Question: i submitted this problem already but the answer is incomplete. i hope this will not deducted my remaining questions. Thanks! Aspen Company estimates its manufacturing

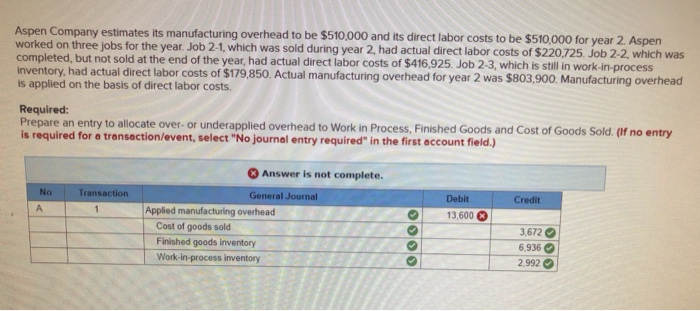

Aspen Company estimates its manufacturing overhead to be $510,000 and its direct labor costs to be $510,000 for year 2. Aspen worked on three jobs for the year. Job 2-1, which was sold during year 2, had actual direct labor costs of $220,725. Job 2-2, which was completed, but not sold at the end of the year, had actual direct labor costs of $416,925. Job 2-3, which is still in work-in-process nventory, had actual direct labor costs of $179,850. Actual manufacturing overhead for year 2 was $803,900. Manufacturing overhead is applied on the basis of direct labor costs. Required: Prepare an entry to allocate over- or underapplied overhead to Work in Process, Finished Goods and Cost of Goods Sold. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is not complete. No Transaction Credit Debit 13,600 General Journal Applied manufacturing overhead Cost of goods sold Finished goods inventory Work-in-process inventory 3672 OOOO 6.936 2.992

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts