Question: I want an answer for the task. Only answer question 1: what actions must bon appetit take to avoid the threatened takeover by lcarus 13

I want an answer for the task. Only answer question 1: what actions must bon appetit take to avoid the threatened takeover by lcarus

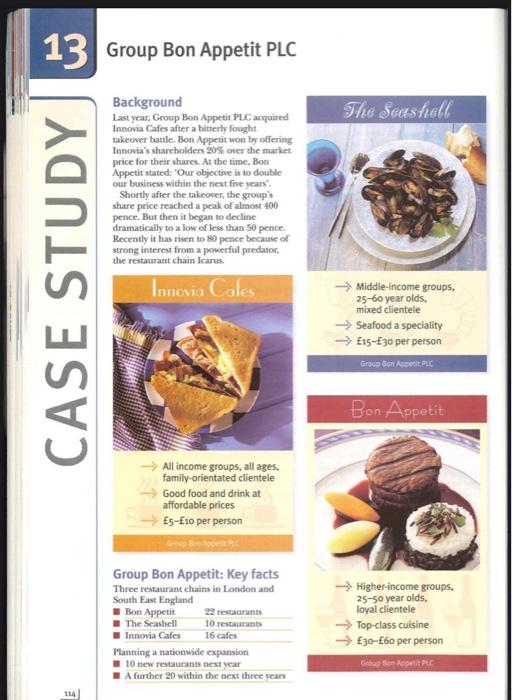

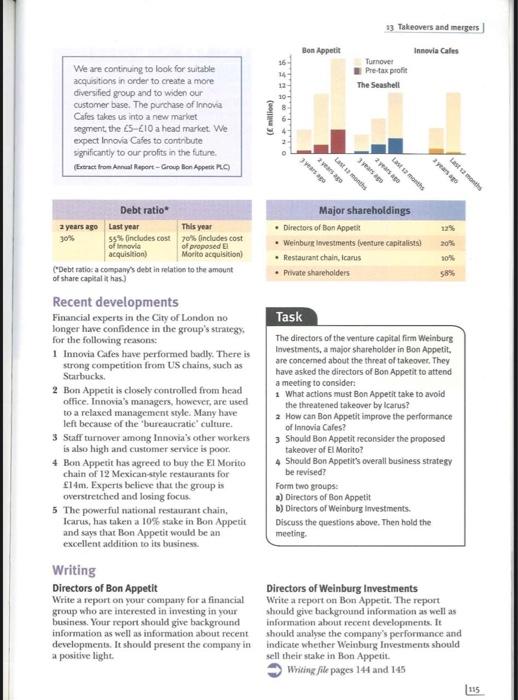

13 Group Bon Appetit PLC The Seashell Background Last year, Group Bon Appetit PLC acquired Innovia Cafes after a bitterly fought takeover battle. Bon Appetit won by offering Innovia's shareholders 20% over the market price for their shares. At the time, Bon Appetit stated: "Our objective is to double our business within the next five years Shortly after the sakeover, the group's share price reached a peak of almost 400 pence. But then it began to decline dramatically to a low of less than 50 pence. Recently it has risen to 80 pence because of strong interest from a powerful predator the restaurant chain Icarus CASE STUDY Innovia Cales Middle-income groups, 25-60 year olds, mixed clientele -> Seafood a speciality --> 15-30 per person Group Ben Aset PLC Bon Appetit All income groups, all ages, family-orientated clientele Good food and drink at affordable prices 5-10 per person Group Bon Appetit: Key facts Three restaurant chains in London and South East England Bon Appetit 22 restaurants The Seashell 10 restaurants Innovia Cafes 16 cafes Planning a nationwide expansion 10 new restaurants next year A further 20 within the next three ye - Higher-income groups, 25-50 year olds, loyal clientele ---> Top-class cuisine 30-60 per person Green AC 114 13 Takeovers and mergers Bon Appetit Innovia Cales Turnover Pre tax profit The Seashell 12 We are continuing to look for suitable acquisitions in order to create a more diversified group and to widen our customer base. The purchase of Innova Cafes takes us into a new market segment, the 25-610 a head market. We expect Innova Cafes to contribute significantly to our profits in the future, Exeract from Artual Report - Group Bon Appets RO (min) Last months Last Last months Major shareholdings Directors of Bon Appeti . Weinburt investments venture capitalists) Restaurant chain, Icarus Private shareholders 2014 30 Debt ratio 2 years ago Last year This year 30% 55% includes cost 70% Includes cost of tonovia of proposed acquisition) Morito acquisition ("Debt ratio a company's debt in relation to the amount of share capital it has.) Recent developments Financial experts in the City of London no longer have confidence in the group's strategy for the following reasons 1 Innovia Cafes have performed badly. There is strong competition from US chains, such as Surbucks. 2 Bon Appetit is closely controlled from head office. Innovia's managers, however, are used to a relaxed management style. Many have left because of the 'bureaucratic culture. 3 Staff turnover among Innovia's other workers is also high and customer service is poor 4 Bon Appetit has agreed to buy the El Morito chain of 12 Mexican style restaurants for 14m. Experts believe that the group is overstretched and losing focus 5 The powerful national restaurant chain, Icarus, has taken a 10% stake in Bon Appetit and says that Bon Appetit would be an excellent addition to its business Writing Directors of Bon Appetit Write a report on your company for a financial group who are interested in investing in your business. Your report should give background information as well as information about recent development. It should present the company in a positive light Task The directors of the venture capital firm Weinburg Investments, a major shareholder in Bon Appetit, are concerned about the threat of takeover. They have asked the directors of Bon Appetit to attend a meeting to consider 1 What actions must Bon Appetit take to avoid the threatened takeover by Icarus? 2 How can Bon Appetit improve the performance of Innovia Cafes? 3 Should Bon Appetit reconsider the proposed takeover of El Morito? Should Bon Appetit's overall business Strategy be revised? Form two groups a) Directors of Bon Appetit b) Directors of Weinburg Investments. Discuss the questions above. Then hold the meeting Directors of Weinburg Investments Write a report on Bon Appetit. The report should give background information as well as information about recent developments. It should analyse the company's performance and indicate whether Weinburg Investments should sell their stake in Bon Appetit Writing Mile pages 144 and 145 1115 Task The directors of the venture capital firm Weinburg Investments, a major shareholder in Bon Appetit, are concerned about the threat of takeover. They have asked the directors of Bon Appetit to attend a meeting to consider: 1 What actions must Bon Appetit take to avoid the threatened takeover by Icarus? 2 How can Bon Appetit improve the performance of Innovia Cafes? 3 Should Bon Appetit reconsider the proposed takeover of El Morito? 4 Should Bon Appetit's overall business strategy be revised? Form two groups: a) Directors of Bon Appetit b) Directors of Weinburg Investments. Discuss the questions above. Then hold the meeting Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock