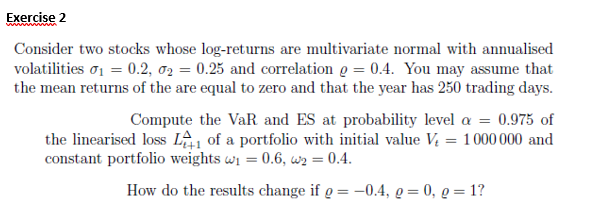

Question: i stuck here solve this question Exercise 2 Consider two stocks whose log-returns are multivariate normal with annualised volatilities 01 = 0.2, 02 = 0.25

i stuck here solve this question

Exercise 2 Consider two stocks whose log-returns are multivariate normal with annualised volatilities 01 = 0.2, 02 = 0.25 and correlation p = 0.4. You may assume that the mean returns of the are equal to zero and that the year has 250 trading days. Compute the VaR and ES at probability level o = 0.975 of the linearised loss Le , of a portfolio with initial value V. = 1000 000 and constant portfolio weights w1 = 0.6, w2 = 0.4. How do the results change if p = -0.4, p = 0, p = 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts