Question: I think there is a an error with the amortization table, and b ,c , and d REMEMBER TO CELL REFERENCE 2) Create an amortization

I think there is a an error with the amortization table, and b ,c , and d

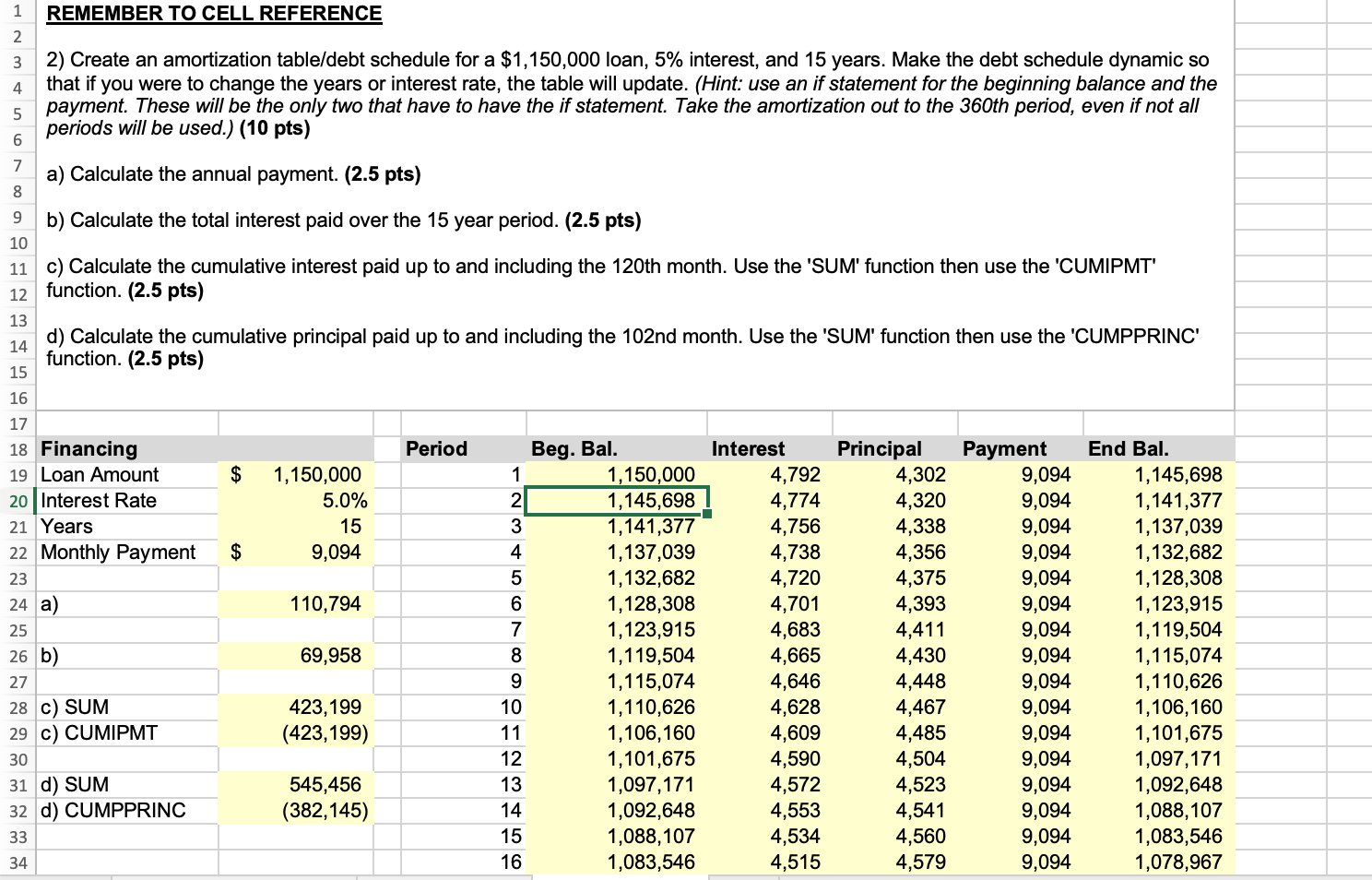

REMEMBER TO CELL REFERENCE 2) Create an amortization table/debt schedule for a $1,150,000 loan, 5% interest, and 15 years. Make the debt schedule dynamic so that if you were to change the years or interest rate, the table will update. (Hint: use an if statement for the beginning balance and the payment. These will be the only two that have to have the if statement. Take the amortization out to the 360th period, even if not all periods will be used.) (10 pts) a) Calculate the annual payment. (2.5 pts) b) Calculate the total interest paid over the 15 year period. (2.5 pts) 11 c) Calculate the cumulative interest paid up to and including the 120th month. Use the 'SUM' function then use the 'CUMIPMT' function. (2.5 pts) d) Calculate the cumulative principal paid up to and including the 102nd month. Use the 'SUM' function then use the 'CUMPPRINC' function. (2.5 pts) Period $ 18 Financing 19 Loan Amount 20 Interest Rate 21 Years 22 Monthly Payment 23 24 a) 1,150,000 5.0% 15 9,094 $ Ovo AWN- 110,794 25 69,958 26 b) 27 28 C) SUM 29 c) CUMIPMT Beg. Bal. 1,150,000 1,145,698 1,141,377 1,137,039 1,132,682 1,128,308 1,123,915 1,119,504 1,115,074 1,110,626 1,106,160 1,101,675 1,097,171 14 1,092,648 15 1,088,107 1,083,546 Interest 4,792 4,774 4,756 4,738 4,720 4,701 4,683 4,665 4,646 4,628 4,609 4,590 4,572 4,553 4,534 4,515 Principal 4,302 4,320 4,338 4,356 4,375 4,393 4,411 4,430 4,448 4,467 4,485 4,504 4,523 4,541 4,560 4,579 Payment 9,094 9,094 9,094 9,094 9,094 9,094 9,094 9,094 9,094 9,094 9,094 9,094 9,094 9,094 9,094 9,094 End Bal. 1,145,698 1,141,377 1,137,039 1,132,682 1,128,308 1,123,915 1,119,504 1,115,074 1,110,626 1,106,160 1,101,675 1,097,171 1,092,648 1,088,107 1,083,546 1,078,967 423,199 (423,199) 7 30 31 d) SUM 32 d) CUMPPRINC 545,456 (382,145)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts