Question: I submitted by mistake. i already have the solution Remaining Time: 2 hours, 26 seconds. Question Completion Status: Moving to another question will save this

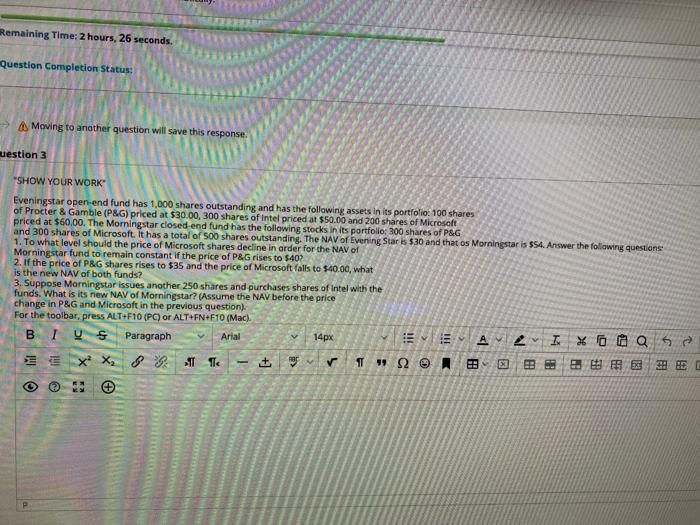

Remaining Time: 2 hours, 26 seconds. Question Completion Status: Moving to another question will save this response uestion 3 "SHOW YOUR WORK Eveningstar open end fund has 1,000 shares outstanding and has the following assets in its portfolio 100 shares of Procter & Gamble (P&G) priced at $30.00, 300 shares of Intel priced at $50.00 and 200 shares of Microsoft priced at $60,00. The Morningstar closed end fund has the following stocks in its portfolio: 300 shares of P&G and 300 shares of Microsoft. It has a total of 500 shares outstanding. The NAV of Evening Star is $30 and that os Morningstar is $54. Answer the following questions 1. To what level should the price of Microsoft shares decline in order for the NAV of Morningstar fund to remain constant if the price of P&G rises to $40 2. If the price of P&G shares rises to $35 and the price of Microsoft falls to $40.00, what is the new NAV of both funds? 3. Suppose Morningstar issues another 250 shares and purchases shares of intel with the funds. What is its new NAV of Morningstar? (Assume the NAV before the price change in P&G and Microsoft in the previous question). For the toolbar, press ALT+F10 (PC) or ALT+FN+E10 (Mac). B I US Paragraph Arial 14px ALI % oa as EX X, 8 ST The TT 35 E. ES

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts