Question: I saw that chegg already posted this same problem before, but the answer was not helpful at all. Frankie, Dino, Sammy, Peter, & Joey incorporate

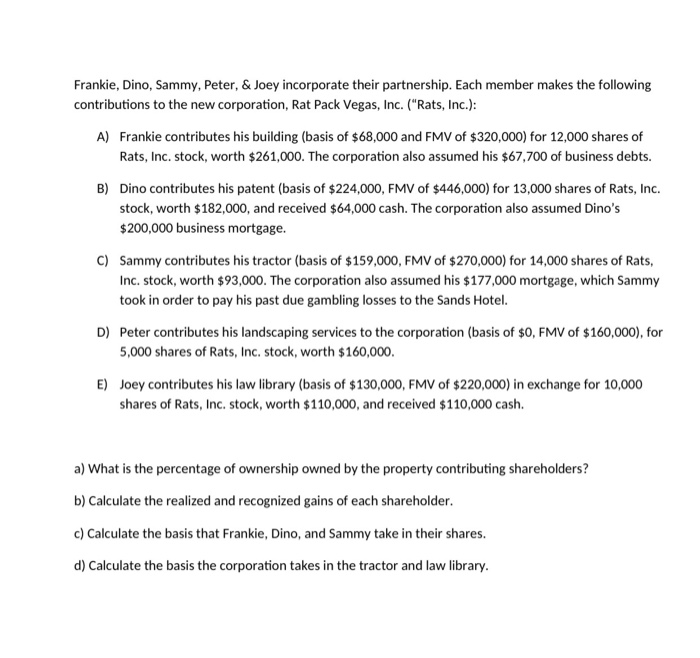

Frankie, Dino, Sammy, Peter, & Joey incorporate their partnership. Each member makes the following contributions to the new corporation, Rat Pack Vegas, Inc. ("Rats, Inc.): A) Frankie contributes his building (basis of $68,000 and FMV of $320,000) for 12,000 shares of Rats, Inc. stock, worth $261,000. The corporation also assumed his $67,700 of business debts. B) Dino contributes his patent (basis of $224,000, FMV of $446,000) for 13,000 shares of Rats, Inc. stock, worth $182,000, and received $64,000 cash. The corporation also assumed Dino's $200,000 business mortgage. C) Sammy contributes his tractor (basis of $159,000, FMV of $270,000) for 14,000 shares of Rats, Inc. stock, worth $93,000. The corporation also assumed his $177,000 mortgage, which Sammy took in order to pay his past due gambling losses to the Sands Hotel. D) Peter contributes his landscaping services to the corporation (basis of $0, FMV of $160,000), for 5,000 shares of Rats, Inc. stock, worth $160,000. E) Joey contributes his law library (basis of $130,000, FMV of $220,000) in exchange for 10,000 shares of Rats, Inc. stock, worth $110,000, and received $110,000 cash. a) What is the percentage of ownership owned by the property contributing shareholders? b) Calculate the realized and recognized gains of each shareholder. c) Calculate the basis that Frankie, Dino, and Sammy take in their shares. d) Calculate the basis the corporation takes in the tractor and law library

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts