Question: I saw an example but don't know how they got the custodial services cost section for the allocations subheading. This is really an odd situation,

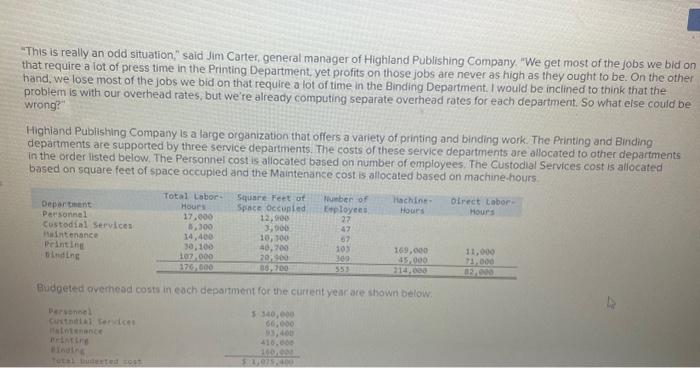

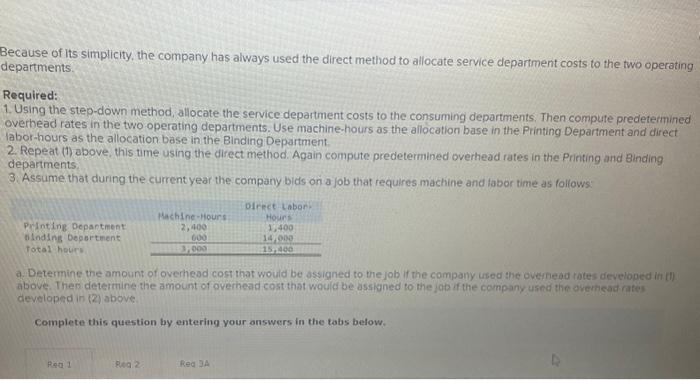

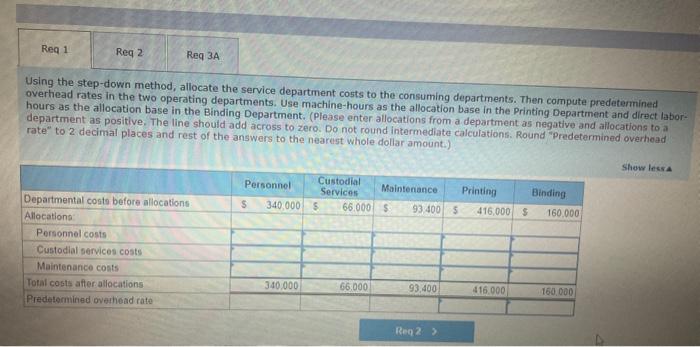

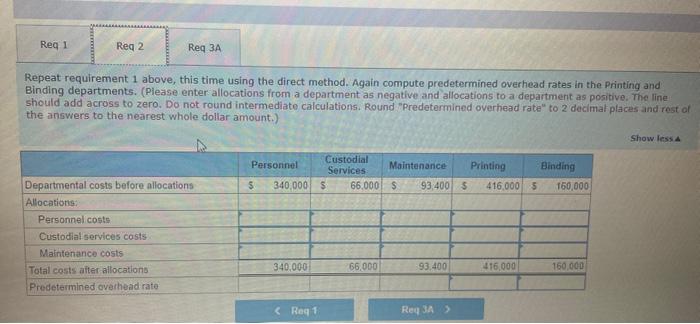

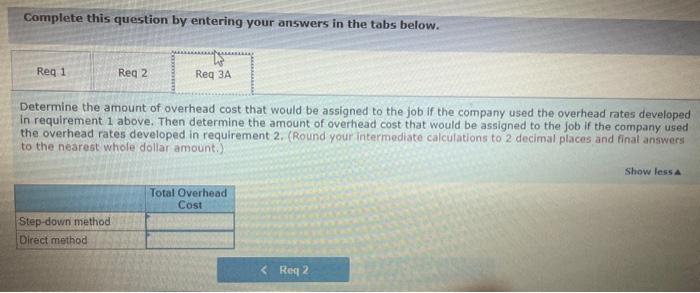

"This is really an odd situation," said Jim Carter, general manager of Highland Publishing Company. "We get most of the jobs we bid on that require a lot of press time in the Printing Department, yet profits on those jobs are never as high as they ought to be. On the other hand, we lose most of the jobs we bid on that require a lot of time in the Binding Department. I would be inclined to think that the problem is with our overhead rates, but we're already computing separate overhead rates for each department. So what else could be wrong? Highland Publishing Company is a large organization that offers a variety of printing and binding work. The Printing and Binding departments are supported by three service departments. The costs of these service departments are allocated to other departments in the order ilsted below. The Personnel cost is allocated based on number of employees. The Custodial Services cost is allocated based on square feet of space occupied and the Maintenance cost is allocated based on machine hours. Budgeted overhead costs in each deparment for the curtent year are shown below: Because of its simplicity, the company has always used the direct method to allocate service department costs to the two operating departments. Required: 1. Using the step-down method, allocate the service department costs to the consuming departments. Then compute predetermined overhead rates in the two operating departments. Use machine-hours as the allocation base in the Printing Department and direct labor-hours as the allocation base in the Binding Department. 2. Repeat (1) above, this time using the direct method. Again compute predetermined overhead rates in the Printing and Binding departments 3. Assume that during the current year the company bids on a job that requires machine and fabor time as follows: a. Determine the amount of overhead cost that would be assigned to the job if the company used the overnead totes developed in (i) above. Then determine the amount of overhead cost that would be assigned to the job if the company used the overhead ated developed in (2) above. Complete this question by entering your answers in the tabs below. Using the step-down method, allocate the service department costs to the consuming departments. Then compute predetermined overhead rates in the two operating departments. Use machine-hours as the allocation base in the Printing Department and direct labor: hours as the allocation base in the Binding Department. (Please enter allocations from a department as negative and allocations to a department as positive. The line should add across to zero. Do not round intermediate calculations. Round "Predetermined overhead rate" to 2 decimal places and rest of the answers to the nearest whole dollar amount.) Repeat requirement 1 above, this time using the direct method. Again compute predetermined overhead rates in the Printing and Binding departments. (Please enter allocations from a department as negative and allocations to a departmerit as positive. The line should add across to zero. Do not round intermediate calculations. Round "Predetermined overhead rate" to 2 decimal places and rest of the answers to the nearest whole dollar amount.) Complete this question by entering your answers in the tabs below. Determine the amount of overhead cost that would be assigned to the job if the company used the overhead rates developed In requirement 1 above. Then determine the amount of overhead cost that would be assigned to the job if the company used the overhead rates developed in requirement 2. (Round your intermediate calculations to 2 decimal places and finat answers to the nearest whole dollar amount.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts