Question: I understand how to do the first journal entry, but I'm struggling with the assignment overall. I have to record these in Excel, so if

I understand how to do the first journal entry, but I'm struggling with the assignment overall. I have to record these in Excel, so if someone could just do the first few entries in a format like Excel that would be super helpful. I've attached the first few entries as well as the instructions for the assignment.

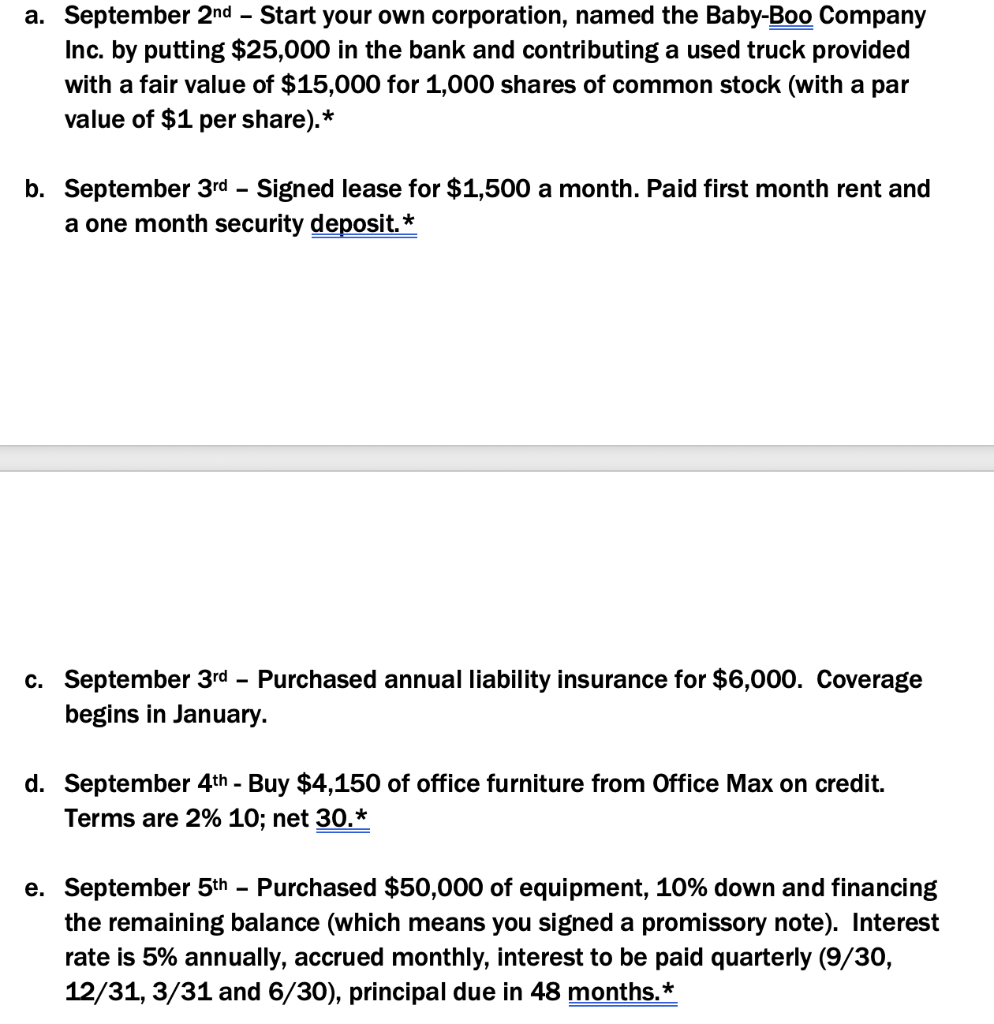

This is a practice assignment is designed to help you better interpret typical business transactions, how to account for them, and to introduce you to the Excel software. In an Excel workbook Student JE Practice 2021", change the file name by using you name (first and last name please). There are 4 sheets labeled "journal entries sheet, T accounts, Trial Balance, and Financial Statements" in the workbook. Look for additional requirements and hints on each worksheet. You are to: a. update the journal entries worksheet with the transactions below. Transactions with an * represent a new accounting rule/principle. b. build the T-accounts in the second sheet c. update the T-accounts for the journal entries d. compute the ending balance of each T-account e. transfer (link) the ending balances to the 3rd sheet called Trial Balance" under the UNADJUSTED TRIAL BALANCE columns f. Sum and balance your UNADJUSTED TRIAL BALANCE columns Remember all individual journal entries must balance (debits=credits). The journal must be summed and balanced (sum the totals of the Debit and Credit columns using Excel's sum function". To build the T-accounts, go to the "font" tab, click the "borders" tab and Insert the appropriate vertical and horizontal line. Label each T-account and highlight In "yellow" that account's normal balance. Do this for EVERY T-account needed. After all journal entries have been transferred to the T-accounts, sum each T-account to obtain its ending balance. a. September 2nd - Start your own corporation, named the Baby-Boo Company Inc. by putting $25,000 in the bank and contributing a used truck provided with a fair value of $15,000 for 1,000 shares of common stock (with a par value of $1 per share).* b. September 3rd Signed lease for $1,500 a month. Paid first month rent and a one month security deposit. * c. September 3rd - Purchased annual liability insurance for $6,000. Coverage begins in January. d. September 4th - Buy $4,150 of office furniture from Office Max on credit. Terms are 2% 10; net 30.* e. September 5th - Purchased $50,000 of equipment, 10% down and financing the remaining balance (which means you signed a promissory note). Interest rate is 5% annually, accrued monthly, interest to be paid quarterly (9/30, 12/31, 3/31 and 6/30), principal due in 48 months.*

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts