Question: i solved part a but i need help on part B Blossom Company purchased equipment on account on September 3,2022 , at an invoice price

i solved part a but i need help on part B

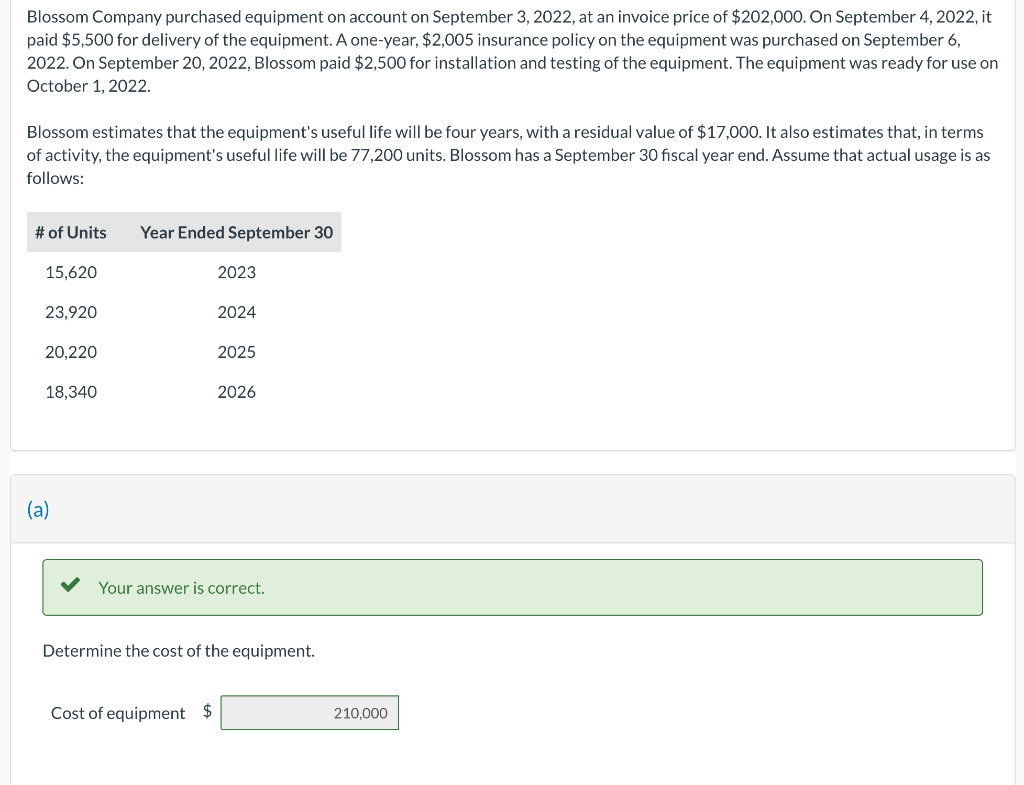

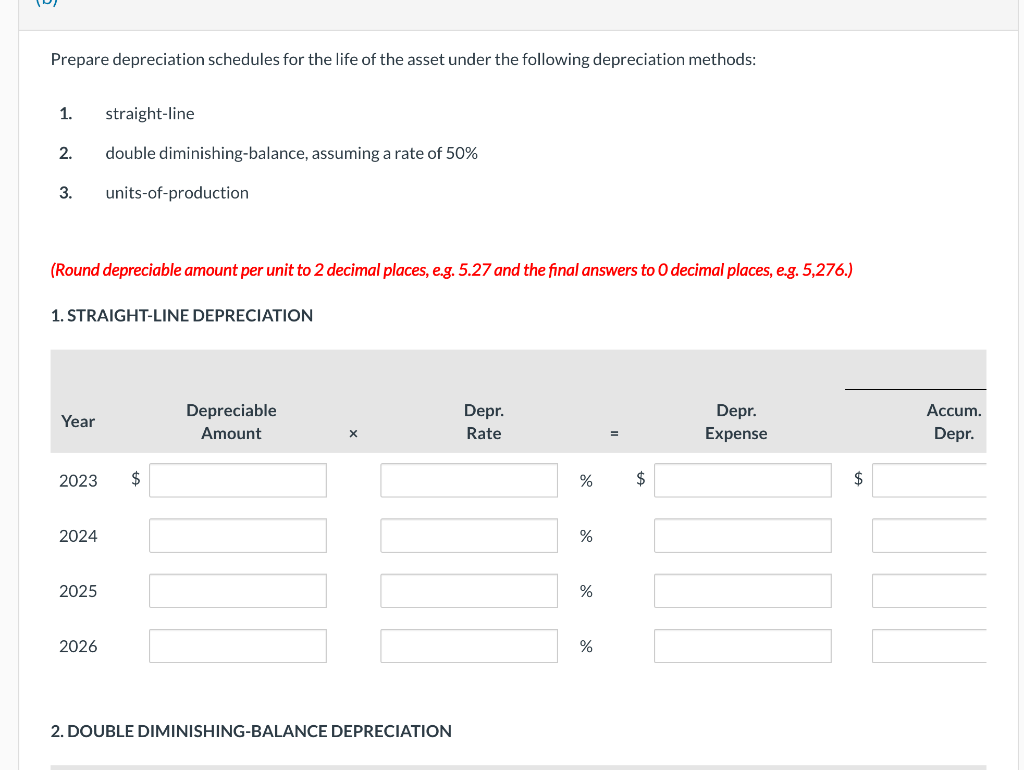

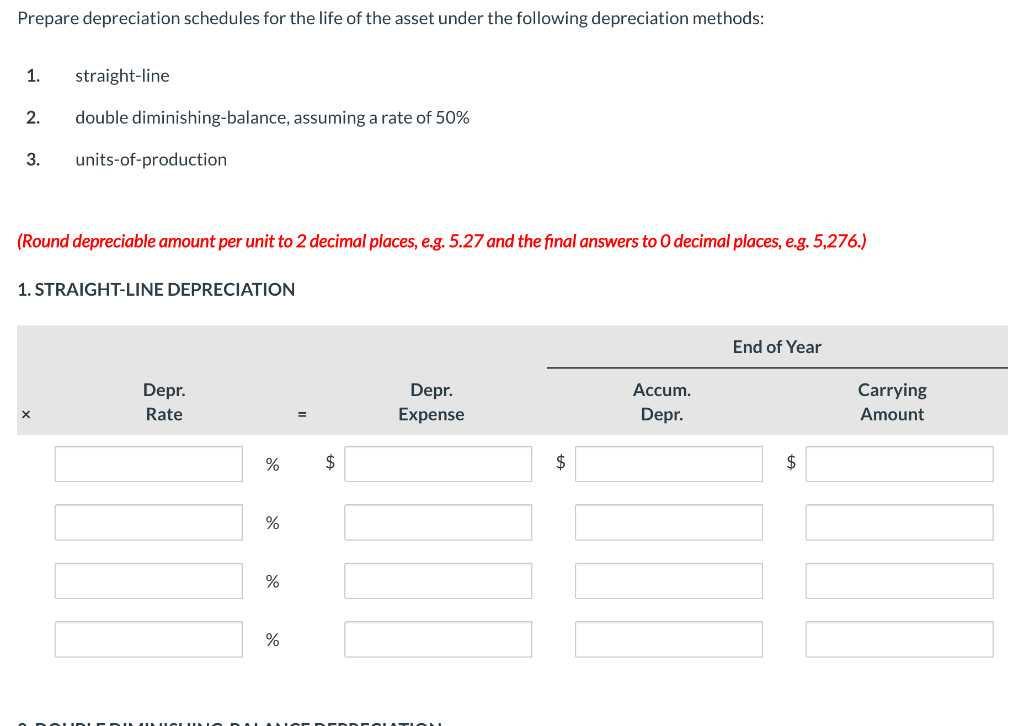

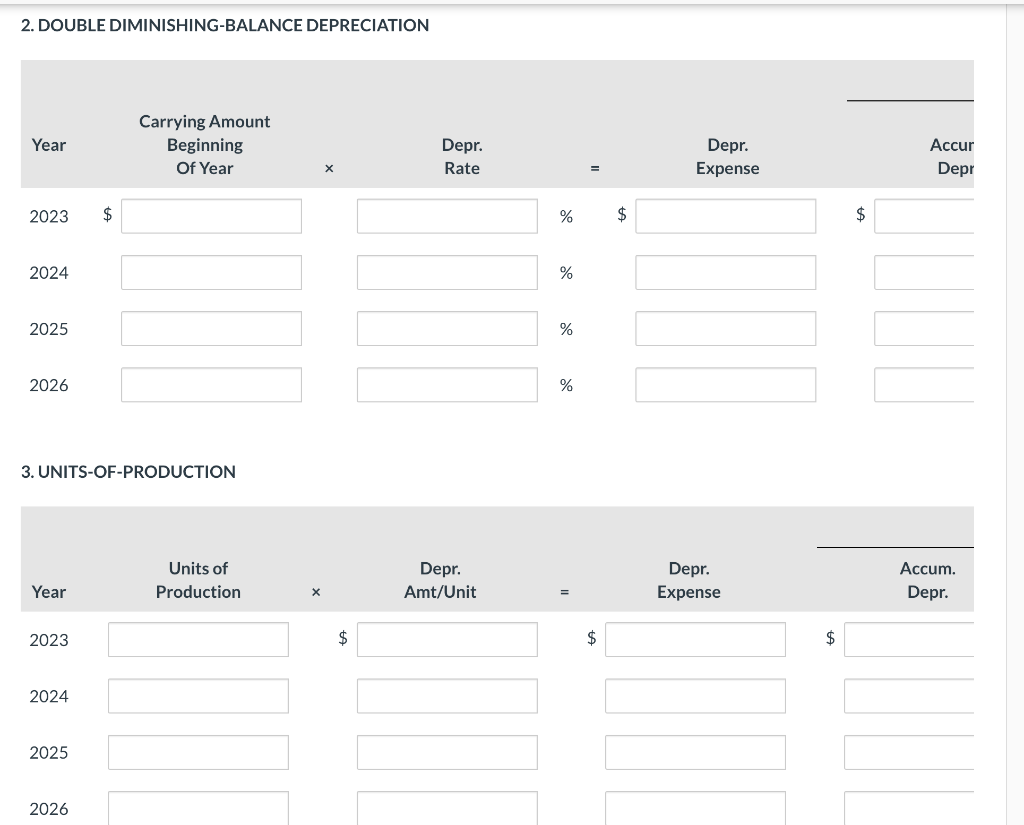

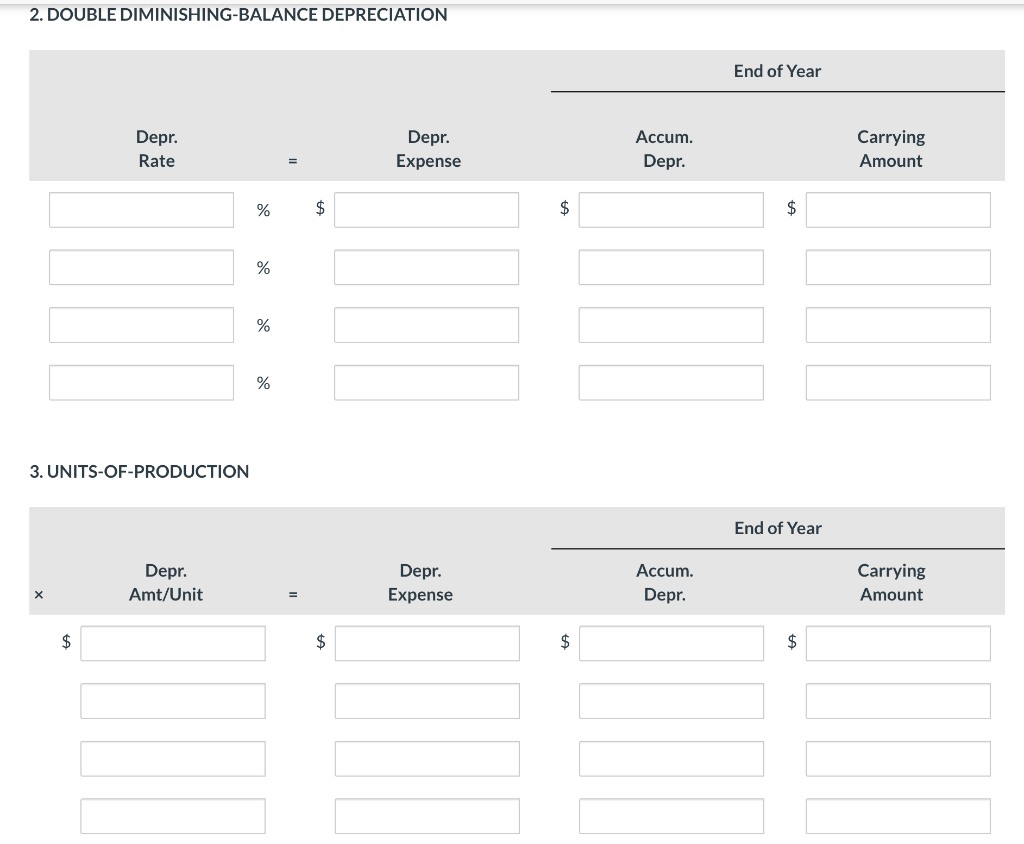

Blossom Company purchased equipment on account on September 3,2022 , at an invoice price of $202,000. On September 4,2022 , it paid $5,500 for delivery of the equipment. A one-year, $2,005 insurance policy on the equipment was purchased on September 6 , 2022. On September 20, 2022, Blossom paid $2,500 for installation and testing of the equipment. The equipment was ready for use on October 1, 2022. Blossom estimates that the equipment's useful life will be four years, with a residual value of $17,000. It also estimates that, in terms of activity, the equipment's useful life will be 77,200 units. Blossom has a September 30 fiscal year end. Assume that actual usage is as follows: (a) Determine the cost of the equipment. Cost of equipment $ Prepare depreciation schedules for the life of the asset under the following depreciation methods: 1. straight-line 2. double diminishing-balance, assuming a rate of 50% 3. units-of-production (Round depreciable amount per unit to 2 decimal places, e.g. 5.27 and the final answers to 0 decimal places, e.g. 5,276.) 1. STRAIGHT-LINE DEPRECIATION 2. DOUBLE DIMINISHING-BALANCE DEPRECIATION Prepare depreciation schedules for the life of the asset under the following depreciation methods: 1. straight-line 2. double diminishing-balance, assuming a rate of 50% 3. units-of-production (Round depreciable amount per unit to 2 decimal places, e.g. 5.27 and the final answers to 0 decimal places, e.g. 5,276.) 1. STRAIGHT-LINE DEPRECIATION 2. DOUBLE DIMINISHING-BALANCE DEPRECIATION Cear CarryingAmountBeginningOfYear 2023$ 2024 2025 3. UNITS-OF-PRODUCTION 3. UNITS-OF-PRODUCTION

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts