Question: I require and answer for question a All the plant was purchased on 1 April 20x0. The accumulated depreciation balance at 31 March 203 was

I require and answer for question a

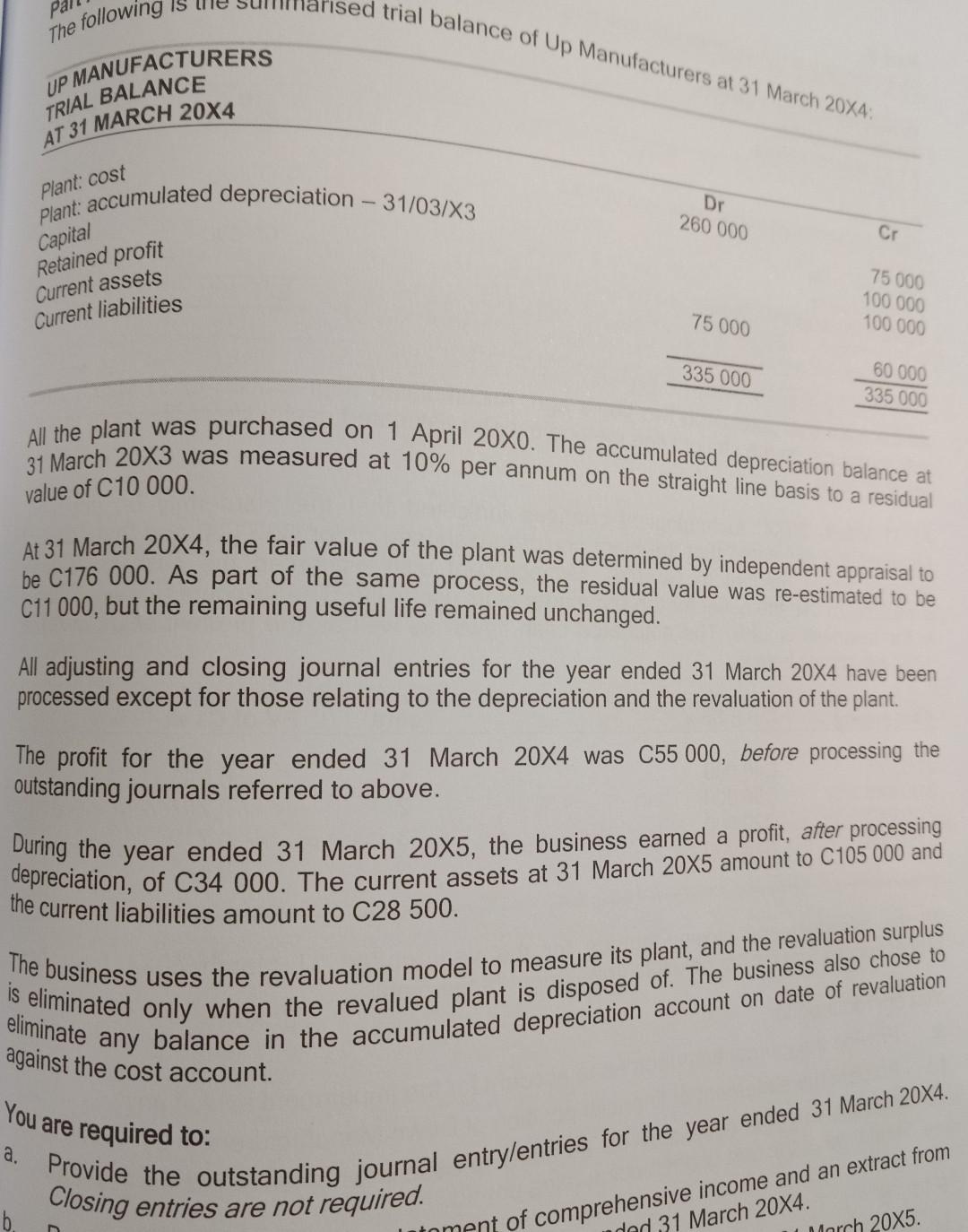

All the plant was purchased on 1 April 20x0. The accumulated depreciation balance at 31 March 203 was measured at 10% per annum on the straight line basis to a residual value of C10000. At 31 March 20X4, the fair value of the plant was determined by independent appraisal to be C176000. As part of the same process, the residual value was re-estimated to be C11000, but the remaining useful life remained unchanged. All adjusting and closing journal entries for the year ended 31 March 204 have been processed except for those relating to the depreciation and the revaluation of the plant. The profit for the year ended 31 March 20X4 was C55000, before processing the outstanding journals referred to above. During the year ended 31 March 20X5, the business earned a profit, after processing depreciation, of C34 000. The current assets at 31 March 20X5 amount to C105 000 and the current liabilities amount to C28 500 . The business uses the revaluation model to measure its plant, and the revaluation surplus is eliminated only when the revalued plant is disposed of. The business also chose to eliminate any balance in the accumulated depreciation account on date of revaluation against the cost account. You are required to: a. Provide the outstanding journal entry/entries for the year ended 31 March 204. Closing entries are not required. All the plant was purchased on 1 April 20x0. The accumulated depreciation balance at 31 March 203 was measured at 10% per annum on the straight line basis to a residual value of C10000. At 31 March 20X4, the fair value of the plant was determined by independent appraisal to be C176000. As part of the same process, the residual value was re-estimated to be C11000, but the remaining useful life remained unchanged. All adjusting and closing journal entries for the year ended 31 March 204 have been processed except for those relating to the depreciation and the revaluation of the plant. The profit for the year ended 31 March 20X4 was C55000, before processing the outstanding journals referred to above. During the year ended 31 March 20X5, the business earned a profit, after processing depreciation, of C34 000. The current assets at 31 March 20X5 amount to C105 000 and the current liabilities amount to C28 500 . The business uses the revaluation model to measure its plant, and the revaluation surplus is eliminated only when the revalued plant is disposed of. The business also chose to eliminate any balance in the accumulated depreciation account on date of revaluation against the cost account. You are required to: a. Provide the outstanding journal entry/entries for the year ended 31 March 204. Closing entries are not required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts