Question: i specifically need help on part 3 Problem 8-6A Disposal of plant assets LO C1, P1, P2 [The following information applies to the questions displayed

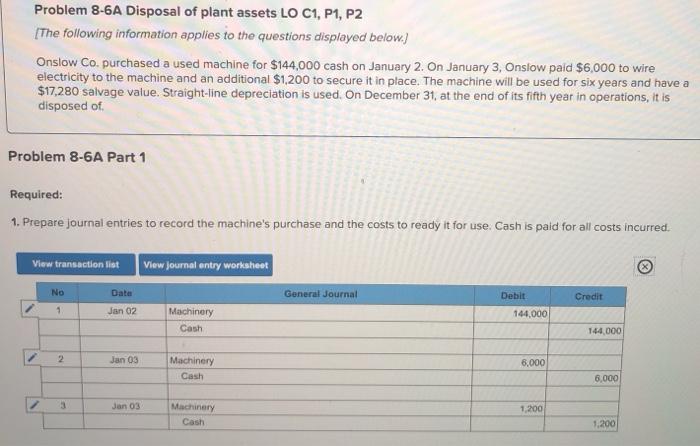

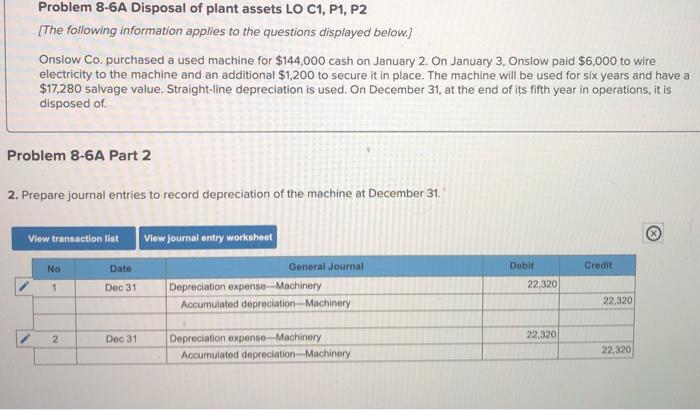

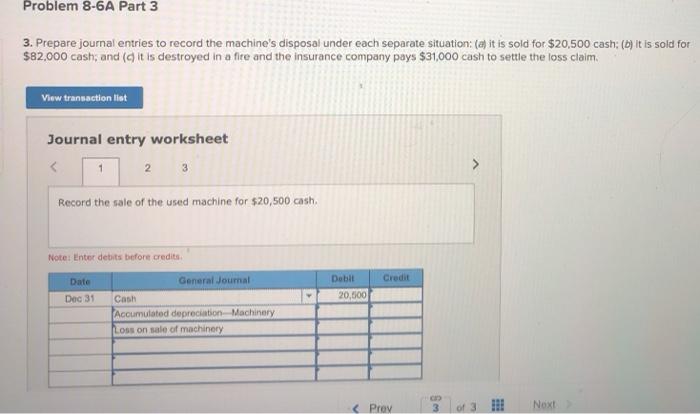

Problem 8-6A Disposal of plant assets LO C1, P1, P2 [The following information applies to the questions displayed below.) Onslow Co. purchased a used machine for $144,000 cash on January 2. On January 3, Onslow paid $6,000 to wire electricity to the machine and an additional $1,200 to secure it in place. The machine will be used for six years and have a $17,280 salvage value. Straight-line depreciation is used. On December 31, at the end of its fifth year in operations, it is disposed of Problem 8-6A Part 1 Required: 1. Prepare journal entries to record the machine's purchase and the costs to ready it for use Cash is paid for all costs incurred. View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 Jan 02 144,000 Machinery Cash 144,000 2 Jan 03 Machinery Cash 6.000 6.000 Jan 03 Machinery Cash 1.200 1,200 Problem 8-6A Disposal of plant assets LO C1, P1, P2 [The following information applies to the questions displayed below.) Onslow Co. purchased a used machine for $144,000 cash on January 2 On January 3, Onslow paid $6,000 to wire electricity to the machine and an additional $1,200 to secure it in place. The machine will be used for six years and have a $17,280 salvage value. Straight-line depreciation is used. On December 31, at the end of its fifth year in operations, it is disposed of. Problem 8-6A Part 2 2. Prepare journal entries to record depreciation of the machine at December 31, View transaction list View journal entry worksheet No Date Dobit Credit 1 Dec 31 General Journal Depreciation expense - Machinery Accumulated depreciation - Machinery 22,320 22,320 2 Dec 31 22,320 Depreciation expense - Machinery Accumulated depreciation - Machinery 22,320 Problem 8-6A Part 3 3. Prepare journal entries to record the machine's disposal under each separate situation: (a) it is sold for $20,500 cash; (b) It is sold for $82,000 cash; and (it is destroyed in a fite and the insurance company pays $31,000 cash to settle the loss claim. View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts