Question: I understand everything except where the $134,000,000 comes from. I get the 77,000,000 comes from the difference in NOWC, but how do you get the

I understand everything except where the $134,000,000 comes from. I get the 77,000,000 comes from the difference in NOWC, but how do you get the cap. expenditure of $134,000,000?

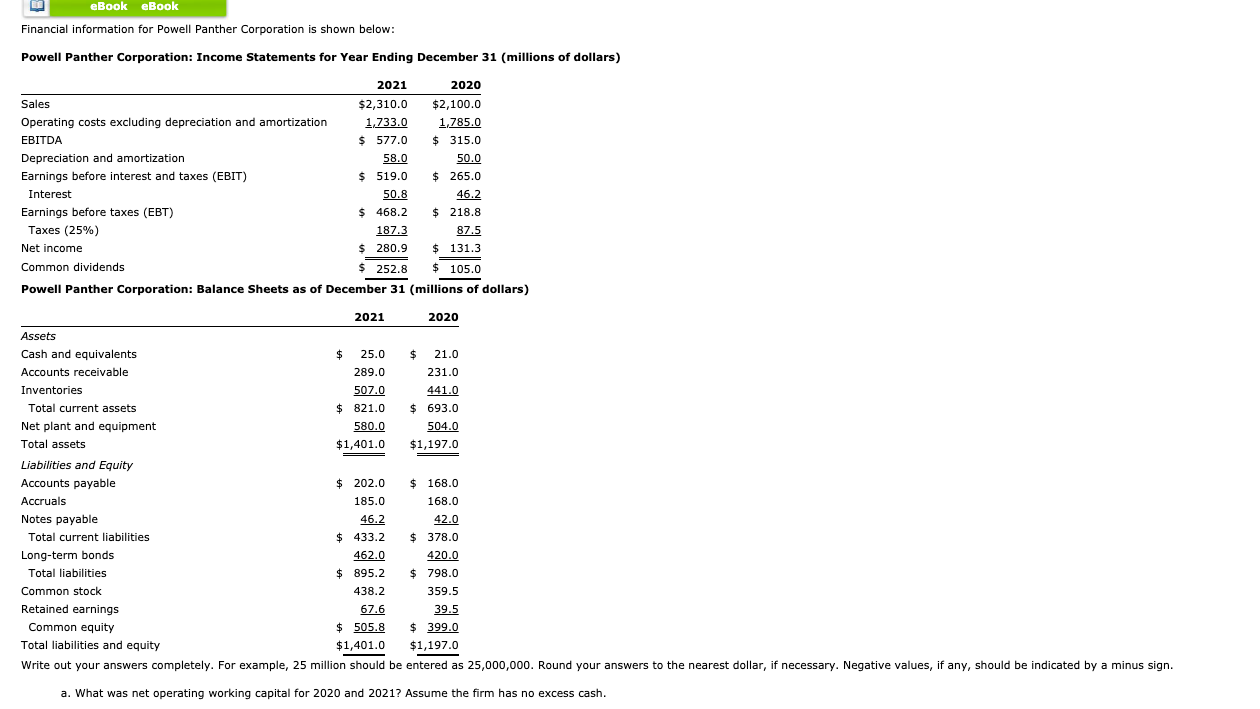

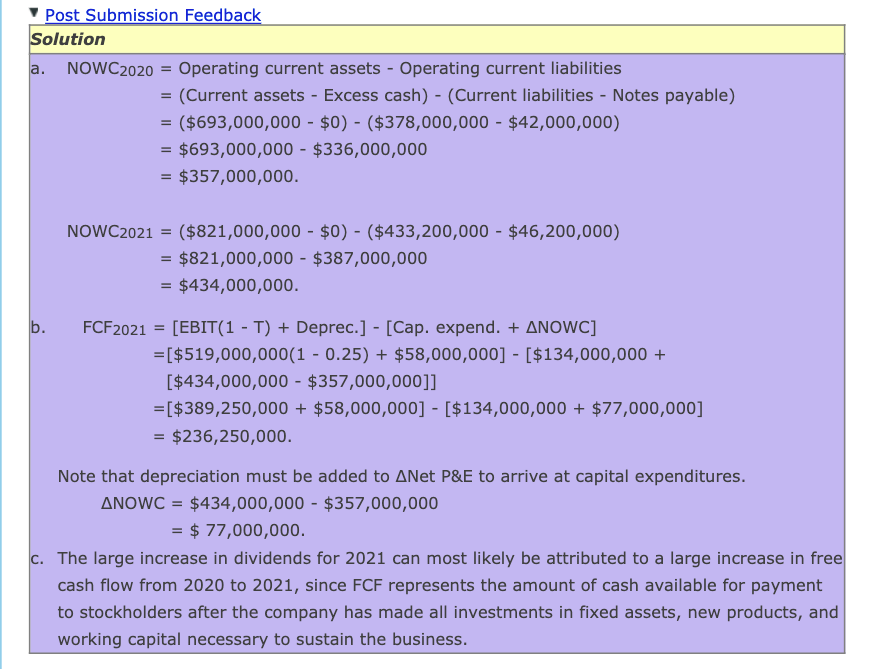

eBook eBook Financial information for Powell Panther Corporation is shown below: Powell Panther Corporation: Income Statements for Year Ending December 31 (millions of dollars) 2021 2020 Sales $2,310.0 $2,100.0 Operating costs excluding depreciation and amortization 1,733.0 1,785.0 EBITDA $ 577.0 $ 315.0 Depreciation and amortization 58.0 50.0 Earnings before interest and taxes (EBIT) $ 519.0 $ 265.0 Interest 50.8 46.2 Earnings before taxes (EBT) $ 468.2 $ 218.8 Taxes (25%) 187.3 87.5 Net income $ 280.9 $ 131.3 Common dividends $ 252.8 $ 105.0 Powell Panther Corporation: Balance Sheets as of December 31 (millions of dollars) 2021 2020 Assets Cash and equivalents $ 25.0 $ 21.0 Accounts receivable 289.0 231.0 Inventories 507.0 441.0 Total current assets $ 821.0 $ 693.0 Net plant and equipment 580.0 504.0 Total assets $1,401.0 $1,197.0 Liabilities and Equity Accounts payable $ 202.0 $ 168.0 Accruals 185.0 168.0 Notes payable 46.2 42.0 Total current liabilities $ 433.2 $ 378.0 Long-term bonds 462.0 420.0 Total liabilities $ 895.2 $ 798.0 Common stock 438.2 359.5 Retained earnings 67.6 39.5 Common equity $ 505.8 $ 399.0 Total liabilities and equity $1,401.0 $1,197.0 Write out your answers completely. For example, 25 million should be entered as 25,000,000. Round your answers to the nearest dollar, if necessary. Negative values, if any, should be indicated by a minus sign. a. What was net operating working capital for 2020 and 2021? Assume the firm has no excess cash. Post Submission Feedback Solution a. NOWC2020 = Operating current assets - Operating current liabilities = (Current assets - Excess cash) - (Current liabilities - Notes payable) ($693,000,000 - $0) - ($378,000,000 - $42,000,000) = $693,000,000 - $336,000,000 = $357,000,000. NOWC2021 = ($821,000,000 - $0) - ($433,200,000 - $46,200,000) = $821,000,000 - $387,000,000 = $434,000,000. b. FCF2021 = [EBIT(1 - T) + Deprec.] - [Cap. expend. + ANOWC] =[$519,000,000(1 - 0.25) + $58,000,000] - [$134,000,000 + [$434,000,000 - $357,000,000]] = [$389,250,000 + $58,000,000] - [$134,000,000 + $77,000,000] = $236,250,000. Note that depreciation must be added to ANet P&E to arrive at capital expenditures. ANOWC = $434,000,000 - $357,000,000 = $ 77,000,000 c. The large increase in dividends for 2021 can most likely be attributed to a large increase in free cash flow from 2020 to 2021, since FCF represents the amount of cash available for payment to stockholders after the company has made all investments in fixed assets, new products, and working capital necessary to sustain the business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts