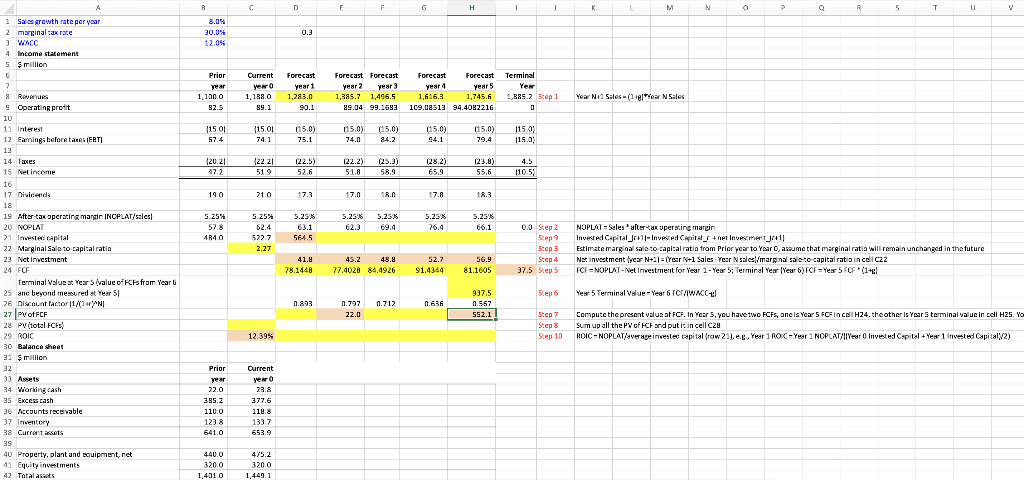

Question: I think my fcf (row 24) is wrong. Need help verifying A R D F F G H K M N N 0 Q R

I think my fcf (row 24) is wrong. Need help verifying

I think my fcf (row 24) is wrong. Need help verifying

A R D F F G H K M N N 0 Q R 5 T LI 1 Sales growth rata per year 2 marginal tax rate 3 WACC 4 Income statement 5 million 8.08 30.0% 12.0% 0.3 Prior year 1,100.0 32.5 Current yewo 1.168.0 89.1 Forecast year 1 1,283.0 90.1 Forecast forecast Forecast Forecast year 2 years year 4 year 5 1,385.7 1,496.5 1,616.3 1,745.6 29.04 99.1583 109.02513 94.4092216 Terminal Yer 1,885.2 Sep 1 0 Year N11 Sales -(11 ear N Sales (15.01 57.4 (150) (15.01 74.1 (15,0) 75.1 (15.0) 74.0 (15.0) 84.2 (15.0) 79.4 1150) 115.0) 94.1 120.21 47.2 122.21 51.9 (22.5) 52.6 (22.2) 51.8 (25.3) 58,9 (28.2) 65.9 123.9) 55,6 4.5 110.5 ) 19.0 21.0 17.3 17.0 17.8 5.25% 57.8 4140 5.25% 63.1 564.5 5.25% 62.3 5.25% 69.9 5.25% 76.4 5.25% 62.4 5227 2.27 5.25% 66.1 0.0 Step 2 Sep 9 Step 3 Step 4 37.5 Steps NOPLAT - Sales alter-tax operating margin Inveted Capital_r+1)- Invested Capital_r+net Invesmert_jr+1} Estimate marginal saloto capital ratia from Prior year to Year, anume that marginal ratia will remain unchanged in the future Net investment year N+2) = (Year N+1 Sales - Year N sales/marginal aleto capital ratio incellc22 FCF = NOPLAT-Net Investment for Year 1-Year 5; Terminal Yes Year 6) FCF = Yes 5 FOF(1+ 41.9 78.1448 45.2 48.8 77.4028 84.4926 52.7 91.4344 56.9 81.1605 7 & Revenues 9 Operating profit 10 11 Interest 12 Eaming before takes EST] 13 14 Taxes 15 Net income 16 17 Dividends 18 19 After tax operating margir INOPLAT/sales 20 NOPLAT 21 Invested capital 22 Marginal Saloto capital ratio 23 Net investment 24 FCF Terminal value at Year 5 value of his from Year 25 and beyond measured at Year 51 26 Discount factor 11/14/NI 27 POFCF 28 PV (total FCF! 29 ROIC 30 Balance sheet 33 Smillion 32 33 Assets 34 Working cash 35 Excex cash 36 Accounts recevable 37 Inventory 38 Current sets 39 40 Property, plant and equipment.net 11 Equity investments 42 Totalaus Step 6 Year 5 Terminal wueYear 6 CFWACCU! 0.893 0.712 0.636 0.797 22.0 937.5 0.567 552.1 Step 7 Step 8 Step 10 Compute the present value of FCF. In Year 5, you have two FCFS, ancis Year 5 FC incel H24, theother is Year S terminal value in cell HZS. YO Sum up all the PV of FCF and put it in cell cu ROIC-NOPLAT/Average invested capital frow 211.ee. Year 1 ROIC-Year 1 NOPLAT/IIYear O Invested Capital + Year 1 invested Capital 2) 12 39% Prior year 22.0 385.2 110.0 1238 641.0 Current yero 23.8 377.6 119.8 133.7 653.9 440.0 3200 1,401.0 475.2 3200 1,449.1 A R D F F G H K M N N 0 Q R 5 T LI 1 Sales growth rata per year 2 marginal tax rate 3 WACC 4 Income statement 5 million 8.08 30.0% 12.0% 0.3 Prior year 1,100.0 32.5 Current yewo 1.168.0 89.1 Forecast year 1 1,283.0 90.1 Forecast forecast Forecast Forecast year 2 years year 4 year 5 1,385.7 1,496.5 1,616.3 1,745.6 29.04 99.1583 109.02513 94.4092216 Terminal Yer 1,885.2 Sep 1 0 Year N11 Sales -(11 ear N Sales (15.01 57.4 (150) (15.01 74.1 (15,0) 75.1 (15.0) 74.0 (15.0) 84.2 (15.0) 79.4 1150) 115.0) 94.1 120.21 47.2 122.21 51.9 (22.5) 52.6 (22.2) 51.8 (25.3) 58,9 (28.2) 65.9 123.9) 55,6 4.5 110.5 ) 19.0 21.0 17.3 17.0 17.8 5.25% 57.8 4140 5.25% 63.1 564.5 5.25% 62.3 5.25% 69.9 5.25% 76.4 5.25% 62.4 5227 2.27 5.25% 66.1 0.0 Step 2 Sep 9 Step 3 Step 4 37.5 Steps NOPLAT - Sales alter-tax operating margin Inveted Capital_r+1)- Invested Capital_r+net Invesmert_jr+1} Estimate marginal saloto capital ratia from Prior year to Year, anume that marginal ratia will remain unchanged in the future Net investment year N+2) = (Year N+1 Sales - Year N sales/marginal aleto capital ratio incellc22 FCF = NOPLAT-Net Investment for Year 1-Year 5; Terminal Yes Year 6) FCF = Yes 5 FOF(1+ 41.9 78.1448 45.2 48.8 77.4028 84.4926 52.7 91.4344 56.9 81.1605 7 & Revenues 9 Operating profit 10 11 Interest 12 Eaming before takes EST] 13 14 Taxes 15 Net income 16 17 Dividends 18 19 After tax operating margir INOPLAT/sales 20 NOPLAT 21 Invested capital 22 Marginal Saloto capital ratio 23 Net investment 24 FCF Terminal value at Year 5 value of his from Year 25 and beyond measured at Year 51 26 Discount factor 11/14/NI 27 POFCF 28 PV (total FCF! 29 ROIC 30 Balance sheet 33 Smillion 32 33 Assets 34 Working cash 35 Excex cash 36 Accounts recevable 37 Inventory 38 Current sets 39 40 Property, plant and equipment.net 11 Equity investments 42 Totalaus Step 6 Year 5 Terminal wueYear 6 CFWACCU! 0.893 0.712 0.636 0.797 22.0 937.5 0.567 552.1 Step 7 Step 8 Step 10 Compute the present value of FCF. In Year 5, you have two FCFS, ancis Year 5 FC incel H24, theother is Year S terminal value in cell HZS. YO Sum up all the PV of FCF and put it in cell cu ROIC-NOPLAT/Average invested capital frow 211.ee. Year 1 ROIC-Year 1 NOPLAT/IIYear O Invested Capital + Year 1 invested Capital 2) 12 39% Prior year 22.0 385.2 110.0 1238 641.0 Current yero 23.8 377.6 119.8 133.7 653.9 440.0 3200 1,401.0 475.2 3200 1,449.1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts