Question: i stuck on these to question please answer them quickly please Ali Inc. expects to generate free-cash of $330000 per year forever. If the firm's

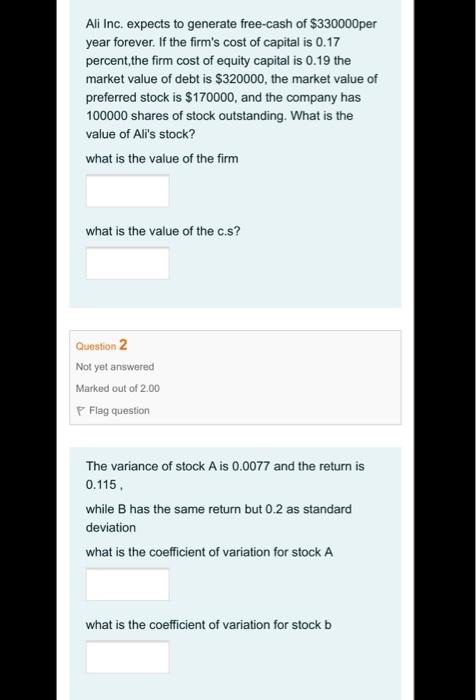

Ali Inc. expects to generate free-cash of $330000 per year forever. If the firm's cost of capital is 0.17 percent, the firm cost of equity capital is 0.19 the market value of debt is $320000, the market value of preferred stock is $170000, and the company has 100000 shares of stock outstanding. What is the value of Ali's stock? what is the value of the firm what is the value of the c.s? Question 2 Not yet answered Marked out of 2.00 Flag question The variance of stock A is 0.0077 and the return is 0.115 while B has the same return but 0.2 as standard deviation what is the coefficient of variation for stock A what is the coefficient of variation for stock b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts