Question: I SEND YOU WHOLE QUESTION WHATEVER MY PROFESSOR SEND IT CAN YOU PLEASE ANSWER THIS 3 QUESTION I'M REALLY THANK full to you 9. Problem

I SEND YOU WHOLE QUESTION WHATEVER MY PROFESSOR SEND IT

I SEND YOU WHOLE QUESTION WHATEVER MY PROFESSOR SEND IT

CAN YOU PLEASE ANSWER THIS 3 QUESTION I'M REALLY THANK full to you

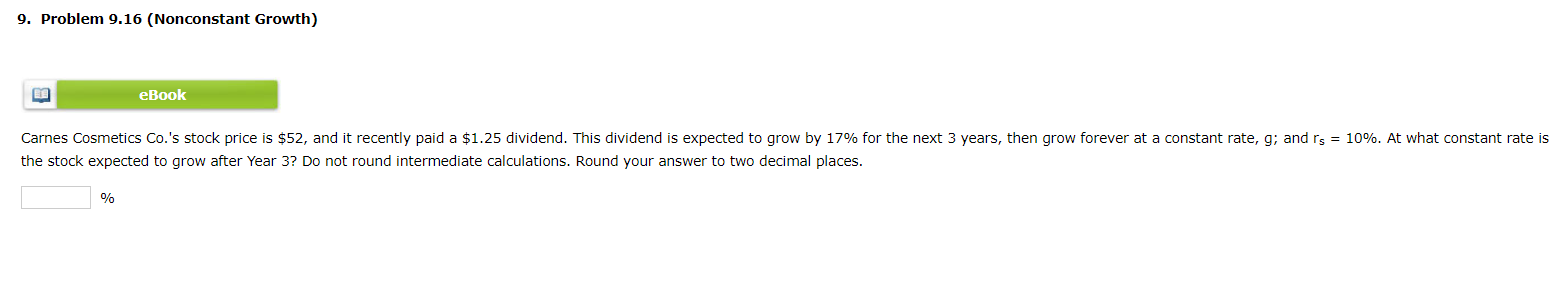

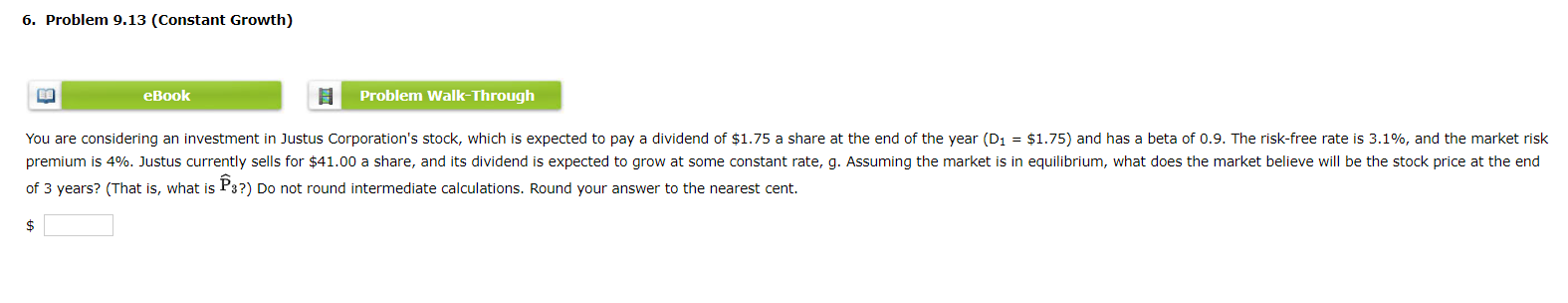

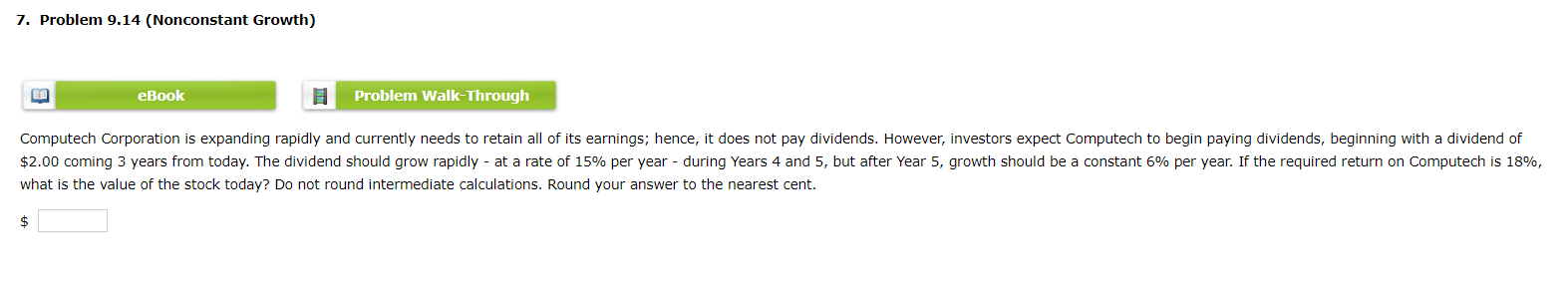

9. Problem 9.16 (Nonconstant Growth) eBook Carnes Cosmetics Co.'s stock price is $52, and it recently paid a $1.25 dividend. This dividend is expected to grow by 17% for the next 3 years, then grow forever at a constant rate, g; and rs = 10%. At what constant rate is the stock expected to grow after Year 3? Do not round intermediate calculations. Round your answer to two decimal places. % 6. Problem 9.13 (Constant Growth) eBook Problem Walk-Through You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $1.75 a share at the end of the year (D1 = $1.75) and has a beta of 0.9. The risk-free rate is 3.1%, and the market risk premium is 4%. Justus currently sells for $41.00 a share, and its dividend is expected to grow at some constant rate, g. Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? (That is, what is P3?) Do not round intermediate calculations. Round your answer to the nearest cent. 7. Problem 9.14 (Nonconstant Growth) eBook Problem Walk-Through Computech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence, it does not pay dividends. However, investors expect Computech to begin paying dividends, beginning with a dividend of $2.00 coming 3 years from today. The dividend should grow rapidly - at a rate of 15% per year - during Years 4 and 5, but after Year 5, growth should be a constant 6% per year. If the required return on Computech is 18%, what is the value of the stock today? Do not round intermediate calculations. Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts