Question: i text Arial + BIU A - E DE E- 123456 Question 5 Consider the following two mutually exclusive investments: Investment T=0 1 1 2

i

i

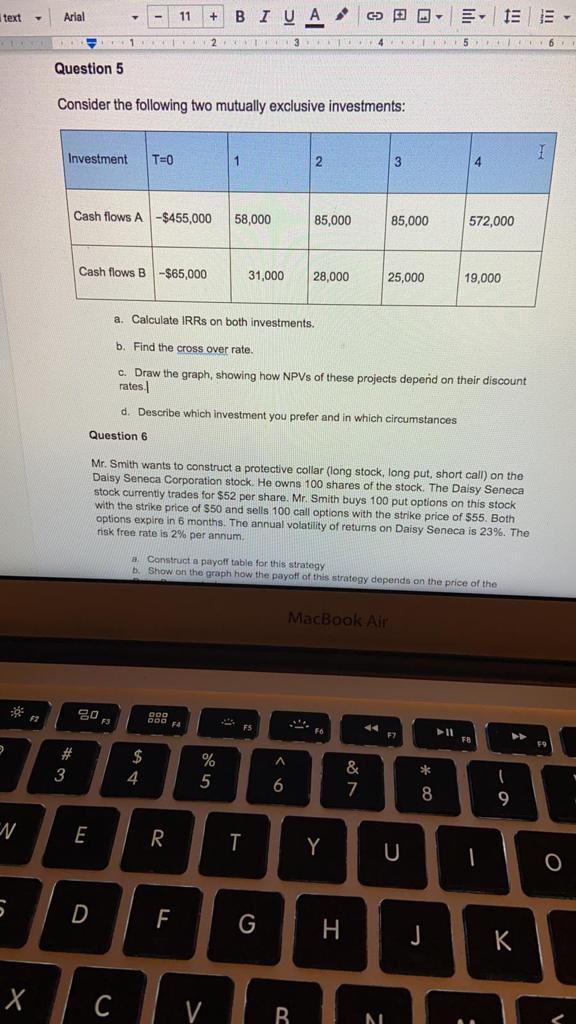

text Arial + BIU A - E DE E- 123456 Question 5 Consider the following two mutually exclusive investments: Investment T=0 1 1 2 3 4 Cash flows A -$455,000 58,000 85,000 85,000 572,000 Cash flows B -$65,000 31,000 28,000 25,000 19,000 a Calculate IRRs on both investments. b. Find the cross over rate. c. Draw the graph, showing how NPVs of these projects depend on their discount rates. d. Describe which investment you prefer and in which circumstances Question 6 Mr. Smith wants to construct a protective collar (long stock, long put, short call) on the Daisy Seneca Corporation stock. He owns 100 shares of the stock. The Daisy Seneca stock currently trades for $52 per share. Mr. Smith buys 100 put options on this stock with the strike price of $50 and sells 100 call options with the strike price of $55. Both options expire in 6 months. The annual volatility of retums on Daisy Seneca is 23%. The risk free rate is 2% per annum. a Construct a payoff table for this strategy b. Show on the graph how the payoff of this strategy depends on the price of the MacBook Air 80 16 TE %23 A % 5 * 3 4 & 7 6 8 9 E R T Y 1 D F G H . J X C B M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts