Question: I seek assistance solving this practice question please Stocks A, B, C, D, and E have expected returns of 15%, 15%, 12%, 20%, and 20%,

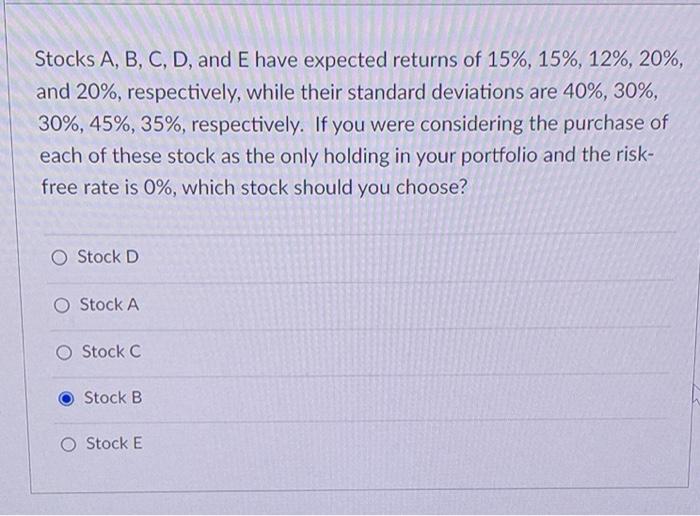

Stocks A, B, C, D, and E have expected returns of 15%, 15%, 12%, 20%, and 20%, respectively, while their standard deviations are 40%, 30%, 30%, 45%, 35%, respectively. If you were considering the purchase of each of these stock as the only holding in your portfolio and the risk- free rate is 0%, which stock should you choose? O Stock D O Stock A O Stock C Stock B Stock E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts