Question: I understand if you can only answer one. anything helps:) 5. Professional Properties is considering remodeling the office building it leases to Heartland Insurance. The

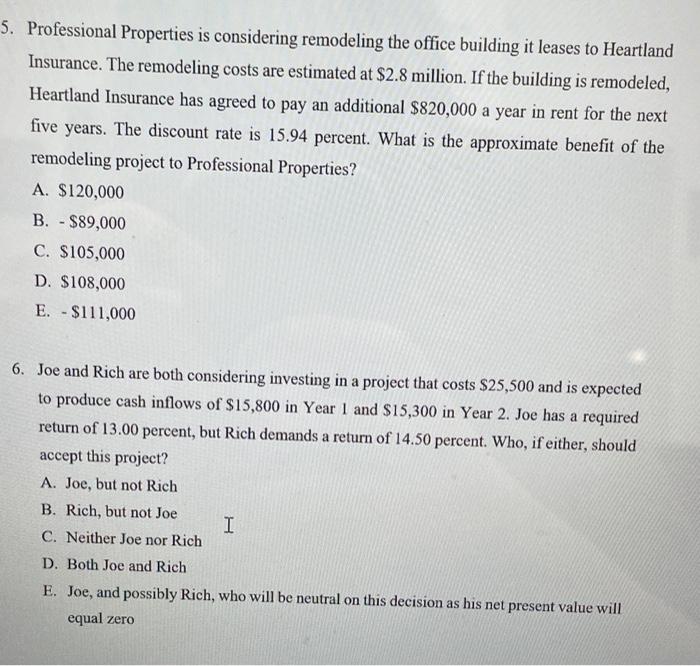

5. Professional Properties is considering remodeling the office building it leases to Heartland Insurance. The remodeling costs are estimated at $2.8 million. If the building is remodeled, Heartland Insurance has agreed to pay an additional $820,000 a year in rent for the next five years. The discount rate is 15.94 percent. What is the approximate benefit of the remodeling project to Professional Properties? A. $120,000 B. - $89,000 C. $105,000 D. $108,000 E. - $111,000 6. Joe and Rich are both considering investing in a project that costs $25,500 and is expected to produce cash inflows of $15,800 in Year 1 and $15,300 in Year 2. Joe has a required return of 13.00 percent, but Rich demands a return of 14.50 percent. Who, if either, should accept this project? A. Joe, but not Rich B. Rich, but not Joe I C. Neither Joe nor Rich D. Both Joe and Rich E. Joe, and possibly Rich, who will be neutral on this decision as his net present value will equal zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts