Question: ( i ) Upelste Help Sove 8 Exit Submit roblem 2 4 - 4 5 ( LO 2 4 - 2 ) ( Algo )

i

Upelste

Help

Sove Exit

Submit

roblem LO Algo

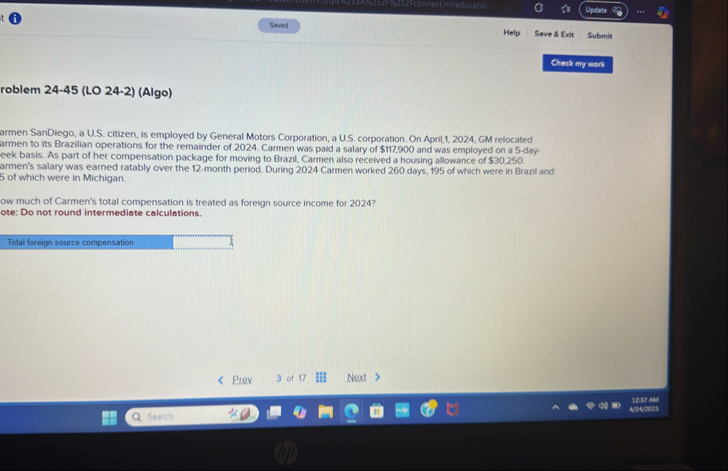

armen SanDiego, a US citizen, is employed by General Motors Corporation, a US corporation. On April GM relocated armen to its Brazilian operations for the remainder of Carmen was paid a salary of $ and was employed on a dayeek basis. As part of her compensation package for moving to Brazil, Carmen also received a housing allowance of $ armen's salary was earned ratably over the month period. During Carmen worked days, of which were in Brazil and of which were in Michigan.

ow much of Carmen's total compensation is treated as foreign source income for

ote: Do not round intermediate calculations.

Total foreign source compensation

Rrav

of

Noxt

Byays

Search

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock