Question: i) The Query Company has identified two alternative capital structures. If the firm borrows 15% of the value of the firm, it can borrow the

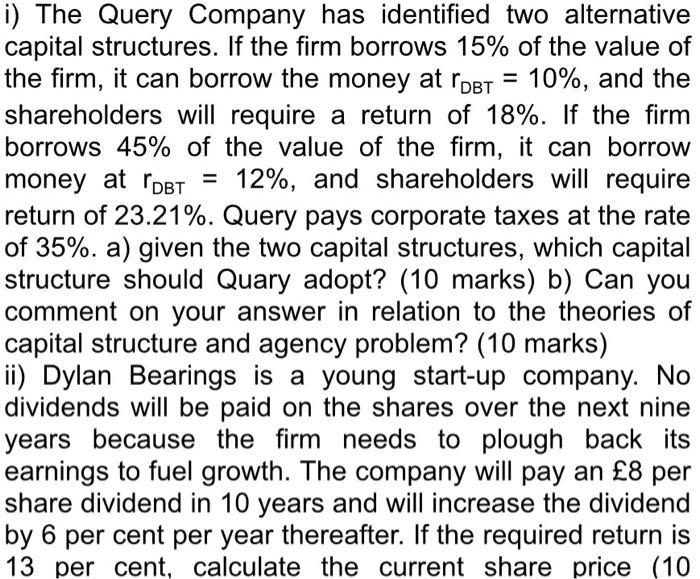

i) The Query Company has identified two alternative capital structures. If the firm borrows 15% of the value of the firm, it can borrow the money at lobt = 10%, and the shareholders will require a return of 18%. If the firm borrows 45% of the value of the firm, it can borrow money at lobt = 12%, and shareholders will require return of 23.21%. Query pays corporate taxes at the rate of 35%. a) given the two capital structures, which capital structure should Quary adopt? (10 marks) b) Can you comment on your answer in relation to the theories of capital structure and agency problem? (10 marks) ii) Dylan Bearings is a young start-up company. No dividends will be paid on the shares over the next nine years because the firm needs to plough back its earnings to fuel growth. The company will pay an 8 per share dividend in 10 years and will increase the dividend by 6 per cent per year thereafter. If the required return is 13 per cent, calculate the current share price (10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts