Question: I think for this question there is another calculation I have to do in order to recognize a loss. I'm not sure why those answers

I think for this question there is another calculation I have to do in order to recognize a loss. I'm not sure why those answers are wrong. I'm assuming that there might be an update to revenue recognition system for this year. If someone knows please let me know. Thanks.

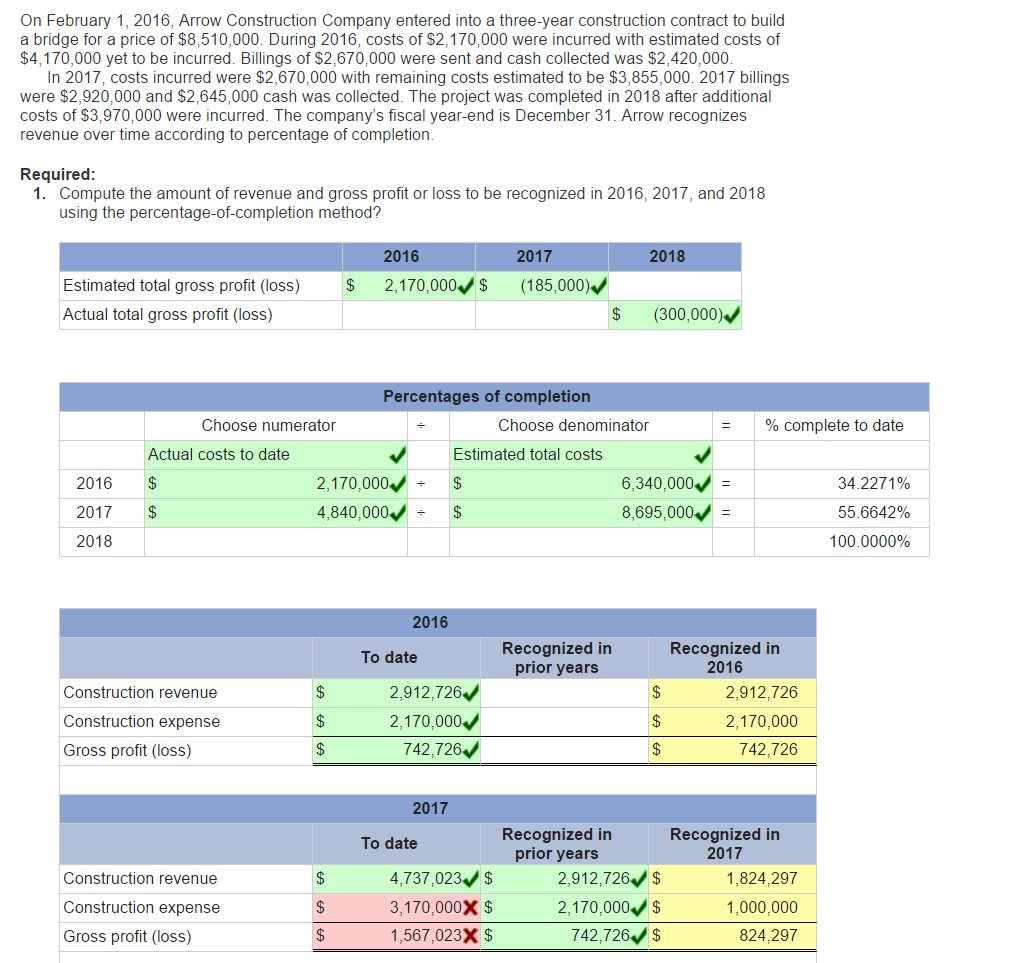

On February 1, 2016, Arrow Construction Company entered into a three-year construction contract to build a bridge for a price of $8,510,000. During 2016, costs of $2,170,000 were incurred with estimated costs of $4,170,000 yet to be incurred. Billings of $2,670,000 were sent and cash collected was $2,420,000 In 2017, costs incurred were $2,670,000 with remaining costs estimated to be $3,855,000. 2017 billings were $2,920,000 and $2,645,000 cash was collected. The project was completed in 2018 after additional costs of $3,970,000 were incurred. The company's fiscal year-end is December 31. Arrow recognizes revenue over time according to percentage of completion Required 1. Compute the amount of revenue and gross profit or loss to be recognized in 2016, 2017, and 2018 using the percentage-of-completion method? 2016 2017 2018 $. 2.170.000 $ (185,000).' Estimated total gross profit (loss) Actual total gross profit (loss) $ (300,000) Percentages of completion Choose numerator Choose denominator % complete to date Actual costs to date Estimated total costs 2016S 2017$ 2018 2,170,000 4,840,000 34.2271 % 55.6642% 100.0000% 6,340,000 8,695,000 2016 Recognized in prior years Recognized in 2016 To date Construction revenue Construction expense Gross profit (loss) 2,912,726 2,170,000 742,726 2,912,726 2,170,000 742,726 2017 Recognized in prior years Recognized in 2017 To date Construction revenue Construction expense Gross profit (loss) 4,737 , 023 $ 3,170,000X $ 1,567,023X $ 2,912,726S 2.170.000 1,824,297 1,000,000 824,297 742,726S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts