Question: I think I've got my concepts wrong. I can't reconcile my answer to the second question with the third one. Question 2 (20 marks) Assume

I think I've got my concepts wrong. I can't reconcile my answer to the second question with the third one.

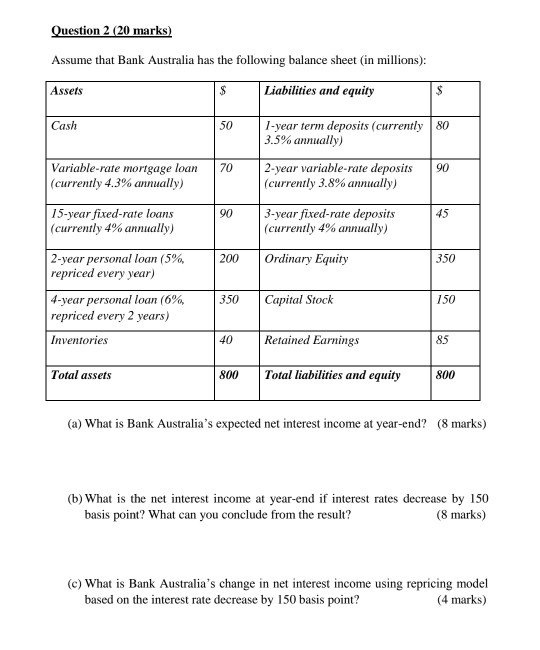

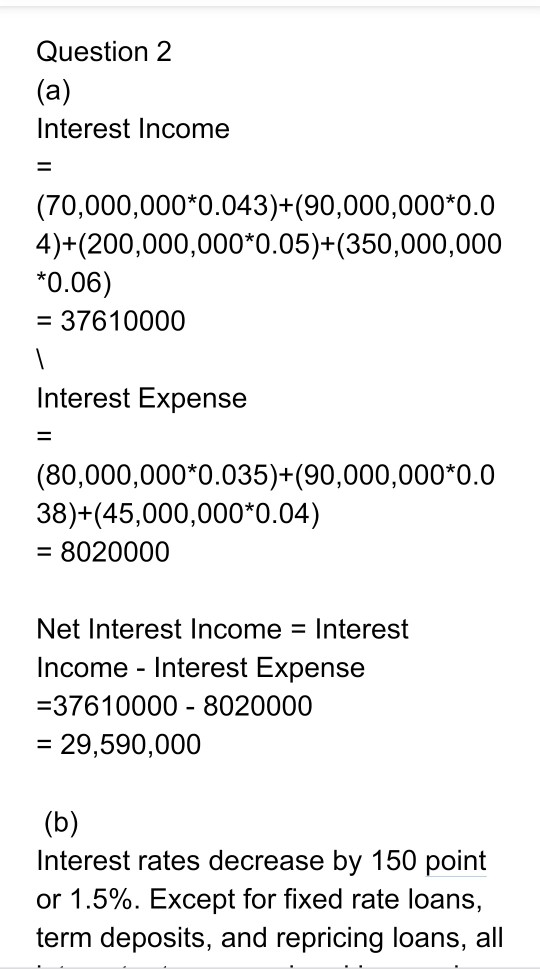

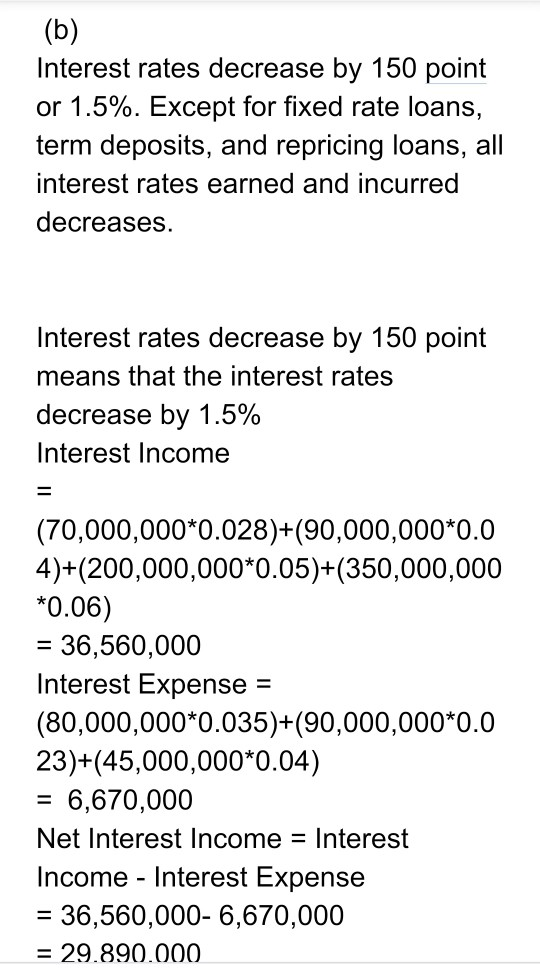

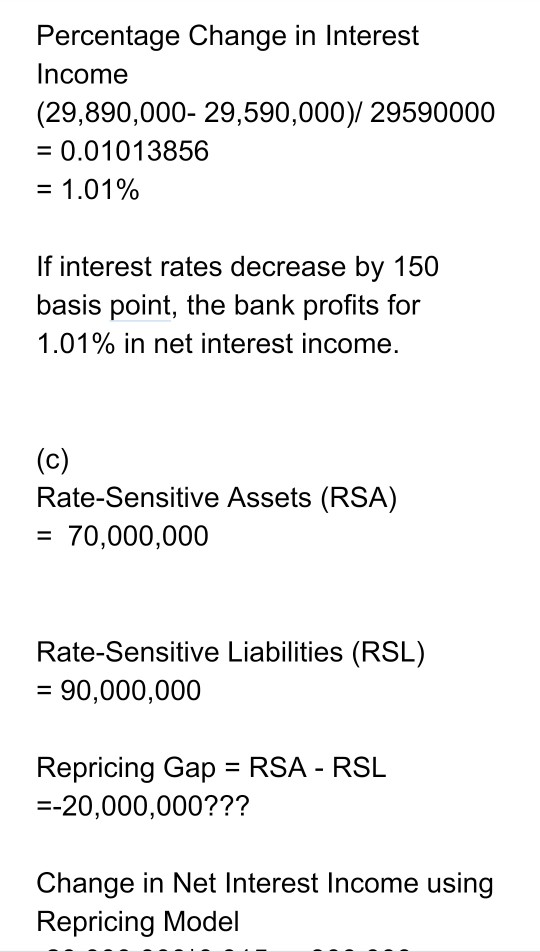

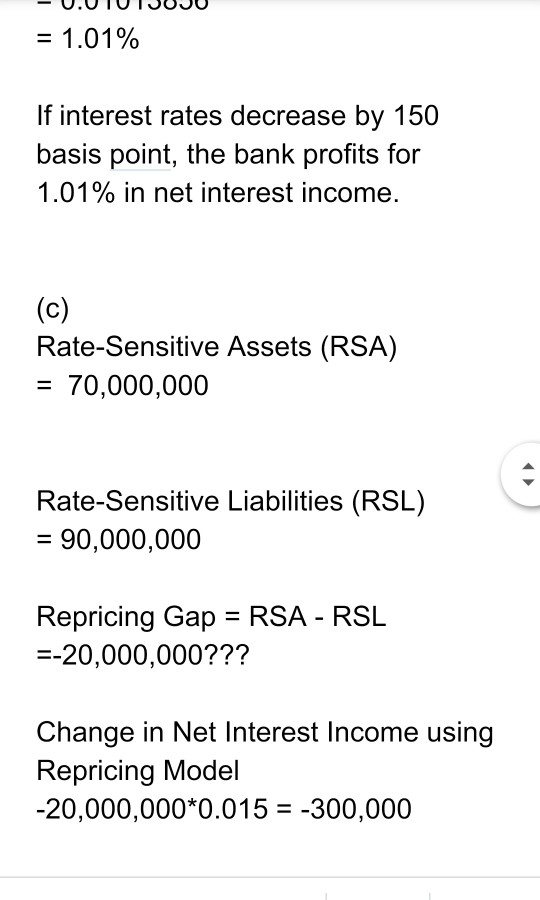

Question 2 (20 marks) Assume that Bank Australia has the following balance sheet (in millions): Assets $ Liabilities and equity $ Cash 50 1-year term deposits (currently 80 3.5% annually) 2-year variable-rate deposits 90 (currently 3.8% annually) 70 Variable-rate mortgage loan (currently 4.3% annually) 90 45 15-year fixed-rate loans (currently 4% annually) 3-year fixed-rate deposits (currently 4% annually) 200 Ordinary Equity 350 2-year personal loan (5% repriced every year) 4-year personal loan (6% repriced every 2 years) 350 Capital Stock 150 Inventories 40 Retained Earnings 85 Total assets 800 Total liabilities and equity 800 (a) What is Bank Australia's expected net interest income at year-end? (8 marks) (b) What is the net interest income at year-end if interest rates decrease by 150 basis point? What can you conclude from the result? (8 marks) (C) What is Bank Australia's change in net interest income using repricing model based on the interest rate decrease by 150 basis point? (4 marks) Question 2 (a) Interest Income (70,000,000*0.043)+(90,000,000*0.0 4)+(200,000,000*0.05)+(350,000,000 *0.06) = 37610000 . Interest Expense (80,000,000*0.035)+(90,000,000*0.0 38)+(45,000,000*0.04) 8020000 = = Net Interest Income Interest Income - Interest Expense =37610000 - 8020000 = 29,590,000 (b) Interest rates decrease by 150 point or 1.5%. Except for fixed rate loans, term deposits, and repricing loans, all (b) Interest rates decrease by 150 point or 1.5%. Except for fixed rate loans, term deposits, and repricing loans, all interest rates earned and incurred decreases. Interest rates decrease by 150 point means that the interest rates decrease by 1.5% Interest Income (70,000,000*0.028)+(90,000,000*0.0 4)+(200,000,000*0.05)+(350,000,000 *0.06) = 36,560,000 Interest Expense (80,000,000*0.035)+(90,000,000*0.0 23)+(45,000,000*0.04) 6,670,000 Net Interest Income = Interest Income - Interest Expense = 36,560,000-6,670,000 = 29.890.000 Percentage Change in Interest Income (29,890,000- 29,590,000)/ 29590000 = 0.01013856 = 1.01% If interest rates decrease by 150 basis point, the bank profits for 1.01% in net interest income. (c) Rate-Sensitive Assets (RSA) 70,000,000 = Rate-Sensitive Liabilities (RSL) = 90,000,000 Repricing Gap = RSA - RSL =-20,000,000??? Change in Net Interest Income using Repricing Model = 1.01% If interest rates decrease by 150 basis point, the bank profits for 1.01% in net interest income. (c) Rate-Sensitive Assets (RSA) 70,000,000 Rate-Sensitive Liabilities (RSL) = 90,000,000 = Repricing Gap = RSA - RSL =-20,000,000??? Change in Net Interest Income using Repricing Model -20,000,000*0.015 = -300,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts