/pound. Palmerstown negotiated a bank loan of 4,000,000 pounds on January 5, Year 1, and purchased plant and equipment in the amount of 10,000,000 pounds on January 8, Year 1. Plant and equipment is depreciated on a straight-line basis over a 10-year useful life. The first purchase of inventory in the amount of 1,000,000 pounds was made on January 10, Year 1. Additional inventory of 12,000,000 pounds was acquired at three points in time during the year at an average exchange rate of $0.86/pound. Inventory on hand at year-end was acquired when the exchange rate was $0.83/pound. The first-in, first-out (FIFO) method is used to determine cost of goods sold. Additional exchange rates for the pound during Year 1 are as follows:

Prepare a report for the chief executive officer of Palmerstown Company summarizing the differences that will be reported in the Year 1 consolidated financial statements because the pound, rather than the U.S. dollar, is the foreign subsidiarys functional currency. In your report, discuss the relationship between the current ratio, the debt-to-equity ratio, and the profit margin calculated from the foreign currency financial statements and from the translated U.S.-dollar financial statements. Also, include a discussion of the meaning of the translated U.S.-dollar amounts for inventory and for property, plant, and equipment.

The foreign subsidiary's income statement for Year 1 and balance sheet at December 31, Year 1 , are as follows:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts