Question: I used this solution for the question above. so I get this feed back down below so, can I get help on fixing that. The

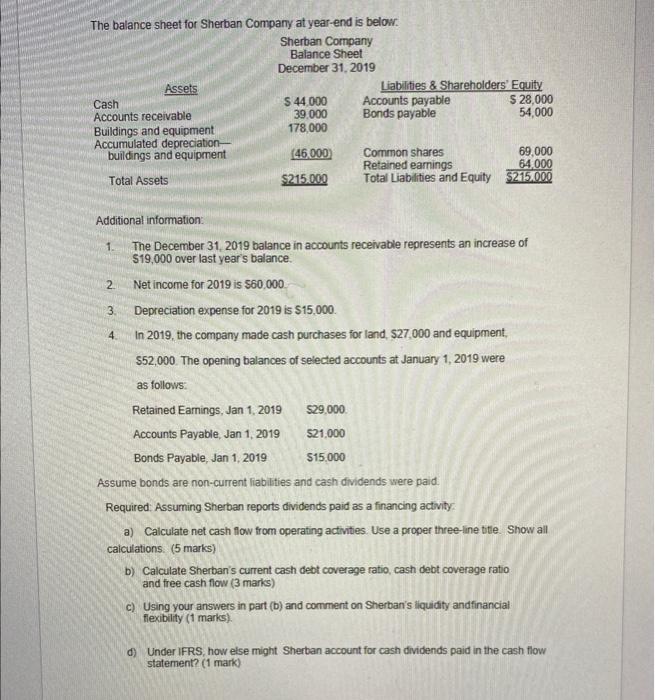

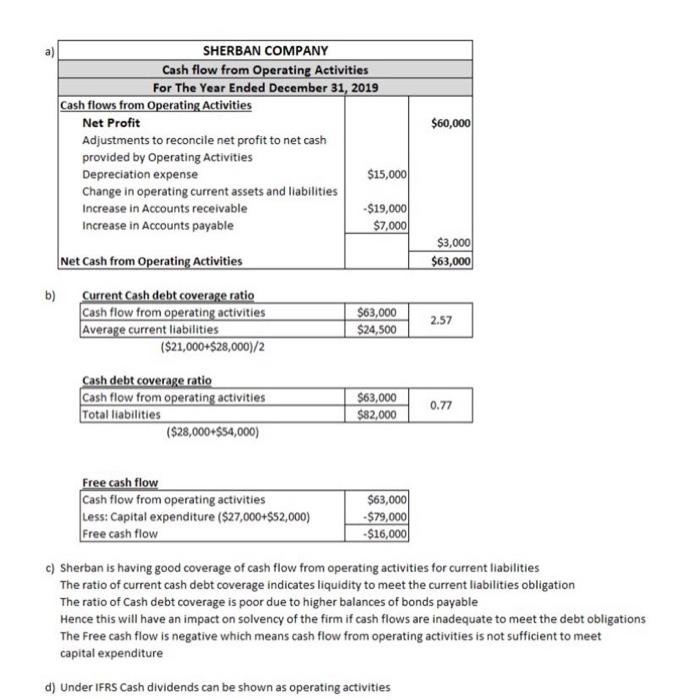

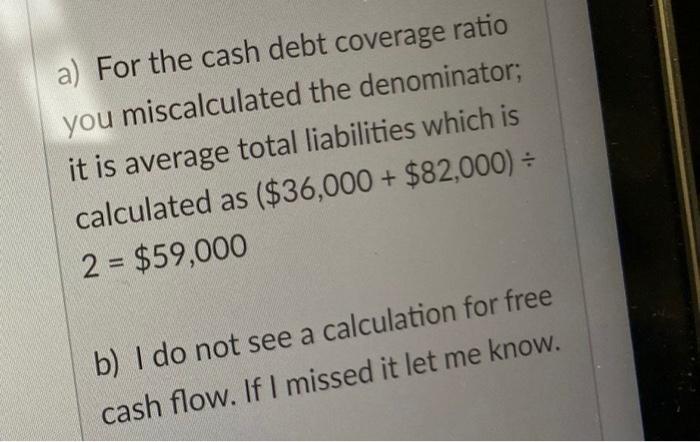

The balance sheet for Sherban Company at year-end is below: Additional information: 1. The December 31, 2019 balance in accounts receivable represents an increase of $19,000 over last year's balance. 2. Net income for 2019 is $60,000 3. Depreciation expense for 2019 is $15,000. 4. In 2019, the company made cash purchases for land, \$27,000 and equipment, $52,000. The opening balances of selected accounts at January 1, 2019 were as follows: Assume bonds are non-current liabilities and cash dividends were paid. Required: Assuming Sherban reports dividends paid as a financing activity: a) Calculate net cash flow from operating activities. Use a proper three-line tite. Show all calculations. ( 5 marks) b) Calculate Sherban's current cash debt coverage ratio, cash debt coverage ratio and free cash flow (3 marks) c) Using your answers in part (b) and comment on Sherban's liquidity andfinancial flexibility ( 1 marks). d) Under IFRS, how else might Sherban account for cash dividends paid in the cash flow statement? (1 mark) c) Sherban is having good coverage of cash flow from operating activities for current liabilities The ratio of current cash debt coverage indicates liquidity to meet the current liabilities obligation The ratio of Cash debt coverage is poor due to higher balances of bonds payable Hence this will have an impact on solvency of the firm if cash flows are inadequate to meet the debt obligations The Free cash flow is negative which means cash flow from operating activities is not sufficient to meet capital expenditure d) Under IFRS Cash dividends can be shown as operating activities a) For the cash debt coverage ratio you miscalculated the denominator; it is average total liabilities which is calculated as ($36,000+$82,000) 2=$59,000 b) I do not see a calculation for free cash flow. If I missed it let me know

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts