Question: I require workflow for calculation question . Airil & Sons has a capital structure which is based on 40 percent debt, 5 percent preferred stock,

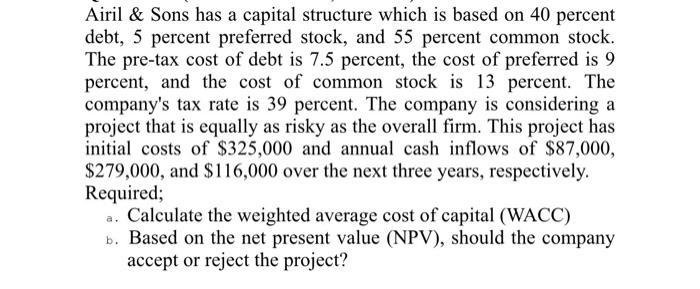

Airil & Sons has a capital structure which is based on 40 percent debt, 5 percent preferred stock, and 55 percent common stock. The pre-tax cost of debt is 7.5 percent, the cost of preferred is 9 percent, and the cost of common stock is 13 percent. The company's tax rate is 39 percent. The company is considering a project that is equally as risky as the overall firm. This project has initial costs of $325,000 and annual cash inflows of $87,000, $279,000, and $116,000 over the next three years, respectively. Required; a. Calculate the weighted average cost of capital (WACC) b. Based on the net present value (NPV), should the company accept or reject the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts