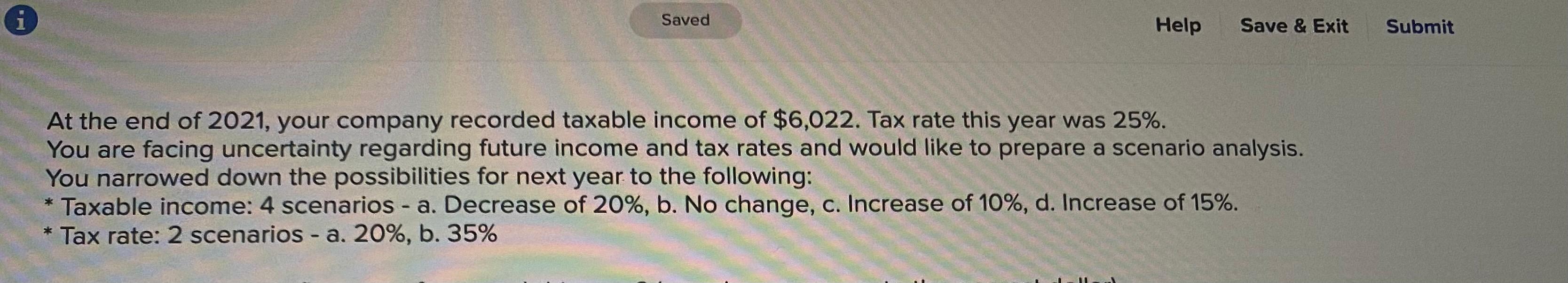

Question: i Saved Help Save & Exit Submit At the end of 2021, your company recorded taxable income of $6,022. Tax rate this year was 25%.

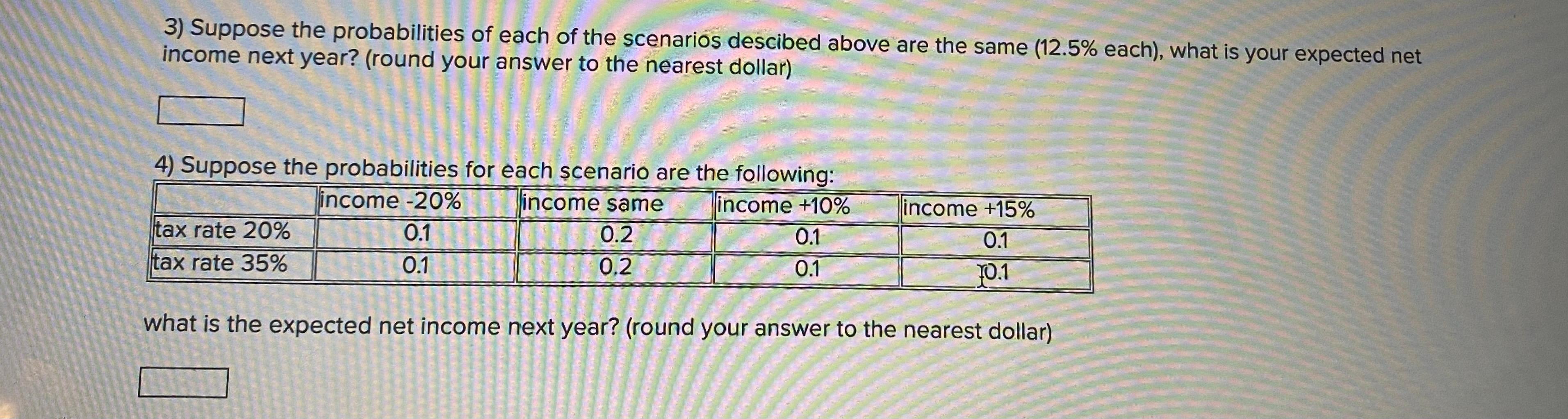

i Saved Help Save & Exit Submit At the end of 2021, your company recorded taxable income of $6,022. Tax rate this year was 25%. You are facing uncertainty regarding future income and tax rates and would like to prepare a scenario analysis. You narrowed down the possibilities for next year to the following: * Taxable income: 4 scenarios - a. Decrease of 20%, b. No change, c. Increase of 10%, d. Increase of 15%. * Tax rate: 2 scenarios - a. 20%, b. 35% - 3) Suppose the probabilities of each of the scenarios descibed above are the same (12.5% each), what is your expected net income next year? (round your answer to the nearest dollar) 4) Suppose the probabilities for each scenario are the following: income -20% income same income +10% tax rate 20% 0.1 0.2 0.1 tax rate 35% 0.1 0.2 0.1 income +15% 0.1 10.1 what is the expected net income next year? (round your answer to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts