Question: I think I know the answer to question 9, E. but I'm not sure because I don't really understand what I'm looking at. A. Equipment

I think I know the answer to question 9, E. but I'm not sure because I don't really understand what I'm looking at.

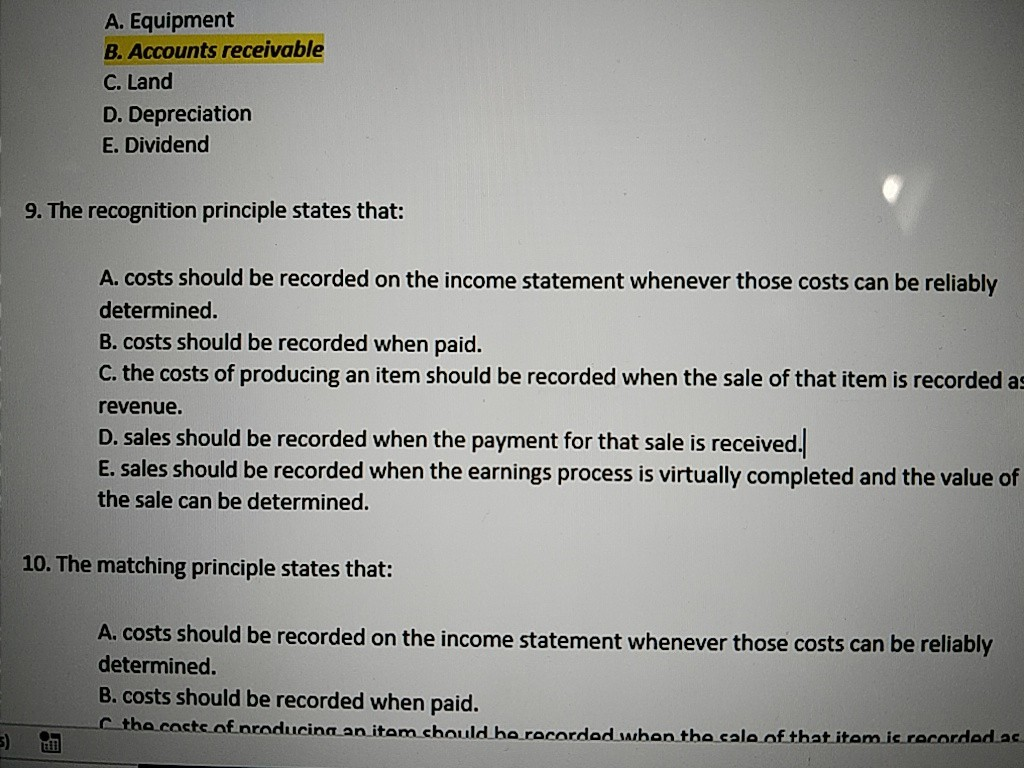

A. Equipment B. Accounts receivable C. Land D. Depreciation E. Dividend 9. The recognition principle states that: A. costs should be recorded on the income statement whenever those costs can be reliably determined. B. costs should be recorded when paid. C. the costs of producing an item should be recorded when the sale of that item is recorded a revenue. D. sales should be recorded when the payment for that sale is received. E. sales should be recorded when the earnings process is virtually completed and the value of the sale can be determined. 10. The matching principle states that: A. costs should be recorded on the income statement whenever those costs can be reliably determined. B. costs should be recorded when paid. ctho.cost.of.nroducing an item should be recorded when the cale of that item.ic recorded as

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts