Question: I True / False Indicate whether the statement is true or false normally allow the use of the direct write-off method of accounting I. Generally

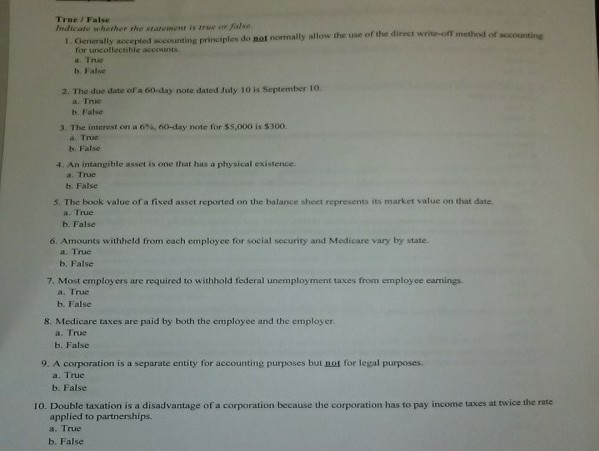

I True / False Indicate whether the statement is true or false normally allow the use of the direct write-off method of accounting I. Generally accepted accounting principles do not for uncollectible accounts a. True b. False 2. The due date ora 00-day note dated July 10 is September 10 a. True b. False 3 The interest on a 6%, 60-day note for $5,000 is $300. a True b. Fatse 4. An intangible asset is one that has physical existence. a. True b. False 5. The book value of a fixed asset reported on the balance sheet represents its market value on that date a. True b. False 6. Amounts withheld from each employce for social security and Medicare vary by state. a. True b. False 7. Most employers are required to withhold federal unemployment taxes from employee eanings. a. True b. False 8. Medicare taxes are paid by both the employee and the employer a. True b. False 9. A corporation is a separate entity for accounting purposes but not for legal purposes a. True b. False 10. Double taxation is a disadvantage of a corporation because the corporation has to pay income taxes at twice the rate applied to partnerships. a. True b. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts