Question: I thought I calculated this correctly, however it seems my calculations were wrong. Could someone kindly provide me with guidance? Instructions would be appreciated. Abbot

I thought I calculated this correctly, however it seems my calculations were wrong. Could someone kindly provide me with guidance? Instructions would be appreciated.

I thought I calculated this correctly, however it seems my calculations were wrong. Could someone kindly provide me with guidance? Instructions would be appreciated.

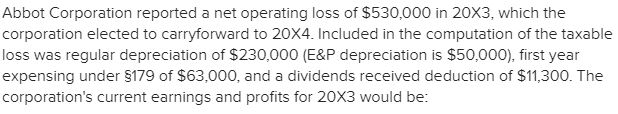

Abbot Corporation reported a net operating loss of $530,000 in 20X3, which the corporation elected to carryforward to 20X4. Included in the computation of the taxable loss was regular depreciation of $230,000 (E&P depreciation is $50,000), first year expensing under $179 of $63,000, and a dividends received deduction of $11,300. The corporation's current earnings and profits for 20X3 would be: Multiple Choice ($288,300). ($338,700). 1598700) ($530,000). (1643.000) ($643,000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts