Question: I. Student Loans (25 points, 5 points per question) 2. How long will it take to pay off this amount (repayment period)? In years? In

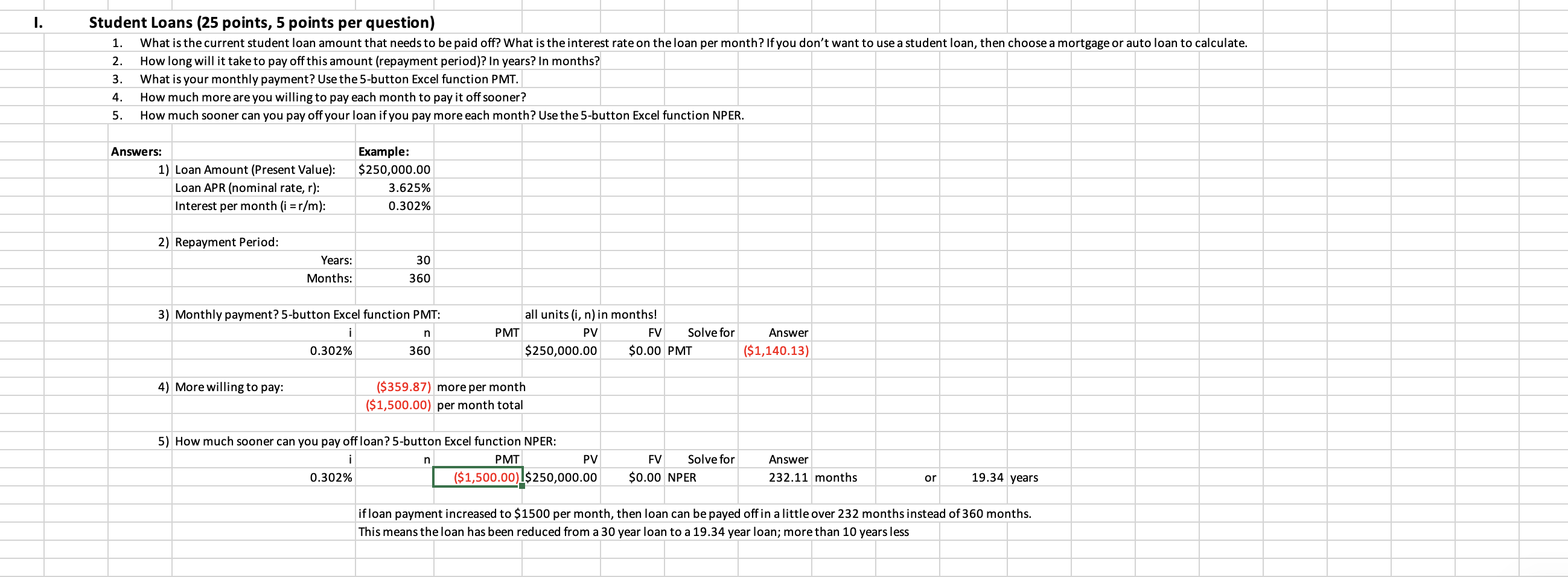

I. Student Loans (25 points, 5 points per question) 2. How long will it take to pay off this amount (repayment period)? In years? In months? 3. What is your monthly payment? Use the 5-button Excel function PMT. 4. How much more are you willing to pay each month to pay it off sooner? 5. How much sooner can you pay off your loan if you pay more each month? Use the 5-button Excel function NPER. Answers: 1) Loan Amount (Present Value): Loan APR (nominal rate, r ): Interest per month (i=r/m) : 2) Repayment Period: 3) Monthly payment? 5-button Excel function PMT: Example: $250,000.00 0.302% Years:Months:30360 if loan payment increased to $1500 per month, then loan can be payed off in a little over 232 months instead of 360 months. This means the loan has been reduced from a 30 year loan to a 19.34 year loan; more than 10 years less I. Student Loans (25 points, 5 points per question) 2. How long will it take to pay off this amount (repayment period)? In years? In months? 3. What is your monthly payment? Use the 5-button Excel function PMT. 4. How much more are you willing to pay each month to pay it off sooner? 5. How much sooner can you pay off your loan if you pay more each month? Use the 5-button Excel function NPER. Answers: 1) Loan Amount (Present Value): Loan APR (nominal rate, r ): Interest per month (i=r/m) : 2) Repayment Period: 3) Monthly payment? 5-button Excel function PMT: Example: $250,000.00 0.302% Years:Months:30360 if loan payment increased to $1500 per month, then loan can be payed off in a little over 232 months instead of 360 months. This means the loan has been reduced from a 30 year loan to a 19.34 year loan; more than 10 years less

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts