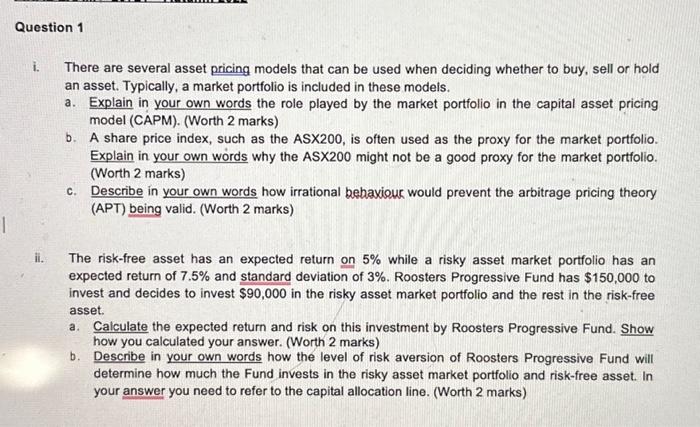

Question: i. There are several asset pricing models that can be used when deciding whether to buy, sell or hold an asset. Typically, a market portfolio

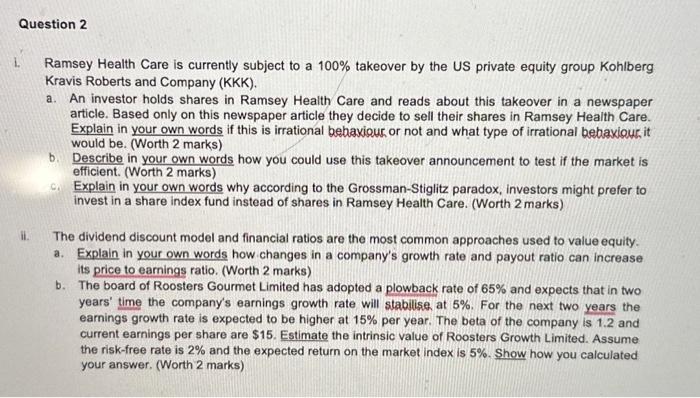

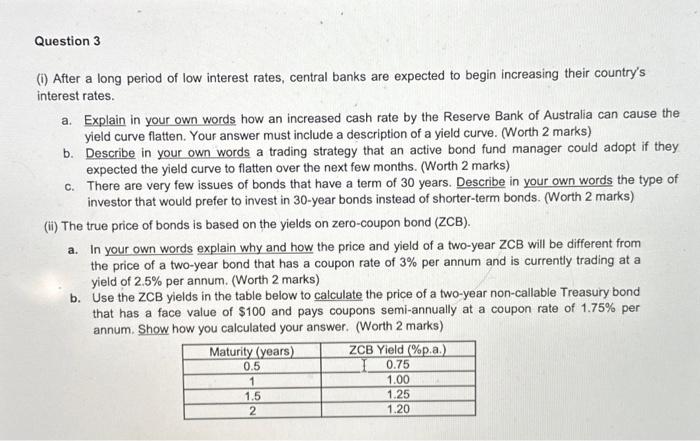

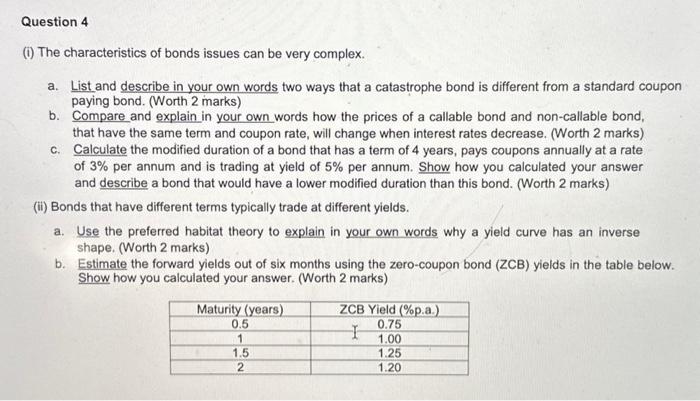

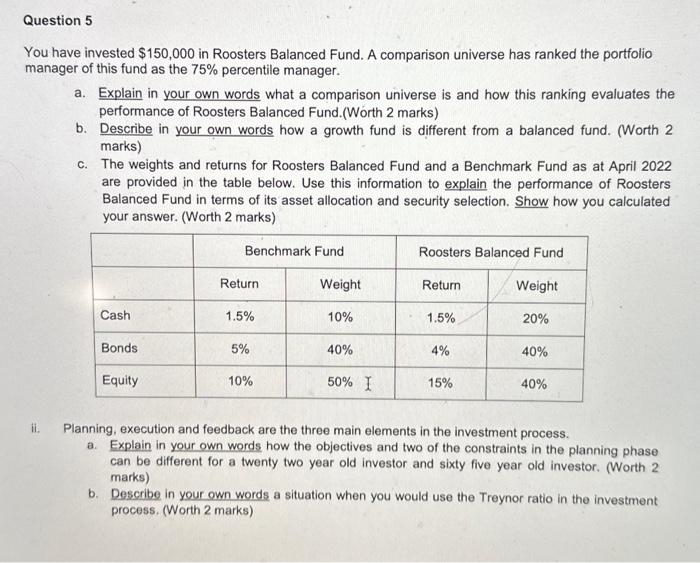

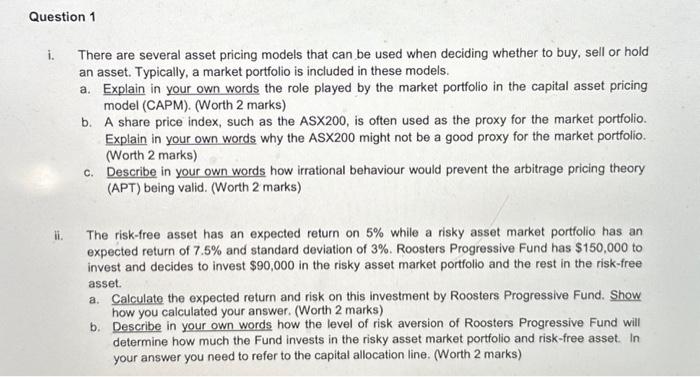

i. There are several asset pricing models that can be used when deciding whether to buy, sell or hold an asset. Typically, a market portfolio is included in these models. a. Explain in your own words the role played by the market portfolio in the capital asset pricing model (CAPM). (Worth 2 marks) b. A share price index, such as the ASX200, is often used as the proxy for the market portfolio. Explain in your own words why the ASX200 might not be a good proxy for the market portfolio. (Worth 2 marks) c. Describe in your own words how irrational behaviour would prevent the arbitrage pricing theory (APT) being valid. (Worth 2 marks) ii. The risk-free asset has an expected return on 5% while a risky asset market portfolio has an expected return of 7.5% and standard deviation of 3%. Roosters Progressive Fund has $150,000 to invest and decides to invest $90,000 in the risky asset market portfolio and the rest in the risk-free asset. a. Calculate the expected return and risk on this investment by Roosters Progressive Fund. Show how you calculated your answer. (Worth 2 marks) b. Describe in your own words how the level of risk aversion of Roosters Progressive Fund will determine how much the Fund invests in the risky asset market portfolio and risk-free asset. In your answer you need to refer to the capital allocation line. (Worth 2 marks) 1. Ramsey Health Care is currently subject to a 100% takeover by the US private equity group Kohlberg Kravis Roberts and Company (KKK). a. An investor holds shares in Ramsey Health Care and reads about this takeover in a newspaper article. Based only on this newspaper article they decide to sell their shares in Ramsey Health Care. Explain in your own words if this is irrational bebaxiour or not and what type of irrational bebaxiour, it would be. (Worth 2 marks) b. Describe in your own words how you could use this takeover announcement to test if the market is efficient. (Worth 2 marks) c. Explain in your own words why according to the Grossman-Stiglitz paradox, investors might prefer to invest in a share index fund instead of shares in Ramsey Health Care. (Worth 2 marks) ii. The dividend discount model and financial ratios are the most common approaches used to value equity. a. Explain in your own words how changes in a company's growth rate and payout ratio can increase its price to earnings ratio. (Worth 2 marks) b. The board of Roosters Gourmet Limited has adopted a plowback rate of 65% and expects that in two years' time the company's earnings growth rate will stabilise at 5%. For the next two years the earnings growth rate is expected to be higher at 15% per year. The beta of the company is 1.2 and current earnings per share are \$15. Estimate the intrinsic value of Roosters Growth Limited. Assume the risk-free rate is 2% and the expected return on the market index is 5%. Show how you calculated your answer. (Worth 2 marks) (i) After a long period of low interest rates, central banks are expected to begin increasing their country's interest rates. a. Explain in your own words how an increased cash rate by the Reserve Bank of Australia can cause the yield curve flatten. Your answer must include a description of a yield curve. (Worth 2 marks) b. Describe in your own words a trading strategy that an active bond fund manager could adopt if they expected the yield curve to flatten over the next few months. (Worth 2 marks) c. There are very few issues of bonds that have a term of 30 years. Describe in your own words the type of investor that would prefer to invest in 30 -year bonds instead of shorter-term bonds. (Worth 2 marks) (ii) The true price of bonds is based on the yields on zero-coupon bond (ZCB). a. In your own words explain why and how the price and yield of a two-year ZCB will be different from the price of a two-year bond that has a coupon rate of 3% per annum and is currently trading at a yield of 2.5% per annum. (Worth 2 marks) b. Use the ZCB yields in the table below to calculate the price of a two-year non-callable Treasury bond that has a face value of $100 and pays coupons semi-annually at a coupon rate of 1.75% per annum. Show how you calculated your answer. (Worth 2 marks) (i) The characteristics of bonds issues can be very complex. a. List and describe in your own words two ways that a catastrophe bond is different from a standard coupon paying bond. (Worth 2 marks) b. Compare and explain in your own words how the prices of a callable bond and non-callable bond, that have the same term and coupon rate, will change when interest rates decrease. (Worth 2 marks) c. Calculate the modified duration of a bond that has a term of 4 years, pays coupons annually at a rate of 3% per annum and is trading at yield of 5% per annum. Show how you calculated your answer and describe a bond that would have a lower modified duration than this bond. (Worth 2 marks) (ii) Bonds that have different terms typically trade at different yields. a. Use the preferred habitat theory to explain in your own words why a yield curve has an inverse shape. (Worth 2 marks) b. Estimate the forward yields out of six months using the zero-coupon bond (ZCB) yields in the table below. Show how you calculated your answer. (Worth 2 marks) You have invested $150,000 in Roosters Balanced Fund. A comparison universe has ranked the portfolio manager of this fund as the 75% percentile manager. a. Explain in your own words what a comparison universe is and how this ranking evaluates the performance of Roosters Balanced Fund.(Worth 2 marks) b. Describe in your own words how a growth fund is different from a balanced fund. (Worth 2 marks) c. The weights and refurns for Roosters Balanced Fund and a Benchmark Fund as at April 2022 are provided in the table below. Use this information to explain the performance of Roosters Balanced Fund in terms of its asset allocation and security selection. Show how you calculated your answer. (Worth 2 marks) ii. Planning, execution and feedback are the three main elements in the investment process. a. Explain in your own words how the objectives and two of the constraints in the planning phase can be different for a twenty two year old investor and sixty five year old investor. (Worth 2 marks) b. Describe in your own words a situation when you would use the Treynor ratio in the investment process. (Worth 2 marks) i. There are several asset pricing models that can be used when deciding whether to buy, sell or hold an asset. Typically, a market portfolio is included in these models. a. Explain in your own words the role played by the market portfolio in the capital asset pricing model (CAPM). (Worth 2 marks) b. A share price index, such as the ASX200, is often used as the proxy for the market portfolio. Explain in your own words why the ASX200 might not be a good proxy for the market portfolio. (Worth 2 marks) c. Describe in your own words how irrational behaviour would prevent the arbitrage pricing theory (APT) being valid. (Worth 2 marks) ii. The risk-free asset has an expected return on 5% while a risky asset market portfolio has an expected return of 7.5% and standard deviation of 3%. Roosters Progressive Fund has $150,000 to invest and decides to invest $90,000 in the risky asset market portfolio and the rest in the risk-free asset: a. Calculate the expected return and risk on this investment by Roosters Progressive Fund. Show how you calculated your answer. (Worth 2 marks) b. Describe in your own words how the level of risk aversion of Roosters Progressive Fund will determine how much the Fund invests in the risky asset market portfolio and risk-free asset. In your answer you need to refer to the capital allocation line. (Worth 2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts