Question: i. The equity method of accounting also does not allow the investor to include their share of the investee's revenues along with other revenues reported

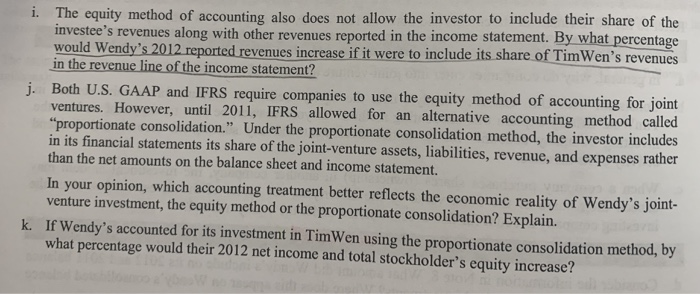

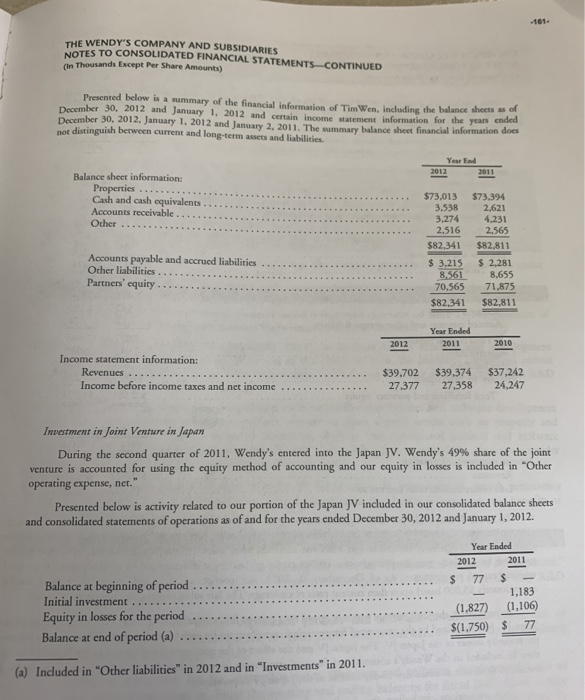

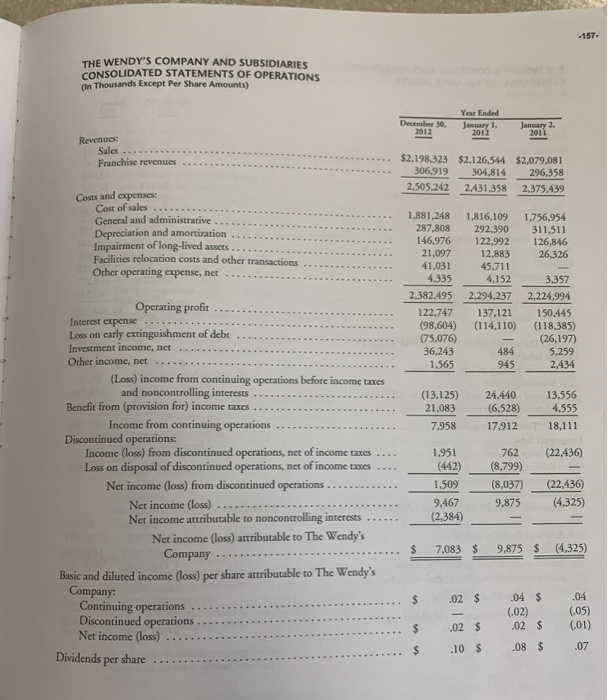

i. The equity method of accounting also does not allow the investor to include their share of the investee's revenues along with other revenues reported in the income statement. By what percentage would Wendy's 2012 reported revenues increase if it were to include its share of Tim Wen's revenues in the revenue line of the income statement? j. Both U.S. GAAP and IFRS require companies to use the equity method of accounting for joint ventures. However, until 2011, IFRS allowed for an alternative accounting method called "proportionate consolidation." Under the proportionate consolidation method, the investor includes in its financial statements its share of the joint-venture assets, liabilities, revenue, and expenses rather than the net amounts on the balance sheet and income statement. In your opinion, which accounting treatment better reflects the economic reality of Wendy's joint- venture investment, the equity method or the proportionate consolidation? Explain. k. If Wendy's accounted for its investment in TimWen using the proportionate consolidation method, by what percentage would their 2012 net income and total stockholder's equity increase? THE WENDY'S COMPANY AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED in Thousands Except Per Share Amounts) Presented below is a summary of the financial information of minduding the balance sheets of Descmber 30, 2012 and January 1, 2012 and rain in me t information for the year ended December 30, 2012. January 1, 2012 and January 2, 2011. The wmmary balance sheet financial information does distinguish between current and long-term asts and liabilisies Year End 2012 2011 Balance sheet information: Properties ............ Cash and cash equivalents ... Accounts receivable Other .......... $73,013 3.538 3.274 2.516 $82.341 $73.394 2,621 4,231 2.565 $82.811 Accounts payable and accrued liabilities. Other liabilities ... Partners' equiry .... $ 3,215 8,561 70,565 $82,341 $ 2,281 8,655 71,875 $82,811 Year Ended 2012 2011 2010 Income statement information: Revenues Income before income taxes and net income $39.702 27.377 $39.374 27,358 $37,242 24,247 Investment in Joint Venture in Japan During the second quarter of 2011, Wendy's entered into the Japan JV. Wendy's 49% share of the joint venture is accounted for using the equity method of accounting and our equity in losses is included in "Other operating expense, net." Presented below is activity related to our portion of the Japan JV included in our consolidated balance sheets and consolidated statements of operations as of and for the years ended December 30, 2012 and January 1, 2012. Balance at beginning of period .. Initial investment Equity in losses for the period .... Balance at end of period (a) ......... Year Ended 2012 2011 $ 77 $ - - 1,183 (1.827) (1,106) $(1.750) $ 77 (a) Included in "Other liabilities" in 2012 and in "Investments" in 2011. THE WENDY'S COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (in Thousands Except Per Share Amounts) Year Ended December 30, January 1, January 2. 2012 2012 2011 Revenues Sales ... Franchise revenues $2,198,323 $2,126,544 $2,079,081 306,919 304,814 296,358 2,505.242 2431,358 2,375,439 Costs and expenses: Cost of sales ...... General and administrative .... 1,881.248 1.816,109 1,756,954 Depreciation and amortization ... 287,808 292,390 311,511 Impairment of long-lived assets.. 146,976 122,992 126,846 Facilities relocation costs and other transactions 21.097 12,883 26,326 41,031 45,711 Other operating expense, net .... 4,335 4,152 3,357 2,382,495 2,294,237 2,224,994 Operating profit .... 122,747 137.121 150,445 Interest expense ..... (98,604) (114,110) (118.385) Loss on carly extinguishment of debt ........ (75,076) (26,197) Investment income, net .......... 36,243 484 5,259 Other income, net ....... 1,565 945 2,434 (Loss) income from continuing operations before income taxes and noncontrolling interests .. (13,125) 24.440 13,556 Benefit from (provision for) income taxes ........... 21,083 (6,528) 4.555 Income from continuing operations .... 7,958 17,912 18,111 Discontinued operations: Income (loss) from discontinued operations, net of income taxes ... 1.951 762 (22,436) Loss on disposal of discontinued operations, net of income taxes. (442) (8,799) Net income (loss) from discontinued operations .............. 1.509 (8,037) (22,436) Net income (loss) ...... 9,467 9,875 (4,325) Net income attributable to noncontrolling interests ...... (2,384) Net income (loss) attributable to The Wendy's Company .. $ 7,083 $ 9,875 $ (4,325) Basic and diluted income (loss) per share attributable to The Wendy's Company: .........$ .02 $ .04 $ Continuing operations ....... .04 (.02) 0.05) Discontinued operations ........ .02 s .02 $ 0.01) Net income (loss) ......... .......$ 10 $ .08 $ .07 Dividends per share ........ ........ i. The equity method of accounting also does not allow the investor to include their share of the investee's revenues along with other revenues reported in the income statement. By what percentage would Wendy's 2012 reported revenues increase if it were to include its share of Tim Wen's revenues in the revenue line of the income statement? j. Both U.S. GAAP and IFRS require companies to use the equity method of accounting for joint ventures. However, until 2011, IFRS allowed for an alternative accounting method called "proportionate consolidation." Under the proportionate consolidation method, the investor includes in its financial statements its share of the joint-venture assets, liabilities, revenue, and expenses rather than the net amounts on the balance sheet and income statement. In your opinion, which accounting treatment better reflects the economic reality of Wendy's joint- venture investment, the equity method or the proportionate consolidation? Explain. k. If Wendy's accounted for its investment in TimWen using the proportionate consolidation method, by what percentage would their 2012 net income and total stockholder's equity increase? THE WENDY'S COMPANY AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED in Thousands Except Per Share Amounts) Presented below is a summary of the financial information of minduding the balance sheets of Descmber 30, 2012 and January 1, 2012 and rain in me t information for the year ended December 30, 2012. January 1, 2012 and January 2, 2011. The wmmary balance sheet financial information does distinguish between current and long-term asts and liabilisies Year End 2012 2011 Balance sheet information: Properties ............ Cash and cash equivalents ... Accounts receivable Other .......... $73,013 3.538 3.274 2.516 $82.341 $73.394 2,621 4,231 2.565 $82.811 Accounts payable and accrued liabilities. Other liabilities ... Partners' equiry .... $ 3,215 8,561 70,565 $82,341 $ 2,281 8,655 71,875 $82,811 Year Ended 2012 2011 2010 Income statement information: Revenues Income before income taxes and net income $39.702 27.377 $39.374 27,358 $37,242 24,247 Investment in Joint Venture in Japan During the second quarter of 2011, Wendy's entered into the Japan JV. Wendy's 49% share of the joint venture is accounted for using the equity method of accounting and our equity in losses is included in "Other operating expense, net." Presented below is activity related to our portion of the Japan JV included in our consolidated balance sheets and consolidated statements of operations as of and for the years ended December 30, 2012 and January 1, 2012. Balance at beginning of period .. Initial investment Equity in losses for the period .... Balance at end of period (a) ......... Year Ended 2012 2011 $ 77 $ - - 1,183 (1.827) (1,106) $(1.750) $ 77 (a) Included in "Other liabilities" in 2012 and in "Investments" in 2011. THE WENDY'S COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (in Thousands Except Per Share Amounts) Year Ended December 30, January 1, January 2. 2012 2012 2011 Revenues Sales ... Franchise revenues $2,198,323 $2,126,544 $2,079,081 306,919 304,814 296,358 2,505.242 2431,358 2,375,439 Costs and expenses: Cost of sales ...... General and administrative .... 1,881.248 1.816,109 1,756,954 Depreciation and amortization ... 287,808 292,390 311,511 Impairment of long-lived assets.. 146,976 122,992 126,846 Facilities relocation costs and other transactions 21.097 12,883 26,326 41,031 45,711 Other operating expense, net .... 4,335 4,152 3,357 2,382,495 2,294,237 2,224,994 Operating profit .... 122,747 137.121 150,445 Interest expense ..... (98,604) (114,110) (118.385) Loss on carly extinguishment of debt ........ (75,076) (26,197) Investment income, net .......... 36,243 484 5,259 Other income, net ....... 1,565 945 2,434 (Loss) income from continuing operations before income taxes and noncontrolling interests .. (13,125) 24.440 13,556 Benefit from (provision for) income taxes ........... 21,083 (6,528) 4.555 Income from continuing operations .... 7,958 17,912 18,111 Discontinued operations: Income (loss) from discontinued operations, net of income taxes ... 1.951 762 (22,436) Loss on disposal of discontinued operations, net of income taxes. (442) (8,799) Net income (loss) from discontinued operations .............. 1.509 (8,037) (22,436) Net income (loss) ...... 9,467 9,875 (4,325) Net income attributable to noncontrolling interests ...... (2,384) Net income (loss) attributable to The Wendy's Company .. $ 7,083 $ 9,875 $ (4,325) Basic and diluted income (loss) per share attributable to The Wendy's Company: .........$ .02 $ .04 $ Continuing operations ....... .04 (.02) 0.05) Discontinued operations ........ .02 s .02 $ 0.01) Net income (loss) ......... .......$ 10 $ .08 $ .07 Dividends per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts